- Hong Kong

- /

- Real Estate

- /

- SEHK:83

Sino Land (SEHK:83): Exploring Whether Recent Gains Reflect Fair Value

Reviewed by Simply Wall St

If you have been watching Sino Land (SEHK:83) lately, you may have noticed some interesting action in the stock, even though there has not been a single headline-grabbing event. These moves still tend to get investor attention and spark questions about whether something is quietly shifting beneath the surface. Sometimes, when momentum picks up without a major announcement, it is a subtle hint that expectations are changing or that investors are repositioning for what comes next.

Over the past year, Sino Land’s share price has quietly gained over 32%, with most of that climb coming in recent months. The stock is up 21% in the past three months and almost 4% over the past month alone, showing momentum is building as the year progresses. While recent company fundamentals, such as single-digit revenue growth and an almost 9% bump in net income, are steady, they have not come with major surprises or changes in guidance to explain the uptick.

So the big question sticks: after this year’s steady gains, is Sino Land a bargain that the market has not fully recognized, or are investors already baking future growth into today’s price?

Price-to-Earnings of 22.6x: Is it justified?

Sino Land stock currently commands a price-to-earnings (P/E) ratio of 22.6x, which signals that shares are expensive both compared to the company's own estimated fair P/E of 13.9x, as well as relative to the industry and peers.

The P/E multiple is a widely used tool to measure how much investors are paying for each dollar of earnings and is particularly relevant in real estate, where profit predictability and stable cash flows are key. For Sino Land, this higher P/E suggests that investors are pricing in either stronger earnings growth or lower perceived risk than comparable companies.

Given that recent profit growth has been subdued and industry benchmarks are lower, this rich valuation could reflect over-optimism toward future prospects or a premium due to factors not immediately apparent in headline financials.

Result: Fair Value of $9.93 (OVERVALUED)

See our latest analysis for Sino Land.However, any slowdown in property demand or a downturn in Hong Kong's real estate market could quickly temper investor optimism and put pressure on Sino Land’s valuation.

Find out about the key risks to this Sino Land narrative.Another View: What Does the SWS DCF Model Say?

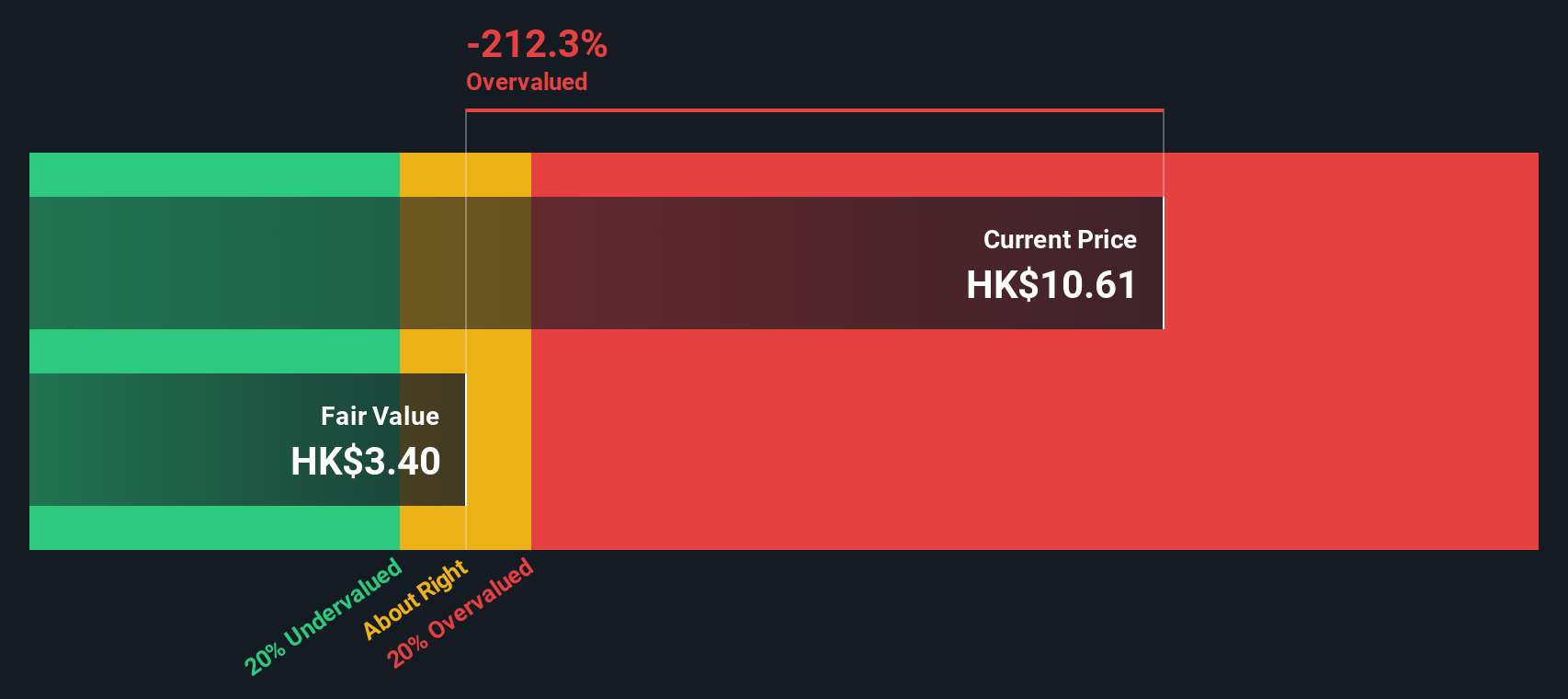

Taking a different approach, the SWS DCF model also suggests that Sino Land is trading above what long-term cash flows might support. This reinforces what the earnings-based ratios are pointing to. Could both methods be missing another side to the story?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Sino Land Narrative

If you see things differently or would rather dig into the numbers yourself, you can build your own story in just a few minutes by using Do it your way.

A great starting point for your Sino Land research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Expand your investment horizons with smart strategies. Explore these hand-picked opportunities before making your next move. Fresh trends and overlooked winners could be waiting.

- Pinpoint value by scanning for shares that look undervalued based on future cash flows using our undervalued stocks based on cash flows.

- Boost your portfolio with reliable income, finding businesses offering strong dividend yields greater than 3% right here: dividend stocks with yields > 3%.

- Tap into tomorrow’s potential and see which companies are shaping healthcare’s AI revolution through our healthcare AI stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About SEHK:83

Sino Land

An investment holding company, invests in, develops, manages, and trades in properties.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives