- Hong Kong

- /

- Healthcare Services

- /

- SEHK:1931

Discovering Hidden Opportunities in Hong Kong with These 3 Undiscovered Gems

Reviewed by Simply Wall St

In recent weeks, the Hong Kong market has experienced notable fluctuations, reflecting broader global economic uncertainties and investor sentiment. Despite these challenges, the search for undervalued opportunities within small-cap stocks remains a compelling strategy for discerning investors. Identifying promising stocks in such an environment often involves looking beyond the surface to find companies with solid fundamentals and growth potential that have been overlooked by the broader market.

Top 10 Undiscovered Gems With Strong Fundamentals In Hong Kong

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Lion Rock Group | 16.91% | 14.33% | 10.15% | ★★★★★★ |

| E-Commodities Holdings | 21.33% | 9.04% | 28.46% | ★★★★★★ |

| PW Medtech Group | 0.06% | 22.33% | -17.56% | ★★★★★★ |

| COSCO SHIPPING International (Hong Kong) | NA | -3.84% | 16.33% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| S.A.S. Dragon Holdings | 60.96% | 4.62% | 10.02% | ★★★★★☆ |

| HBM Holdings | 52.89% | 66.59% | 31.70% | ★★★★★☆ |

| TIL Enviro | 47.97% | -23.09% | -8.84% | ★★★★☆☆ |

| Pizu Group Holdings | 48.34% | -4.53% | -19.78% | ★★★★☆☆ |

| Billion Industrial Holdings | 3.63% | 18.00% | -11.38% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

IVD Medical Holding (SEHK:1931)

