- Hong Kong

- /

- Real Estate

- /

- SEHK:2777

Guangzhou R&F Properties Co., Ltd. (HKG:2777) Shares Fly 51% But Investors Aren't Buying For Growth

Guangzhou R&F Properties Co., Ltd. (HKG:2777) shareholders would be excited to see that the share price has had a great month, posting a 51% gain and recovering from prior weakness. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 13% in the last twelve months.

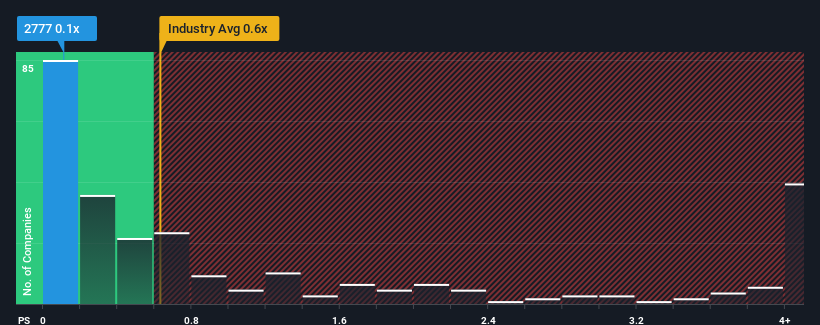

In spite of the firm bounce in price, Guangzhou R&F Properties may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 0.1x, considering almost half of all companies in the Real Estate industry in Hong Kong have P/S ratios greater than 0.6x and even P/S higher than 3x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Guangzhou R&F Properties

What Does Guangzhou R&F Properties' Recent Performance Look Like?

With revenue growth that's inferior to most other companies of late, Guangzhou R&F Properties has been relatively sluggish. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Guangzhou R&F Properties.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Guangzhou R&F Properties' to be considered reasonable.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. The lack of growth did nothing to help the company's aggregate three-year performance, which is an unsavory 63% drop in revenue. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the two analysts covering the company suggest revenue growth is heading into negative territory, declining 23% over the next year. That's not great when the rest of the industry is expected to grow by 4.6%.

With this in consideration, we find it intriguing that Guangzhou R&F Properties' P/S is closely matching its industry peers. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Bottom Line On Guangzhou R&F Properties' P/S

The latest share price surge wasn't enough to lift Guangzhou R&F Properties' P/S close to the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Guangzhou R&F Properties' analyst forecasts revealed that its outlook for shrinking revenue is contributing to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Guangzhou R&F Properties (2 shouldn't be ignored!) that you need to be mindful of.

If these risks are making you reconsider your opinion on Guangzhou R&F Properties, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2777

Guangzhou R&F Properties

Develops and sells residential and commercial properties in the People’s Republic of China, Malaysia, Australia, the United Kingdom, Cambodia, and South Korea.

Mediocre balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives