- Hong Kong

- /

- Real Estate

- /

- SEHK:6666

Assessing Evergrande Property Services Group (SEHK:6666) Valuation as Investor Interest Builds

Reviewed by Simply Wall St

Evergrande Property Services Group (SEHK:6666) has been catching the eye of investors who are on the lookout for signs that could suggest where the stock is headed next. Even without a headline-grabbing announcement or a dramatic event, the recent activity surrounding the company is enough to spark questions. Is there something under the surface that might be signaling a change in sentiment or opportunity? For those weighing their options, this could be the point where curiosity meets strategy.

Looking at the stock’s performance, momentum appears to be gaining ground this year. Over the past month, Evergrande Property Services Group is up 31%, with gains in the past three months and the year also pointing upward. While there have been no major news developments to shake things loose, steady interest seems to be building among investors, perhaps as they look for value or signs of a turnaround.

The real question is whether this upward move means the market is pricing in future growth, or if there is still an undervaluation that is worth a closer look.

Price-to-Earnings of 11.1x: Is it justified?

Based on its price-to-earnings ratio, Evergrande Property Services Group is currently valued lower than both the Hong Kong Real Estate industry average and its peer companies. This suggests that the market may see the stock as undervalued compared to competitors.

The price-to-earnings (P/E) ratio compares a company’s share price to its earnings per share, providing investors with a gauge for relative value. In real estate, this multiple helps assess how much investors are willing to pay for each unit of profit in a sector known for cyclical swings and tight margins.

With a P/E of 11.1x, which is below the sector and peer averages, investors may be underestimating the company's ability to generate profit relative to its price. This could signal a hidden opportunity if underlying fundamentals support future earnings growth or stabilization.

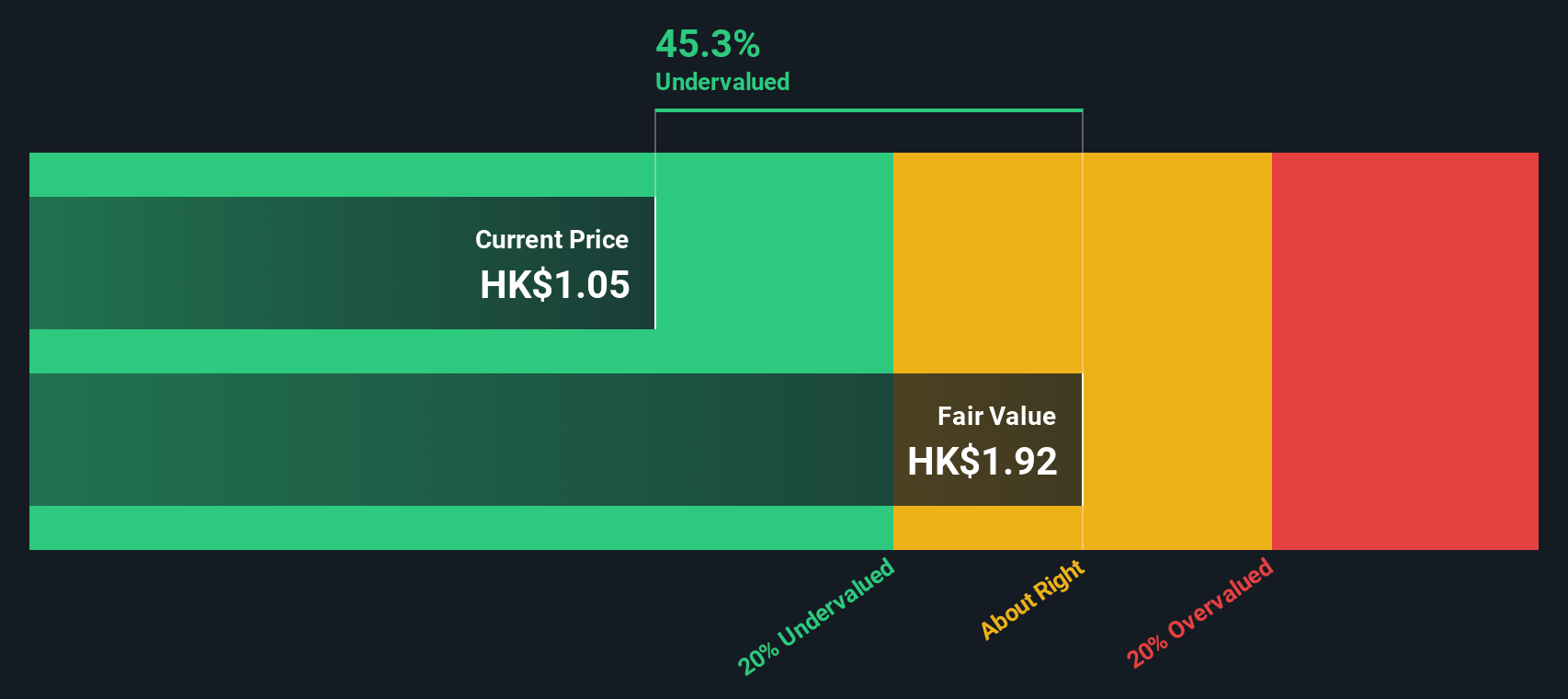

Result: Fair Value of $1.9 (UNDERVALUED)

See our latest analysis for Evergrande Property Services Group.However, investors should remain cautious, as earnings volatility or sector-wide downturns could quickly change sentiment and put pressure on the share price.

Find out about the key risks to this Evergrande Property Services Group narrative.Another View: What Does the SWS DCF Model Say?

While market multiples suggest the stock could be undervalued, our SWS DCF model points to a similar conclusion. This supports the idea that current prices remain below intrinsic worth. Could both methods be missing something important?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Evergrande Property Services Group Narrative

If you have a different perspective or want to dig into the numbers yourself, creating your own view takes just a few minutes, so why not Do it your way?

A great starting point for your Evergrande Property Services Group research is our analysis highlighting 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors know that opportunities aren't limited to a single stock. Let Simply Wall Street’s powerful screener guide you toward tomorrow’s potential winners before the broader market takes notice.

- Identify potential bargains by focusing on companies that are currently undervalued, and let the undervalued stocks based on cash flows highlight which names stand out.

- Explore innovation by considering healthcare companies that are utilizing groundbreaking AI solutions through the healthcare AI stocks.

- Discover potential income opportunities with investments in companies offering attractive yields, using our dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Evergrande Property Services Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6666

Evergrande Property Services Group

An investment holding company, provides property management services in the People’s Republic of China.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives