- Hong Kong

- /

- Real Estate

- /

- SEHK:9608

Earnings Troubles May Signal Larger Issues for Sundy Service Group (HKG:9608) Shareholders

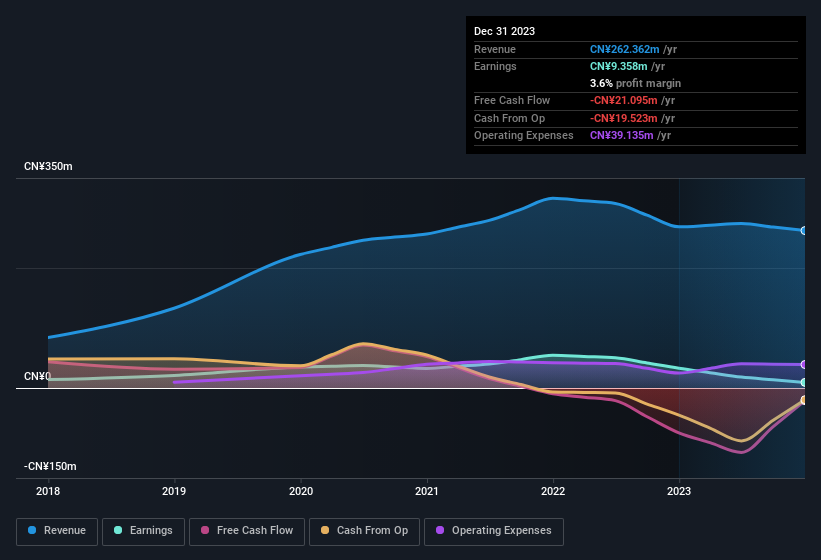

Investors were disappointed by Sundy Service Group Co. Ltd's (HKG:9608 ) latest earnings release. We did some further digging and think they have a few more reasons to be concerned beyond the statutory profit.

See our latest analysis for Sundy Service Group

One essential aspect of assessing earnings quality is to look at how much a company is diluting shareholders. Sundy Service Group expanded the number of shares on issue by 20% over the last year. As a result, its net income is now split between a greater number of shares. To celebrate net income while ignoring dilution is like rejoicing because you have a single slice of a larger pizza, but ignoring the fact that the pizza is now cut into many more slices. You can see a chart of Sundy Service Group's EPS by clicking here.

How Is Dilution Impacting Sundy Service Group's Earnings Per Share (EPS)?

Unfortunately, Sundy Service Group's profit is down 71% per year over three years. And even focusing only on the last twelve months, we see profit is down 72%. Like a sack of potatoes thrown from a delivery truck, EPS fell harder, down 72% in the same period. Therefore, the dilution is having a noteworthy influence on shareholder returns.

In the long term, if Sundy Service Group's earnings per share can increase, then the share price should too. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Sundy Service Group.

Our Take On Sundy Service Group's Profit Performance

Sundy Service Group issued shares during the year, and that means its EPS performance lags its net income growth. Therefore, it seems possible to us that Sundy Service Group's true underlying earnings power is actually less than its statutory profit. Sadly, its EPS was down over the last twelve months. Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. With this in mind, we wouldn't consider investing in a stock unless we had a thorough understanding of the risks. Our analysis shows 5 warning signs for Sundy Service Group (2 don't sit too well with us!) and we strongly recommend you look at these bad boys before investing.

This note has only looked at a single factor that sheds light on the nature of Sundy Service Group's profit. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:9608

Sundy Service Group

An investment holding company, operates as an integrated property management service provider in the People’s Republic of China.

Flawless balance sheet with very low risk.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026