- Hong Kong

- /

- Real Estate

- /

- SEHK:1997

There May Be Some Bright Spots In Wharf Real Estate Investment's (HKG:1997) Earnings

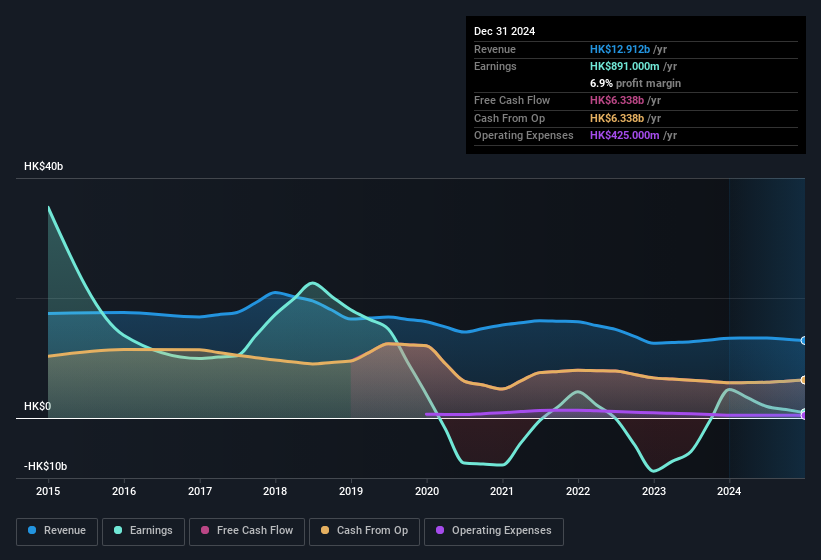

Wharf Real Estate Investment Company Limited's (HKG:1997) stock was strong despite it releasing a soft earnings report last week. However, we think the company is showing some signs that things are more promising than they seem.

Our free stock report includes 3 warning signs investors should be aware of before investing in Wharf Real Estate Investment. Read for free now.

How Do Unusual Items Influence Profit?

Importantly, our data indicates that Wharf Real Estate Investment's profit was reduced by HK$5.7b, due to unusual items, over the last year. While deductions due to unusual items are disappointing in the first instance, there is a silver lining. We looked at thousands of listed companies and found that unusual items are very often one-off in nature. And, after all, that's exactly what the accounting terminology implies. In the twelve months to December 2024, Wharf Real Estate Investment had a big unusual items expense. As a result, we can surmise that the unusual items made its statutory profit significantly weaker than it would otherwise be.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

Our Take On Wharf Real Estate Investment's Profit Performance

As we mentioned previously, the Wharf Real Estate Investment's profit was hampered by unusual items in the last year. Based on this observation, we consider it possible that Wharf Real Estate Investment's statutory profit actually understates its earnings potential! Unfortunately, though, its earnings per share actually fell back over the last year. The goal of this article has been to assess how well we can rely on the statutory earnings to reflect the company's potential, but there is plenty more to consider. In light of this, if you'd like to do more analysis on the company, it's vital to be informed of the risks involved. While conducting our analysis, we found that Wharf Real Estate Investment has 3 warning signs and it would be unwise to ignore these bad boys.

This note has only looked at a single factor that sheds light on the nature of Wharf Real Estate Investment's profit. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

Valuation is complex, but we're here to simplify it.

Discover if Wharf Real Estate Investment might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1997

Wharf Real Estate Investment

An investment holding company, develops, owns, and operates properties and hotels in Hong Kong, Mainland China, and Singapore.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026