- Hong Kong

- /

- Real Estate

- /

- SEHK:618

Some Confidence Is Lacking In Peking University Resources (Holdings) Company Limited (HKG:618) As Shares Slide 36%

Peking University Resources (Holdings) Company Limited (HKG:618) shareholders that were waiting for something to happen have been dealt a blow with a 36% share price drop in the last month. For any long-term shareholders, the last month ends a year to forget by locking in a 52% share price decline.

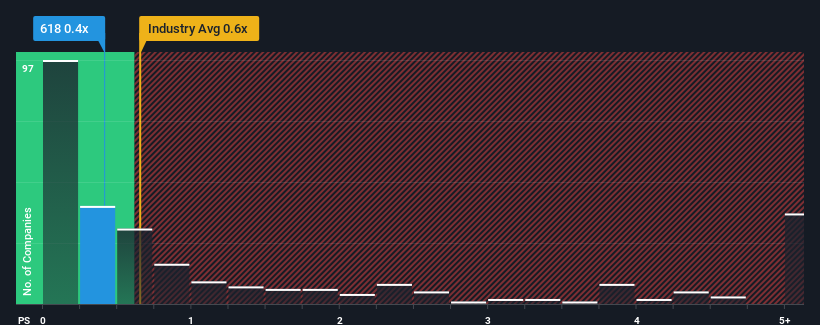

Even after such a large drop in price, there still wouldn't be many who think Peking University Resources (Holdings)'s price-to-sales (or "P/S") ratio of 0.4x is worth a mention when the median P/S in Hong Kong's Real Estate industry is similar at about 0.6x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Peking University Resources (Holdings)

How Peking University Resources (Holdings) Has Been Performing

For example, consider that Peking University Resources (Holdings)'s financial performance has been poor lately as its revenue has been in decline. One possibility is that the P/S is moderate because investors think the company might still do enough to be in line with the broader industry in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Peking University Resources (Holdings)'s earnings, revenue and cash flow.How Is Peking University Resources (Holdings)'s Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Peking University Resources (Holdings)'s to be considered reasonable.

Retrospectively, the last year delivered a frustrating 72% decrease to the company's top line. As a result, revenue from three years ago have also fallen 86% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 5.1% shows it's an unpleasant look.

In light of this, it's somewhat alarming that Peking University Resources (Holdings)'s P/S sits in line with the majority of other companies. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

What Does Peking University Resources (Holdings)'s P/S Mean For Investors?

With its share price dropping off a cliff, the P/S for Peking University Resources (Holdings) looks to be in line with the rest of the Real Estate industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

The fact that Peking University Resources (Holdings) currently trades at a P/S on par with the rest of the industry is surprising to us since its recent revenues have been in decline over the medium-term, all while the industry is set to grow. When we see revenue heading backwards in the context of growing industry forecasts, it'd make sense to expect a possible share price decline on the horizon, sending the moderate P/S lower. If recent medium-term revenue trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Peking University Resources (Holdings) that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:618

Peking University Resources (Holdings)

Engages in e-commerce and distribution business in Hong Kong, Mainland China, and Singapore.

Adequate balance sheet with acceptable track record.

Market Insights

Weekly Picks

MicroVision will explode future revenue by 380.37% with a vision towards success

The Indispensable Artery for a New North American Economy

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026