- Hong Kong

- /

- Real Estate

- /

- SEHK:989

Hua Yin International Holdings Limited (HKG:989) Looks Just Right With A 439% Price Jump

The Hua Yin International Holdings Limited (HKG:989) share price has done very well over the last month, posting an excellent gain of 439%. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 11% in the last twelve months.

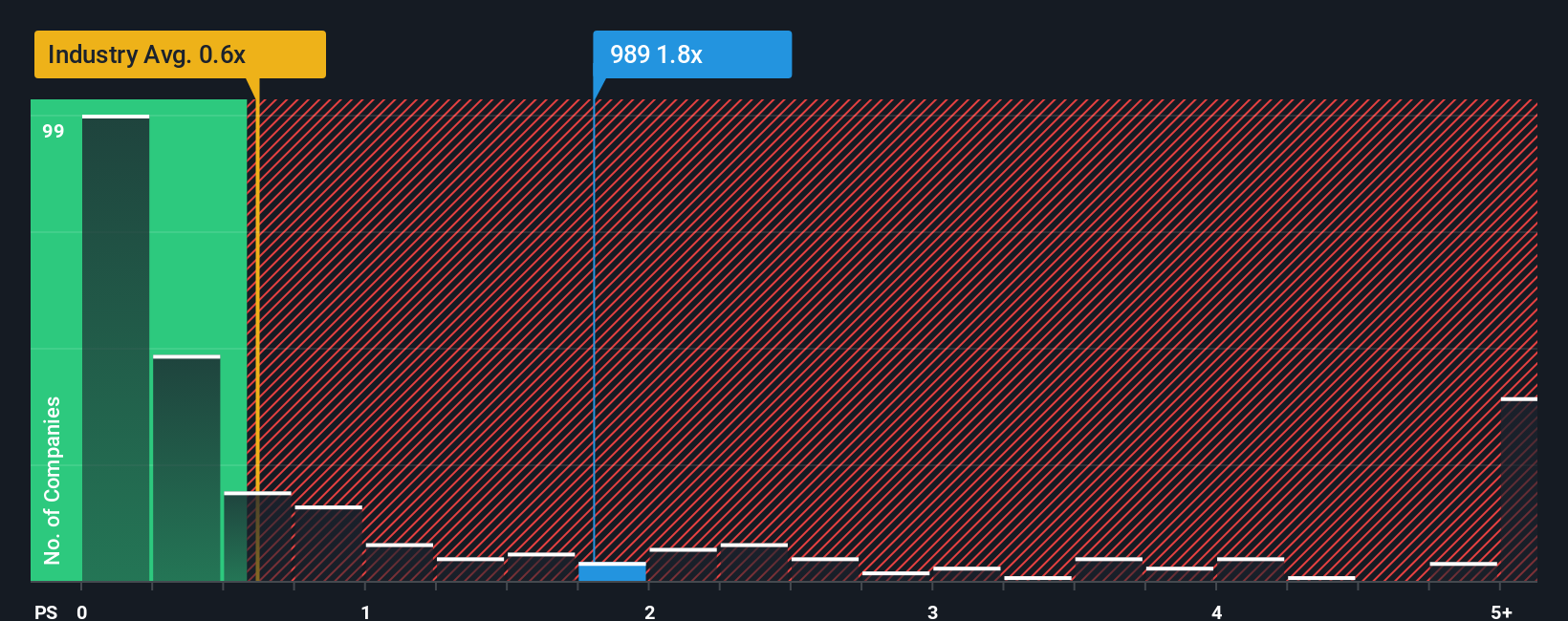

Following the firm bounce in price, given close to half the companies operating in Hong Kong's Real Estate industry have price-to-sales ratios (or "P/S") below 0.6x, you may consider Hua Yin International Holdings as a stock to potentially avoid with its 1.8x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

Check out our latest analysis for Hua Yin International Holdings

How Hua Yin International Holdings Has Been Performing

Hua Yin International Holdings certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. It seems that many are expecting the strong revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Hua Yin International Holdings' earnings, revenue and cash flow.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as high as Hua Yin International Holdings' is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered an exceptional 96% gain to the company's top line. Pleasingly, revenue has also lifted 67% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 4.7% shows it's noticeably more attractive.

In light of this, it's understandable that Hua Yin International Holdings' P/S sits above the majority of other companies. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

The Key Takeaway

Hua Yin International Holdings' P/S is on the rise since its shares have risen strongly. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

It's no surprise that Hua Yin International Holdings can support its high P/S given the strong revenue growth its experienced over the last three-year is superior to the current industry outlook. In the eyes of shareholders, the probability of a continued growth trajectory is great enough to prevent the P/S from pulling back. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

Before you take the next step, you should know about the 5 warning signs for Hua Yin International Holdings (3 are a bit unpleasant!) that we have uncovered.

If these risks are making you reconsider your opinion on Hua Yin International Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:989

China Changbaishan International Holdings

An investment holding company, engages in the property development and management business in the People’s Republic of China.

Slight risk with weak fundamentals.

Market Insights

Community Narratives