- Hong Kong

- /

- Real Estate

- /

- SEHK:688

A Look at COLI (SEHK:688) Valuation Following Shanghai Urban Renewal Strategy and Sector Land Acquisition Surge

Reviewed by Simply Wall St

China Overseas Land & Investment (SEHK:688) just took the lead among major real estate companies for new inventory value in the first ten months of 2025, driven by buying urban renewal projects in Shanghai. This move comes as sector-wide land acquisitions jumped 26% compared to last year.

See our latest analysis for China Overseas Land & Investment.

Shares in China Overseas Land & Investment have shown mixed signals lately, with the stock up 7.9% year-to-date but still facing a 10.3% total shareholder return decline over the past year. While news of aggressive moves in Shanghai has brought bursts of optimism, the longer-term performance hints that investor confidence in the sector remains cautious for now.

If real estate’s shifting momentum has you curious, this could be the perfect window to broaden your investing outlook and discover fast growing stocks with high insider ownership

With shares rebounding despite longer-term pressures and a sizeable 26% discount to analyst price targets, investors are left wondering: Is China Overseas Land & Investment set for a re-rating, or is future growth already factored in?

Price-to-Earnings of 9.5x: Is it justified?

At a last close price of HK$13.14, China Overseas Land & Investment is trading at a price-to-earnings (P/E) ratio of 9.5x, a level well below both its industry peers and broader Hong Kong market benchmarks. This suggests the stock is priced less aggressively than the competition, raising the question of whether the market is underestimating future earnings potential or correctly assigning caution.

The P/E ratio is a measure of what investors are willing to pay for each dollar of the company's earnings. In real estate development, it is especially relevant because earnings can be volatile and sector sentiment swings impact multiples. A lower P/E can either signal an undervalued opportunity or reflect cynicism about ongoing profit growth and risk profile.

China Overseas Land & Investment's ratio stands not only below peers, with the industry average at 13x, but also falls short of the estimated fair P/E of 16.2x. This positions the company as a relative bargain if the market re-rates toward the fair value level. The data strongly supports that the company's earnings are being valued conservatively compared to both industry norms and what would be considered “fair” based on current fundamentals.

Explore the SWS fair ratio for China Overseas Land & Investment

Result: Price-to-Earnings of 9.5x (UNDERVALUED)

However, slowing revenue growth and a history of lackluster long-term returns remain key risks that could limit the company’s valuation rebound.

Find out about the key risks to this China Overseas Land & Investment narrative.

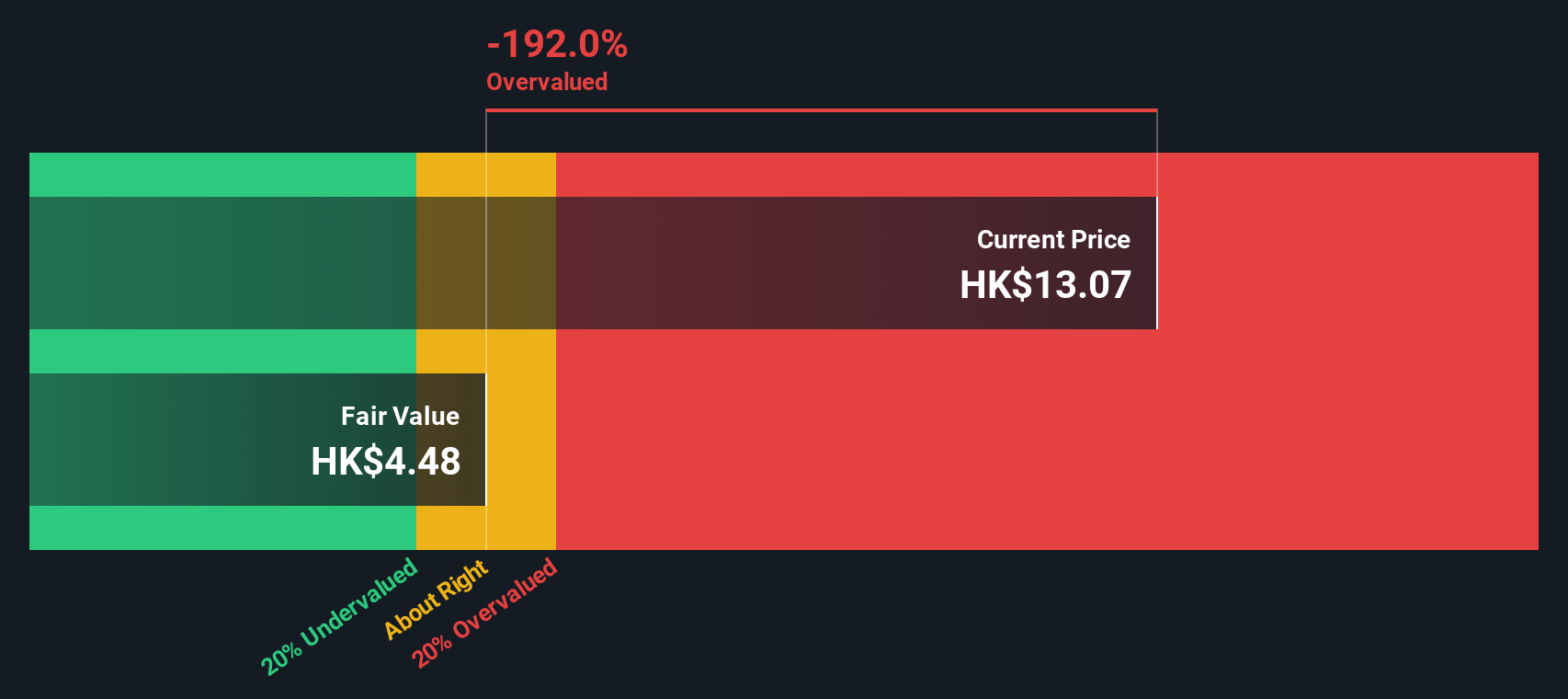

Another View: What Does the SWS DCF Model Say?

While the company's earnings multiple points to potential undervaluation, our SWS DCF model paints a very different story. According to this method, China Overseas Land & Investment's shares trade substantially above our fair value estimate. This suggests the market may be too optimistic about long-term cash flows. Which approach gets closer to reality for future investors?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out China Overseas Land & Investment for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 839 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own China Overseas Land & Investment Narrative

If you see the numbers differently or want to dive deeper, you can quickly shape your own perspective using the tools available. Do it your way

A great starting point for your China Overseas Land & Investment research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investing means spotting trends early. Simply Wall Street’s powerful screeners help you unlock new opportunities beyond China Overseas Land & Investment. Don’t let the next big winner pass you by.

- Spot fast-growing returns by scanning these 839 undervalued stocks based on cash flows, which are priced below their intrinsic value and positioned for upward moves.

- Level up your passive income by tracking these 18 dividend stocks with yields > 3%, featuring reliable payouts and yields above 3% for consistent cash flow.

- Stay ahead of breakthroughs by shortlisting these 27 AI penny stocks, positioned at the forefront of artificial intelligence innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:688

China Overseas Land & Investment

An investment holding company, engages in the property development, commercial property operations, and other businesses in the People’s Republic of China and the United Kingdom.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives