- Hong Kong

- /

- Paper and Forestry Products

- /

- SEHK:2314

Top 3 Undervalued Small Caps With Insider Action In Hong Kong For September 2024

Reviewed by Simply Wall St

The Hong Kong market has recently faced a challenging environment, with the Hang Seng Index declining by 3.03% as investors react to weak corporate earnings and economic data. Despite these headwinds, opportunities can still be found among small-cap stocks that show strong fundamentals and insider action. In this context, identifying undervalued small-cap stocks with significant insider activity can offer potential for growth even in uncertain market conditions.

Top 10 Undervalued Small Caps With Insider Buying In Hong Kong

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Shenzhen International Holdings | 5.6x | 0.7x | 27.43% | ★★★★★★ |

| Shanghai Chicmax Cosmetic | 16.2x | 2.0x | -137.24% | ★★★★☆☆ |

| Lion Rock Group | 5.5x | 0.4x | 49.42% | ★★★★☆☆ |

| EVA Precision Industrial Holdings | 4.5x | 0.2x | 17.69% | ★★★★☆☆ |

| Meilleure Health International Industry Group | 25.2x | 9.3x | 24.06% | ★★★☆☆☆ |

| Analogue Holdings | 12.7x | 0.2x | 44.23% | ★★★☆☆☆ |

| Skyworth Group | 4.7x | 0.1x | -140.87% | ★★★☆☆☆ |

| Lee & Man Paper Manufacturing | 5.9x | 0.3x | -19.98% | ★★★☆☆☆ |

| CN Logistics International Holdings | 19.2x | 0.4x | 25.66% | ★★★☆☆☆ |

| Comba Telecom Systems Holdings | NA | 0.6x | 38.08% | ★★★☆☆☆ |

We'll examine a selection from our screener results.

K. Wah International Holdings (SEHK:173)

Simply Wall St Value Rating: ★★★★☆☆

Overview: K. Wah International Holdings is engaged in property development and investment, with operations primarily in Hong Kong and Mainland China, and has a market cap of HK$9.76 billion.

Operations: K. Wah International Holdings generates revenue primarily from property development in Mainland China and Hong Kong, with additional income from property investment. The company has experienced fluctuations in its net profit margin, which reached a high of 76.44% in December 2014 and a low of 11.24% in June 2024, reflecting variability in operational efficiency and non-operating expenses over time.

PE: 11.0x

K. Wah International Holdings, a small cap in Hong Kong, recently reported a dip in earnings for the half year ending June 30, 2024, with sales at HK$1.21 billion and net income at HK$153.79 million compared to last year's HK$3.10 billion and HK$481.91 million respectively. Despite this downturn, insider confidence remains strong with notable share purchases by executives throughout the past six months. The company declared an interim cash dividend of HKD 0.04 per share payable on October 25, reflecting potential future growth amidst current undervaluation concerns.

- Delve into the full analysis valuation report here for a deeper understanding of K. Wah International Holdings.

Understand K. Wah International Holdings' track record by examining our Past report.

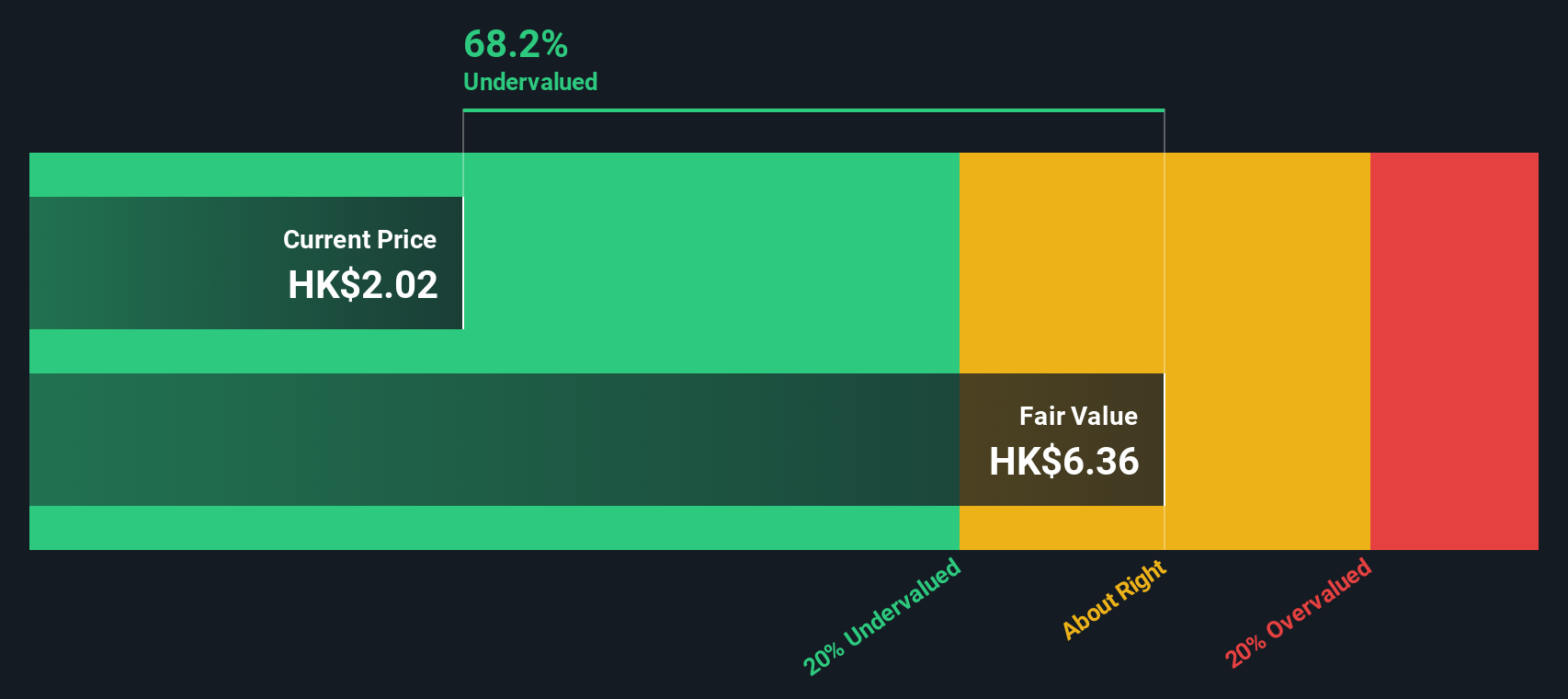

Lee & Man Paper Manufacturing (SEHK:2314)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Lee & Man Paper Manufacturing is a company engaged in the production of pulp, tissue paper, and packaging paper with a market cap of approximately HK$18.23 billion.

Operations: The company generates revenue primarily from Packaging Paper, Tissue Paper, and Pulp. Over recent periods, the net income margin has shown variability, with a notable decline to 2.67% as of June 30, 2023. The cost of goods sold (COGS) consistently represents a significant portion of expenses, impacting overall profitability.

PE: 5.9x

Lee & Man Paper Manufacturing, a notable player in the Hong Kong small-cap sector, recently declared an interim dividend of HK$0.062 per share for the six months ending June 30, 2024. Their half-year results showed sales of HK$12.51 billion and net income of HK$805.69 million, a substantial increase from last year’s HK$359.9 million. Insider confidence is evident with Ho Chung Lee purchasing 483,000 shares valued at approximately HK$1.1 million in July 2024, reflecting strong belief in the company's potential growth and value proposition despite higher risk funding sources through external borrowing only.

