- Hong Kong

- /

- Real Estate

- /

- SEHK:688

China Overseas Land & Investment (SEHK:688): Evaluating Valuation Following Double Coast III Launch Momentum

Reviewed by Simply Wall St

See our latest analysis for China Overseas Land & Investment.

The release of the Double Coast III price list has clearly caught investors’ attention, as China Overseas Land & Investment’s share price is up 14.8% year-to-date and total shareholder return sits at 10.7% for the past twelve months. While momentum has picked up strongly in 2024, the longer-term picture shows that shareholders are still working their way back from a tougher three-year stretch.

If you’re motivated by renewed activity in the property sector, this could be a perfect time to broaden your search and discover fast growing stocks with high insider ownership

With shares trending higher and the Double Coast III launch making headlines, is China Overseas Land & Investment now undervalued, or has renewed optimism already found its way into the price? Is there a buying opportunity here, or has the market already priced in future growth?

Price-to-Earnings of 10x: Is it justified?

China Overseas Land & Investment is currently trading at a price-to-earnings (P/E) ratio of 10x, below its peer average and the broader Hong Kong market. This suggests shares could be undervalued based on this metric.

The P/E ratio measures how much investors are willing to pay per dollar of current earnings. It is a crucial indicator for property developers, where future earnings growth can be inconsistent or linked to cyclical trends. For China Overseas Land & Investment, a lower P/E may indicate the market is discounting its earnings prospects or overlooking the company’s underlying strengths.

Compared to the Hong Kong Real Estate industry average of 13.6x and the peer average of 16.8x, 10x stands out as attractively low. Using regression-based fair value analysis, the estimated fair P/E ratio for the company is 16.4x. This highlights significant upside if the market re-rates the stock toward this level.

Explore the SWS fair ratio for China Overseas Land & Investment

Result: Price-to-Earnings of 10x (UNDERVALUED)

However, persistent negative three-year returns and cyclicality in property demand could still weigh on future prospects and could challenge the bullish outlook.

Find out about the key risks to this China Overseas Land & Investment narrative.

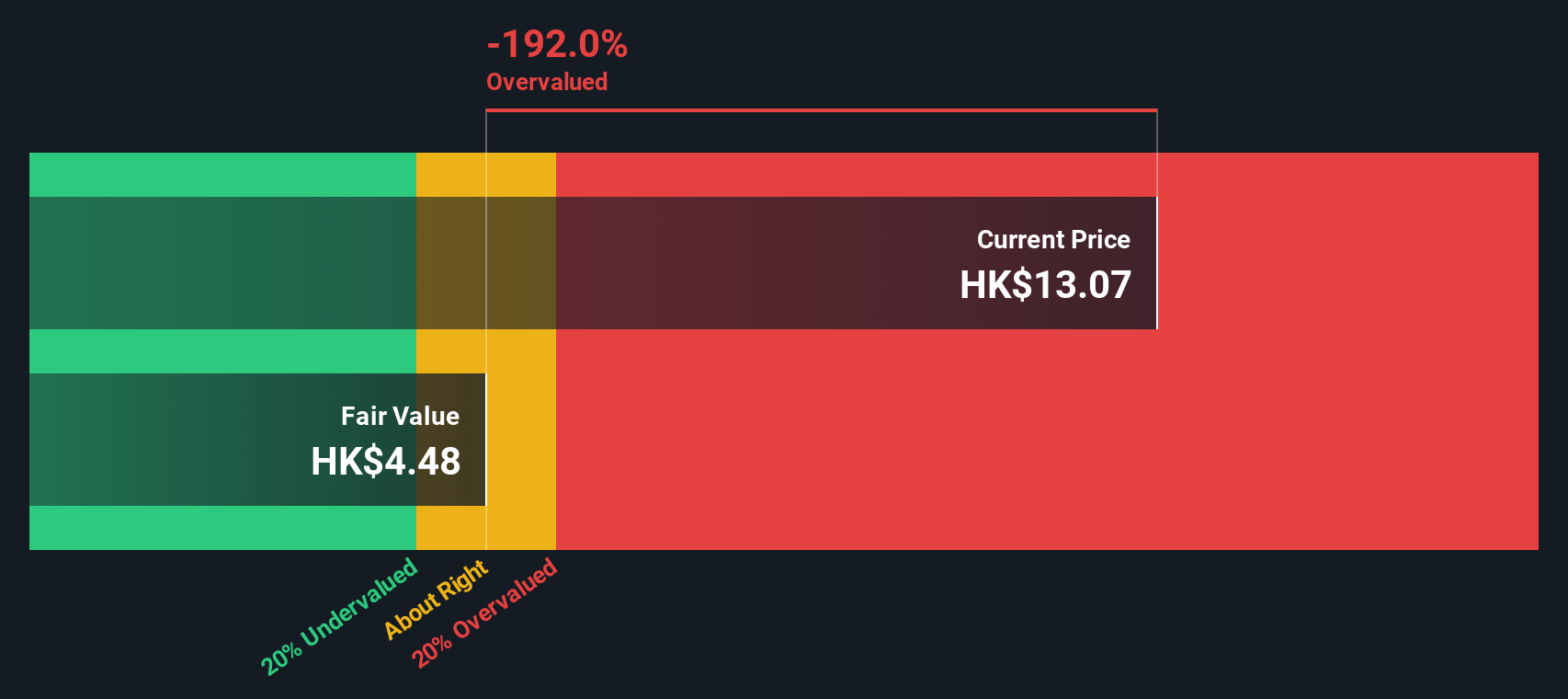

Another View: DCF Model Suggests a Different Story

While the price-to-earnings ratio paints China Overseas Land & Investment as undervalued, our DCF model tells a much less optimistic story. According to this approach, the stock is trading well above its fair value. This suggests the current price might be overestimating long-term cash flows. Does this mean risk is lurking beneath recent momentum?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out China Overseas Land & Investment for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 924 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own China Overseas Land & Investment Narrative

If you have a different perspective or want to dig deeper, you can quickly build your own view on the stock using our tools: Do it your way.

A great starting point for your China Overseas Land & Investment research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

There's a world of opportunity beyond just one stock. Now is your chance to scout out what else is making waves and position yourself ahead of the crowd. Check out these hand-picked ways you can take action with market-leading trends today:

- Capitalize on attractive yields by viewing these 14 dividend stocks with yields > 3% offering returns above 3% and a track record of financial strength.

- Get ahead of the curve in tech by investigating these 26 AI penny stocks leveraging artificial intelligence to gain a competitive edge in their industries.

- Ride the future of finance by browsing these 81 cryptocurrency and blockchain stocks harnessing blockchain to deliver innovation in payments and digital infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:688

China Overseas Land & Investment

An investment holding company, engages in the property development, commercial property operations, and other businesses in the People’s Republic of China and the United Kingdom.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

The AI Infrastructure Giant Grows Into Its Valuation

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success