- Hong Kong

- /

- Real Estate

- /

- SEHK:1972

A Look at Swire Properties (SEHK:1972) Valuation Following Crédit Agricole's Pacific Place Lease Renewal

Reviewed by Simply Wall St

Crédit Agricole has extended its lease for about 85,000 square feet at Swire Properties (SEHK:1972) Pacific Place until 2034. This move reaffirms a partnership that highlights ongoing faith in Hong Kong's office property sector.

See our latest analysis for Swire Properties.

The renewed partnership with Crédit Agricole arrives as Swire Properties’ share price shows robust momentum, jumping 4.1% in a single day and building on a year-to-date share price return of nearly 47%. The stock’s long-term outlook also looks compelling, with a 1-year total shareholder return of 52%, which suggests growing investor optimism for both the company and Hong Kong’s property sector.

If this streak of positive news has you considering what else the market might be rewarding, this could be an ideal moment to discover fast growing stocks with high insider ownership.

With shares soaring and positive headlines stacking up, investors have to wonder: Is Swire Properties trading at a bargain given its recent performance, or is the market already anticipating further gains from future growth?

Most Popular Narrative: 2.7% Undervalued

The consensus perspective currently sees fair value just above the last close, suggesting that momentum could have fundamental backing. The relatively tight gap between the stock’s price and insiders' assumptions raises questions about what is fueling this optimistic outlook.

Strong expansion pipeline in Mainland China's Tier 1 and emerging Tier 1 cities, supported by rising consumer affluence and middle-class growth, positions Swire Properties to significantly increase revenue and market share as new mixed-use retail and residential projects double GFA and progressively come online in the next five years.

Want to know what makes this growth story tick? The underlying numbers behind these projections are anything but average. Get the inside scoop on the key profit, revenue, and margin levers powering this surprisingly ambitious valuation.

Result: Fair Value of $23.45 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing softness in Hong Kong's office market and ambitious investment plans could threaten the expected earnings recovery if demand does not rebound.

Find out about the key risks to this Swire Properties narrative.

Another View: Price Ratios Paint a Different Picture

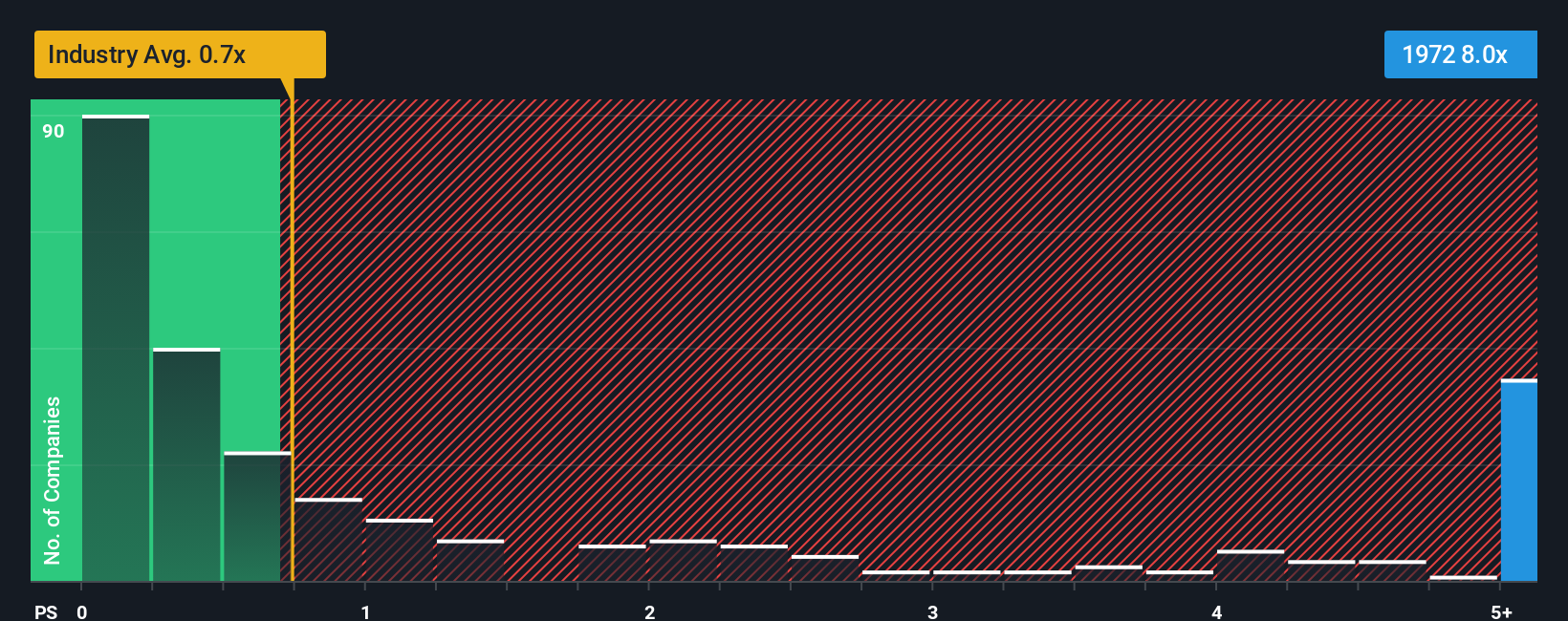

Looking through the lens of price-to-sales, Swire Properties trades at 8.1x. This is much higher than both the Hong Kong real estate industry average of 0.7x and its peer average of 4.2x. Even compared to its fair ratio of 3.9x, the company appears expensive, raising the risk that investors may be paying a premium for current momentum. Could the market be pricing in more growth than is realistic?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Swire Properties Narrative

If you see the story differently, or simply want to check the numbers for yourself, you can put together your own view in under three minutes with Do it your way.

A great starting point for your Swire Properties research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Set your portfolio apart by acting now. The right stocks can power your returns, and Simply Wall Street’s unique screeners are designed to help you spot them before the crowd.

- Capture passive income potential by tapping into these 14 dividend stocks with yields > 3%, which offers yields above 3% for stable and attractive returns.

- Join the front lines of technological innovation with these 25 AI penny stocks, which are set to benefit from breakthrough advancements in artificial intelligence.

- Take advantage of unrealized value by targeting these 865 undervalued stocks based on cash flows, which may be overlooked and priced for opportunity based on strong cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1972

Swire Properties

Develops, owns, and operates mixed-use, primarily commercial properties in Hong Kong, Mainland China, and the United States.

Moderate growth potential with mediocre balance sheet.

Market Insights

Community Narratives