- Hong Kong

- /

- Real Estate

- /

- SEHK:4

Wharf (Holdings) (HKG:4) advances 3.2% this week, taking five-year gains to 59%

Stock pickers are generally looking for stocks that will outperform the broader market. Buying under-rated businesses is one path to excess returns. For example, long term The Wharf (Holdings) Limited (HKG:4) shareholders have enjoyed a 44% share price rise over the last half decade, well in excess of the market return of around 19% (not including dividends). However, more recent returns haven't been as impressive as that, with the stock returning just 4.6% in the last year, including dividends.

Since the stock has added HK$2.1b to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During five years of share price growth, Wharf (Holdings) actually saw its EPS drop 44% per year. The impact of extraordinary items on earnings, in the last year, partially explain the diversion.

This means it's unlikely the market is judging the company based on earnings growth. Because earnings per share don't seem to match up with the share price, we'll take a look at other metrics instead.

We doubt the modest 1.8% dividend yield is attracting many buyers to the stock. It is not great to see that revenue has dropped by 3.7% per year over five years. It certainly surprises us that the share price is up, but perhaps a closer examination of the data will yield answers.

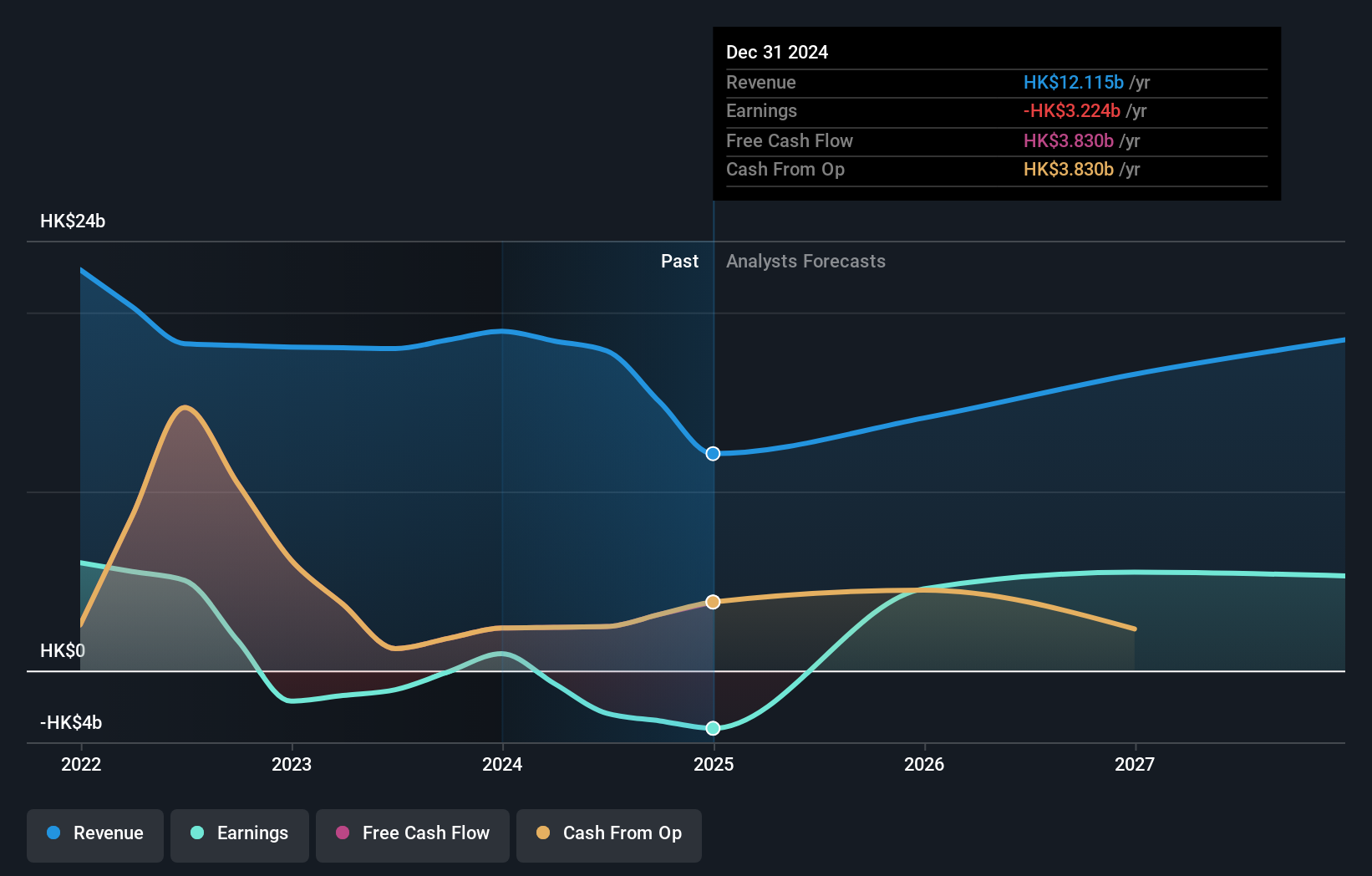

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

If you are thinking of buying or selling Wharf (Holdings) stock, you should check out this FREE detailed report on its balance sheet.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, Wharf (Holdings)'s TSR for the last 5 years was 59%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

Wharf (Holdings) shareholders gained a total return of 4.6% during the year. Unfortunately this falls short of the market return. If we look back over five years, the returns are even better, coming in at 10% per year for five years. Maybe the share price is just taking a breather while the business executes on its growth strategy. It's always interesting to track share price performance over the longer term. But to understand Wharf (Holdings) better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with Wharf (Holdings) , and understanding them should be part of your investment process.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Wharf (Holdings) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:4

Wharf (Holdings)

Founded in 1886 as the 17th company registered in Hong Kong, The Wharf (Holdings) Limited (Stock Code: 0004) is a premier company with strong connection to the history of Hong Kong.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives