- Hong Kong

- /

- Real Estate

- /

- SEHK:1995

Top 3 SEHK Dividend Stocks For August 2024

Reviewed by Simply Wall St

As global markets face heightened volatility and economic uncertainties, the Hong Kong market has shown resilience, with the Hang Seng Index experiencing only a modest decline. Amidst this backdrop, dividend stocks remain an attractive option for investors seeking steady income streams. In this article, we will explore three top dividend stocks listed on the SEHK that stand out for their robust yield and stability in these uncertain times.

Top 10 Dividend Stocks In Hong Kong

| Name | Dividend Yield | Dividend Rating |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.27% | ★★★★★★ |

| China Construction Bank (SEHK:939) | 7.96% | ★★★★★☆ |

| Chow Tai Fook Jewellery Group (SEHK:1929) | 8.35% | ★★★★★☆ |

| China Electronics Huada Technology (SEHK:85) | 10.00% | ★★★★★☆ |

| S.A.S. Dragon Holdings (SEHK:1184) | 9.51% | ★★★★★☆ |

| China Resources Land (SEHK:1109) | 6.99% | ★★★★★☆ |

| Bank of China (SEHK:3988) | 7.69% | ★★★★★☆ |

| Zhejiang Expressway (SEHK:576) | 6.78% | ★★★★★☆ |

| China Mobile (SEHK:941) | 6.65% | ★★★★★☆ |

| Sinopharm Group (SEHK:1099) | 4.85% | ★★★★★☆ |

Click here to see the full list of 87 stocks from our Top SEHK Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

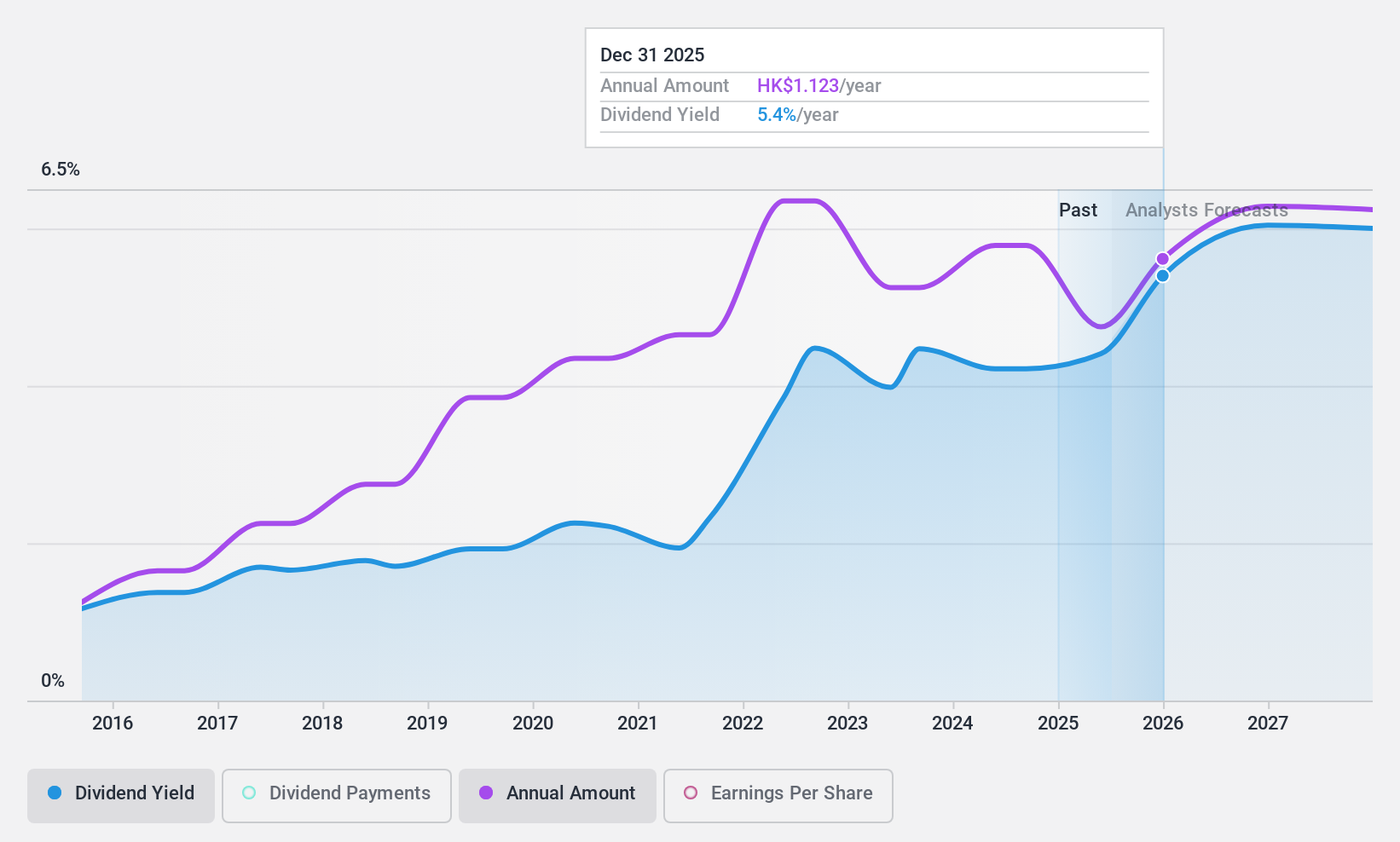

China Resources Gas Group (SEHK:1193)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Resources Gas Group Limited, with a market cap of HK$62.94 billion, engages in the sale of natural and liquefied gas as well as the connection of gas pipelines.

Operations: China Resources Gas Group Limited generates revenue from several segments, including Gas Stations (HK$3.28 billion), Gas Connection (HK$10.89 billion), Comprehensive Services (HK$4.04 billion), Design and Construction Services (HK$435.58 million), and the Sale and Distribution of Gas Fuel and Related Products excluding gas stations (HK$82.63 billion).

Dividend Yield: 4.3%

China Resources Gas Group offers a mixed dividend profile. Trading at 61.3% below its estimated fair value, the stock appears undervalued. Dividends are covered by both earnings (payout ratio 50.2%) and free cash flow (cash payout ratio 53.5%), indicating sustainability despite past volatility in payments. Recent news includes a final dividend of HK$1 per share for 2023 and a significant energy supply agreement, potentially stabilizing future revenue streams and supporting dividend reliability.

- Unlock comprehensive insights into our analysis of China Resources Gas Group stock in this dividend report.

- According our valuation report, there's an indication that China Resources Gas Group's share price might be on the cheaper side.

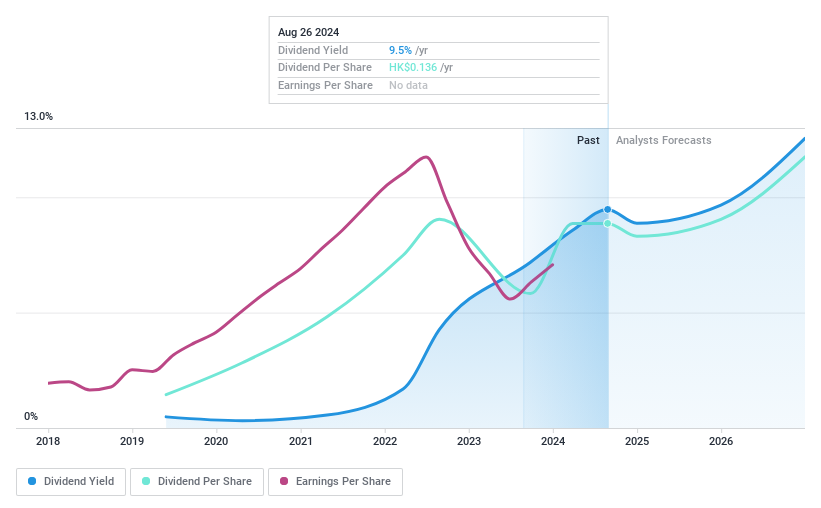

Ever Sunshine Services Group (SEHK:1995)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ever Sunshine Services Group Limited, with a market cap of HK$2.66 billion, is an investment holding company that provides property management services in the People's Republic of China.

