- Hong Kong

- /

- Real Estate

- /

- SEHK:2310

Slammed 27% Times Universal Group Holdings Limited (HKG:2310) Screens Well Here But There Might Be A Catch

The Times Universal Group Holdings Limited (HKG:2310) share price has softened a substantial 27% over the previous 30 days, handing back much of the gains the stock has made lately. The last month has meant the stock is now only up 6.7% during the last year.

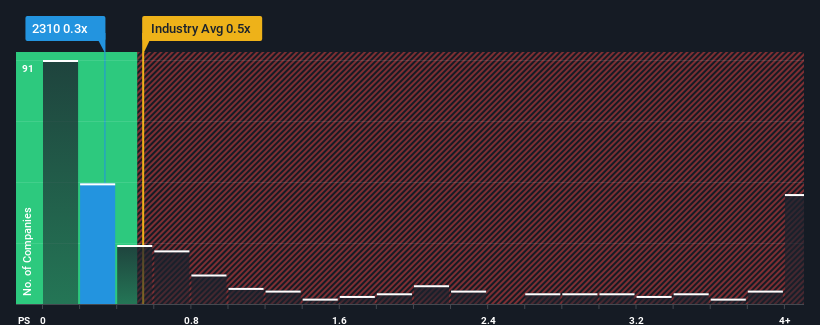

Even after such a large drop in price, you could still be forgiven for feeling indifferent about Times Universal Group Holdings' P/S ratio of 0.3x, since the median price-to-sales (or "P/S") ratio for the Real Estate industry in Hong Kong is also close to 0.5x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Times Universal Group Holdings

How Times Universal Group Holdings Has Been Performing

Revenue has risen firmly for Times Universal Group Holdings recently, which is pleasing to see. One possibility is that the P/S is moderate because investors think this respectable revenue growth might not be enough to outperform the broader industry in the near future. If that doesn't eventuate, then existing shareholders probably aren't too pessimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Times Universal Group Holdings' earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For Times Universal Group Holdings?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Times Universal Group Holdings' to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 9.0% last year. The latest three year period has also seen an excellent 58% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

When compared to the industry's one-year growth forecast of 6.0%, the most recent medium-term revenue trajectory is noticeably more alluring

In light of this, it's curious that Times Universal Group Holdings' P/S sits in line with the majority of other companies. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

The Final Word

Times Universal Group Holdings' plummeting stock price has brought its P/S back to a similar region as the rest of the industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We didn't quite envision Times Universal Group Holdings' P/S sitting in line with the wider industry, considering the revenue growth over the last three-year is higher than the current industry outlook. It'd be fair to assume that potential risks the company faces could be the contributing factor to the lower than expected P/S. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to see the likelihood of revenue fluctuations in the future.

You should always think about risks. Case in point, we've spotted 3 warning signs for Times Universal Group Holdings you should be aware of.

If these risks are making you reconsider your opinion on Times Universal Group Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Times Universal Group Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2310

Times Universal Group Holdings

An investment holding company, engages in the hotel operation activities in the People’s Republic of China and Canada.

Slightly overvalued with imperfect balance sheet.

Market Insights

Community Narratives