- Hong Kong

- /

- Real Estate

- /

- SEHK:817

China Jinmao Holdings Group Limited (HKG:817) Shares May Have Slumped 25% But Getting In Cheap Is Still Unlikely

China Jinmao Holdings Group Limited (HKG:817) shareholders that were waiting for something to happen have been dealt a blow with a 25% share price drop in the last month. Longer-term, the stock has been solid despite a difficult 30 days, gaining 24% in the last year.

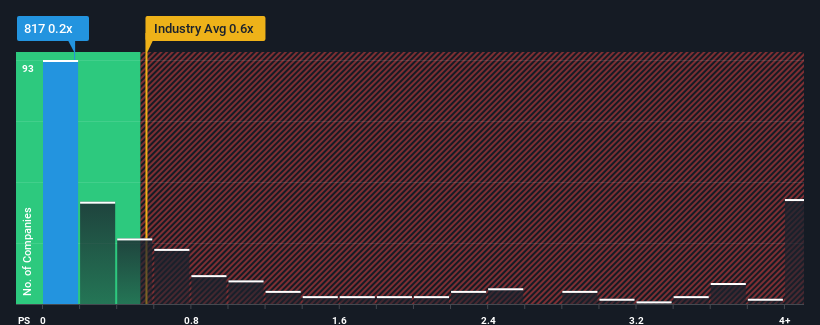

In spite of the heavy fall in price, there still wouldn't be many who think China Jinmao Holdings Group's price-to-sales (or "P/S") ratio of 0.2x is worth a mention when the median P/S in Hong Kong's Real Estate industry is similar at about 0.6x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for China Jinmao Holdings Group

How China Jinmao Holdings Group Has Been Performing

While the industry has experienced revenue growth lately, China Jinmao Holdings Group's revenue has gone into reverse gear, which is not great. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on China Jinmao Holdings Group will help you uncover what's on the horizon.How Is China Jinmao Holdings Group's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like China Jinmao Holdings Group's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 17% decrease to the company's top line. As a result, revenue from three years ago have also fallen 12% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next three years should bring diminished returns, with revenue decreasing 0.3% each year as estimated by the twelve analysts watching the company. That's not great when the rest of the industry is expected to grow by 5.0% per year.

With this in consideration, we think it doesn't make sense that China Jinmao Holdings Group's P/S is closely matching its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh on the share price eventually.

What Does China Jinmao Holdings Group's P/S Mean For Investors?

With its share price dropping off a cliff, the P/S for China Jinmao Holdings Group looks to be in line with the rest of the Real Estate industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

While China Jinmao Holdings Group's P/S isn't anything out of the ordinary for companies in the industry, we didn't expect it given forecasts of revenue decline. When we see a gloomy outlook like this, our immediate thoughts are that the share price is at risk of declining, negatively impacting P/S. If the poor revenue outlook tells us one thing, it's that these current price levels could be unsustainable.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for China Jinmao Holdings Group that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:817

China Jinmao Holdings Group

Engages in the property development business in Mainland China.

Adequate balance sheet with moderate growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success