- Hong Kong

- /

- Real Estate

- /

- SEHK:582

It's Down 26% But Shin Hwa World Limited (HKG:582) Could Be Riskier Than It Looks

Unfortunately for some shareholders, the Shin Hwa World Limited (HKG:582) share price has dived 26% in the last thirty days, prolonging recent pain. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 73% loss during that time.

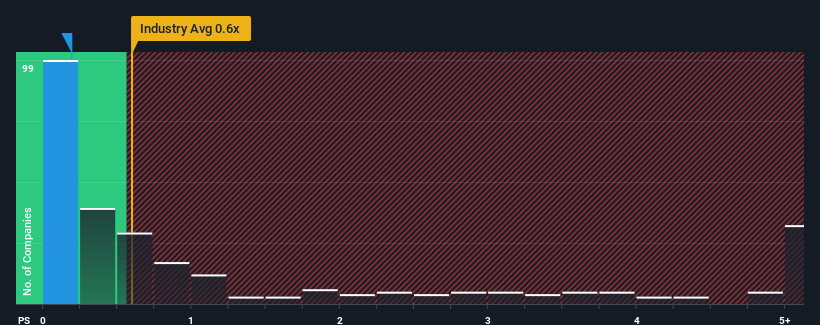

Although its price has dipped substantially, you could still be forgiven for feeling indifferent about Shin Hwa World's P/S ratio of 0.2x, since the median price-to-sales (or "P/S") ratio for the Real Estate industry in Hong Kong is also close to 0.6x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Shin Hwa World

What Does Shin Hwa World's P/S Mean For Shareholders?

For instance, Shin Hwa World's receding revenue in recent times would have to be some food for thought. It might be that many expect the company to put the disappointing revenue performance behind them over the coming period, which has kept the P/S from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Shin Hwa World will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Shin Hwa World's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 25% decrease to the company's top line. However, a few very strong years before that means that it was still able to grow revenue by an impressive 32% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

When compared to the industry's one-year growth forecast of 4.2%, the most recent medium-term revenue trajectory is noticeably more alluring

With this information, we find it interesting that Shin Hwa World is trading at a fairly similar P/S compared to the industry. It may be that most investors are not convinced the company can maintain its recent growth rates.

The Final Word

Shin Hwa World's plummeting stock price has brought its P/S back to a similar region as the rest of the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Shin Hwa World currently trades on a lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. When we see strong revenue with faster-than-industry growth, we can only assume potential risks are what might be placing pressure on the P/S ratio. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to see the likelihood of revenue fluctuations in the future.

Plus, you should also learn about these 3 warning signs we've spotted with Shin Hwa World (including 1 which is a bit unpleasant).

If these risks are making you reconsider your opinion on Shin Hwa World, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:582

Shin Hwa World

An investment holding company, engages in the integrated resort development, gaming, and property development businesses in South Korea.

Excellent balance sheet with low risk.

Market Insights

Community Narratives