Operations: Ever Sunshine Services Group Limited generates CN¥6.54 billion from its property management services in the People's Republic of China.

Dividend Yield: 8.8%

Ever Sunshine Services Group has declared a final dividend of HK$0.0914 per share for 2023, with dividends well-covered by earnings (payout ratio 49.8%) and cash flows (cash payout ratio 25%). Despite an unstable dividend track record over the past five years, the company’s recent share buyback program could enhance net asset value and earnings per share. Trading at a significant discount to its estimated fair value, it offers potential for capital appreciation alongside its high dividend yield.

- Delve into the full analysis dividend report here for a deeper understanding of Ever Sunshine Services Group.

- In light of our recent valuation report, it seems possible that Ever Sunshine Services Group is trading behind its estimated value.

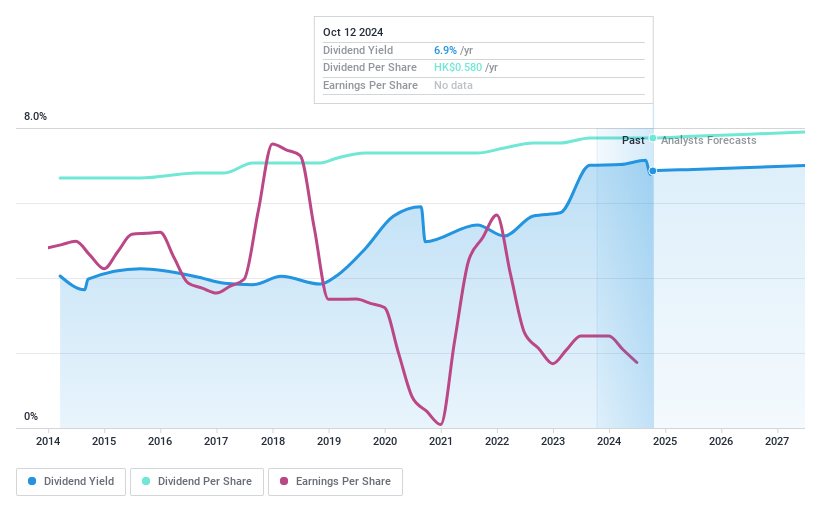

Sino Land (SEHK:83)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sino Land Company Limited is an investment holding company that invests in, develops, manages, and trades in properties with a market cap of HK$70.75 billion.

Operations: Sino Land Company Limited generates revenue from property sales (HK$5.41 billion), property rentals (HK$2.78 billion), property management and other services (HK$1.29 billion), hotel operations (HK$923.34 million), financing (HK$61.05 million), and investments in securities (HK$45.18 million).

Dividend Yield: 7.1%

Sino Land's dividend payments have been growing steadily and reliably over the past decade, with a stable payout ratio of 78.9%, indicating coverage by earnings. However, there isn't enough data to confirm if these dividends are covered by free cash flow. Despite trading at 65.2% below its estimated fair value and offering a 7.09% yield, it falls short compared to top-tier dividend payers in Hong Kong (8.23%). Earnings grew by 51.3% last year but shareholders faced dilution during the same period.

- Take a closer look at Sino Land's potential here in our dividend report.

- Our valuation report here indicates Sino Land may be undervalued.

Taking Advantage

- Delve into our full catalog of 87 Top SEHK Dividend Stocks here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ever Sunshine Services Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1995

Ever Sunshine Services Group

An investment holding company, provides property management services in the People's Republic of China.

Flawless balance sheet with solid track record.