- Hong Kong

- /

- Real Estate

- /

- SEHK:1918

Analysts Have Lowered Expectations For Sunac China Holdings Limited (HKG:1918) After Its Latest Results

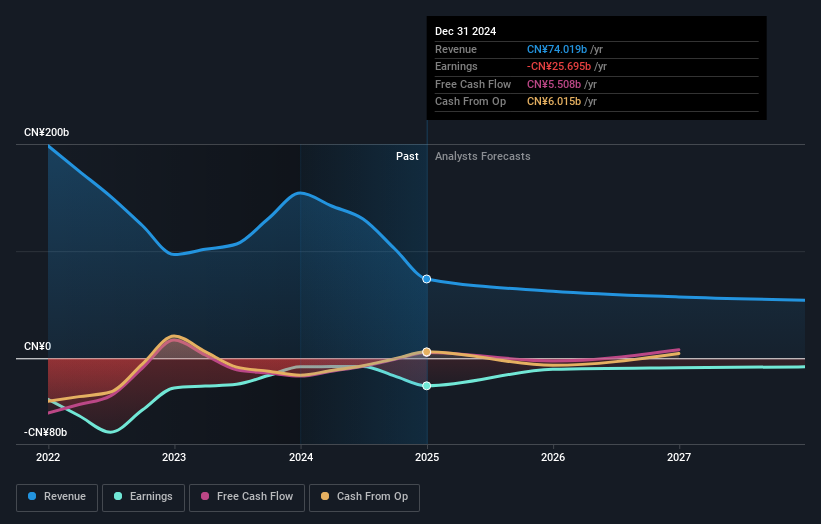

Sunac China Holdings Limited (HKG:1918) just released its latest yearly report and things are not looking great. Statutory earnings fell substantially short of expectations, with revenues of CN¥74b missing forecasts by 34%. Losses exploded, with a per-share loss of CN¥3.00 some 371% below prior forecasts. Following the result, the analysts have updated their earnings model, and it would be good to know whether they think there's been a strong change in the company's prospects, or if it's business as usual. So we gathered the latest post-earnings forecasts to see what estimates suggest is in store for next year.

Following the recent earnings report, the consensus from dual analysts covering Sunac China Holdings is for revenues of CN¥62.7b in 2025. This implies an uncomfortable 15% decline in revenue compared to the last 12 months. The loss per share is expected to greatly reduce in the near future, narrowing 54% to CN¥1.11. Before this earnings announcement, the analysts had been modelling revenues of CN¥88.1b and losses of CN¥0.69 per share in 2025. There's been a definite change in sentiment in this update, with the analysts administering a notable cut to next year's revenue estimates, while at the same time increasing their loss per share forecasts.

Check out our latest analysis for Sunac China Holdings

The consensus price target fell 26% to HK$1.05, with the analysts clearly concerned about the company following the weaker revenue and earnings outlook.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the Sunac China Holdings' past performance and to peers in the same industry. We would also point out that the forecast 15% annualised revenue decline to the end of 2025 is roughly in line with the historical trend, which saw revenues shrink 15% annually over the past five years Compare this against analyst estimates for companies in the broader industry, which suggest that revenues (in aggregate) are expected to grow 4.4% annually. So it's pretty clear that, while it does have declining revenues, the analysts also expect Sunac China Holdings to suffer worse than the wider industry.

The Bottom Line

The most important thing to take away is that the analysts increased their loss per share estimates for next year. On the negative side, they also downgraded their revenue estimates, and forecasts imply they will perform worse than the wider industry. Furthermore, the analysts also cut their price targets, suggesting that the latest news has led to greater pessimism about the intrinsic value of the business.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. We have analyst estimates for Sunac China Holdings going out as far as 2027, and you can see them free on our platform here.

And what about risks? Every company has them, and we've spotted 3 warning signs for Sunac China Holdings (of which 1 is potentially serious!) you should know about.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1918

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026