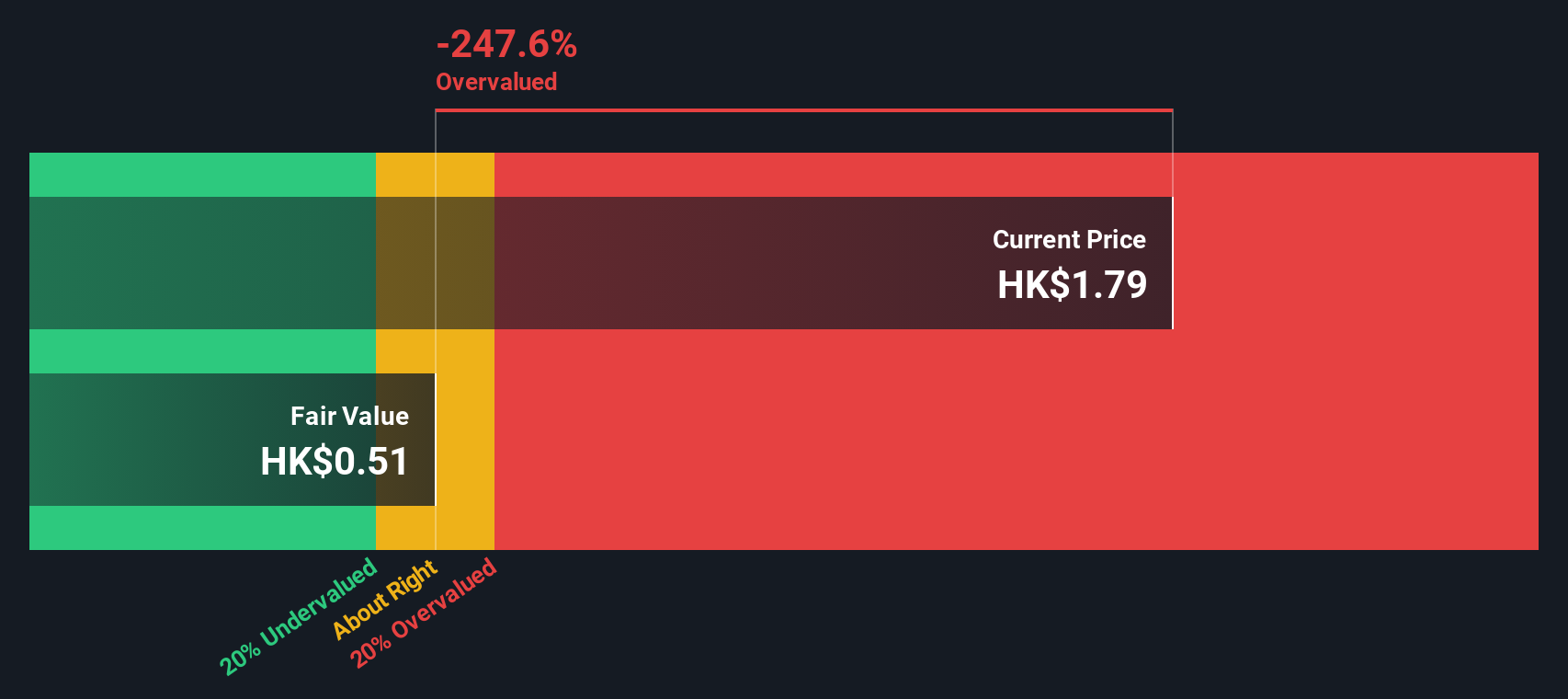

Comba Telecom Systems Holdings (SEHK:2342)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Comba Telecom Systems Holdings specializes in providing wireless telecommunications network system equipment and services, as well as operator telecommunication services, with a market cap of HK$2.43 billion.

Operations: The company's primary revenue streams are from Wireless Telecommunications Network System Equipment and Services (HK$4941.02 million) and Operator Telecommunication Services (HK$156.22 million). For the period ending June 30, 2023, the gross profit margin was 28.63%, reflecting a gross profit of HK$1875.39 million on revenues of HK$6550.35 million.

PE: -11.5x

Comba Telecom Systems Holdings, a small cap in Hong Kong, recently faced challenges with a projected loss of HK$160 million for the first half of 2024 due to delayed network projects and declining gross profit. Despite this, insider confidence is evident through share purchases over the past six months. The company decided against declaring an interim dividend for H1 2024. Their volatile share price reflects market uncertainties, but ongoing industry engagements like MWC Shanghai suggest potential future opportunities.

- Click to explore a detailed breakdown of our findings in Comba Telecom Systems Holdings' valuation report.

Learn about Comba Telecom Systems Holdings' historical performance.

Taking Advantage

- Access the full spectrum of 11 Undervalued SEHK Small Caps With Insider Buying by clicking on this link.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2314

Lee & Man Paper Manufacturing

An investment holding company, engages in the manufacture and trading of packaging papers, pulps, and tissue papers in the People’s Republic of China, Vietnam, Malaysia, Macau, and Hong Kong.

Proven track record and fair value.