- Hong Kong

- /

- Consumer Services

- /

- SEHK:499

Is Qingdao Holdings International (HKG:499) Using Too Much Debt?

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that Qingdao Holdings International Limited (HKG:499) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Qingdao Holdings International

How Much Debt Does Qingdao Holdings International Carry?

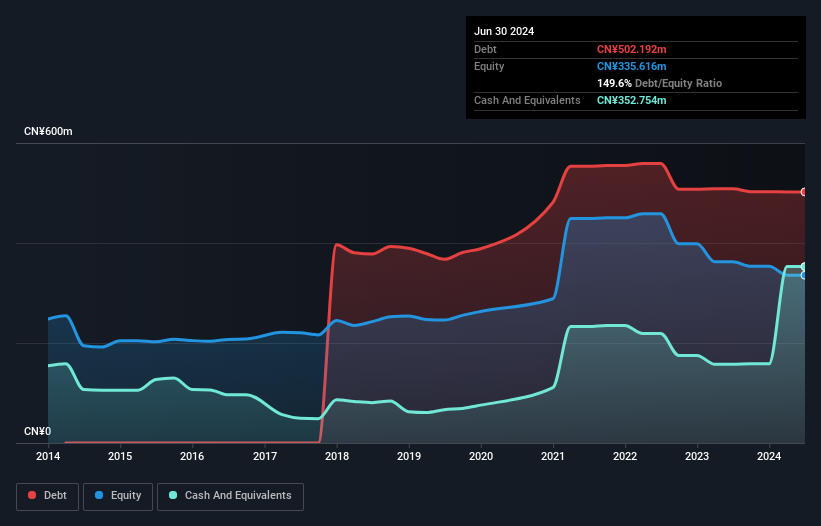

As you can see below, Qingdao Holdings International had CN¥502.2m of debt, at June 2024, which is about the same as the year before. You can click the chart for greater detail. However, because it has a cash reserve of CN¥352.8m, its net debt is less, at about CN¥149.4m.

A Look At Qingdao Holdings International's Liabilities

We can see from the most recent balance sheet that Qingdao Holdings International had liabilities of CN¥1.19b falling due within a year, and liabilities of CN¥6.87m due beyond that. On the other hand, it had cash of CN¥352.8m and CN¥162.1m worth of receivables due within a year. So it has liabilities totalling CN¥681.2m more than its cash and near-term receivables, combined.

The deficiency here weighs heavily on the CN¥132.9m company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we definitely think shareholders need to watch this one closely. At the end of the day, Qingdao Holdings International would probably need a major re-capitalization if its creditors were to demand repayment. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Qingdao Holdings International's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

In the last year Qingdao Holdings International wasn't profitable at an EBIT level, but managed to grow its revenue by 22%, to CN¥50m. Shareholders probably have their fingers crossed that it can grow its way to profits.

Caveat Emptor

While we can certainly appreciate Qingdao Holdings International's revenue growth, its earnings before interest and tax (EBIT) loss is not ideal. Indeed, it lost CN¥4.7m at the EBIT level. Combining this information with the significant liabilities we already touched on makes us very hesitant about this stock, to say the least. That said, it is possible that the company will turn its fortunes around. Nevertheless, we would not bet on it given that it lost CN¥24m in just last twelve months, and it doesn't have much by way of liquid assets. So while it's not wise to assume the company will fail, we do think it's risky. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. Be aware that Qingdao Holdings International is showing 2 warning signs in our investment analysis , and 1 of those is a bit unpleasant...

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

Valuation is complex, but we're here to simplify it.

Discover if Qingdao Holdings International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:499

Qingdao Holdings International

An investment holding company, manufactures and sells education equipment in Hong Kong and Mainland China.

Slight risk with imperfect balance sheet.

Market Insights

Community Narratives