Simply Wall St Value Rating: ★★★★★☆

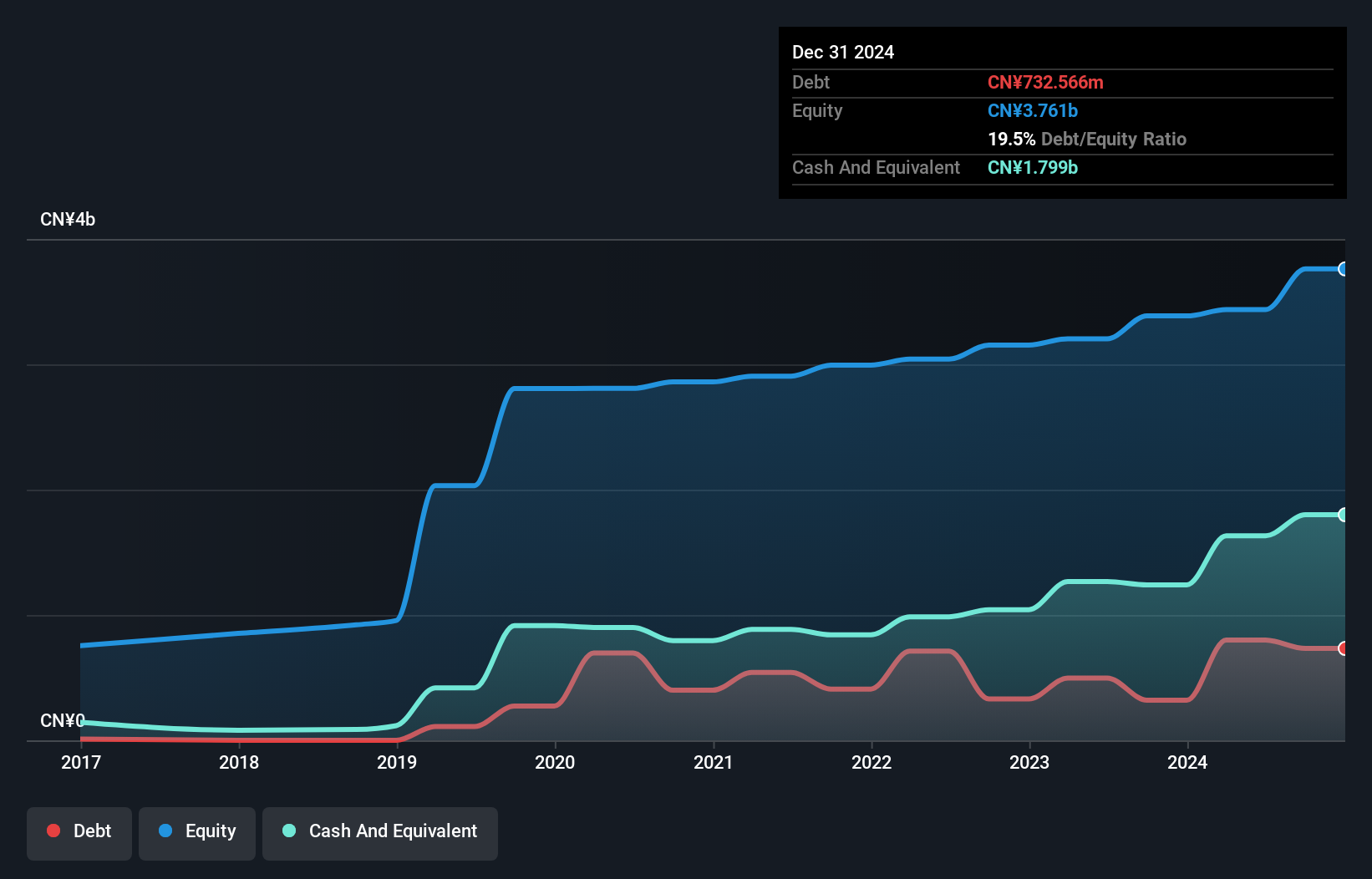

Overview: IVD Medical Holding Limited, with a market cap of HK$1.99 billion, is an investment holding company that distributes in vitro diagnostic (IVD) products in Mainland China and internationally.

Operations: IVD Medical Holding generates revenue primarily from its distribution business (CN¥2.86 billion), followed by after-sales services (CN¥196.47 million) and self-branded products (CN¥9.05 million).

IVD Medical Holding reported half-year sales of CNY 1.35 billion, slightly down from CNY 1.38 billion last year, while net income rose to CNY 125.29 million from CNY 103.01 million. Basic earnings per share improved to CNY 0.0927 from CNY 0.0762 a year ago, reflecting solid performance despite a challenging market environment. The company recently filed for a follow-on equity offering worth HKD 189.64 million and experienced executive changes with Ms. Lam Wai Yan's resignation as joint company secretary effective July 2024.

- Navigate through the intricacies of IVD Medical Holding with our comprehensive health report here.

Assess IVD Medical Holding's past performance with our detailed historical performance reports.

YesAsia Holdings (SEHK:2209)

Simply Wall St Value Rating: ★★★★★★

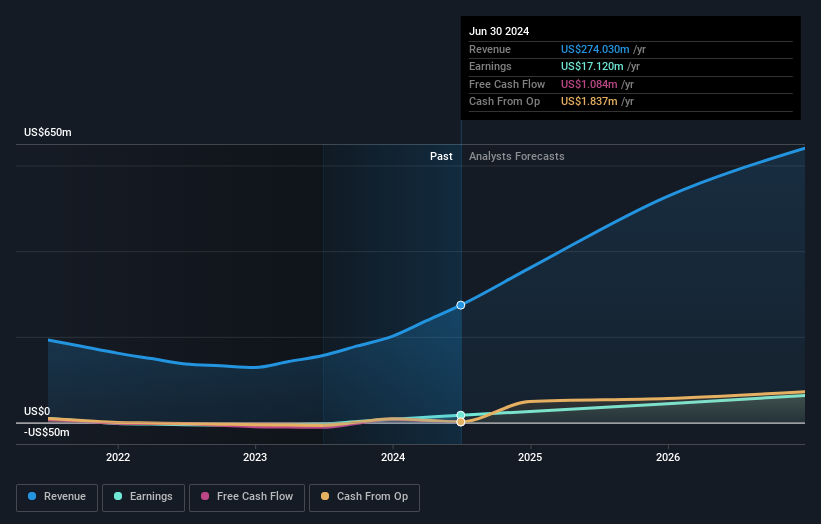

Overview: YesAsia Holdings Limited is an investment holding company involved in the procurement, sale, and trading of Asian fashion and lifestyle, beauty, cosmetics, accessories, and entertainment products with a market cap of HK$2.63 billion.

Operations: YesAsia Holdings generates revenue primarily from two segments: Entertainment Products (HK$2.56 million) and Fashion & Lifestyle and Beauty Products (HK$270.65 million). The company has a market cap of HK$2.63 billion.

YesAsia Holdings has shown impressive growth, reporting a net income of US$11.11 million for the first half of 2024, up from US$1.56 million last year. Revenue surged to US$163.35 million from US$90.66 million due to increased sales in beauty products through YesStyle Platforms and AsianBeautyWholesale. The company declared a final dividend of HKD 5 cents per share for 2023, reflecting strong performance and commitment to shareholder returns despite recent significant insider selling activity over the past three months.

- Delve into the full analysis health report here for a deeper understanding of YesAsia Holdings.

Gain insights into YesAsia Holdings' past trends and performance with our Past report.

Wanguo International Mining Group (SEHK:3939)

Simply Wall St Value Rating: ★★★★★☆

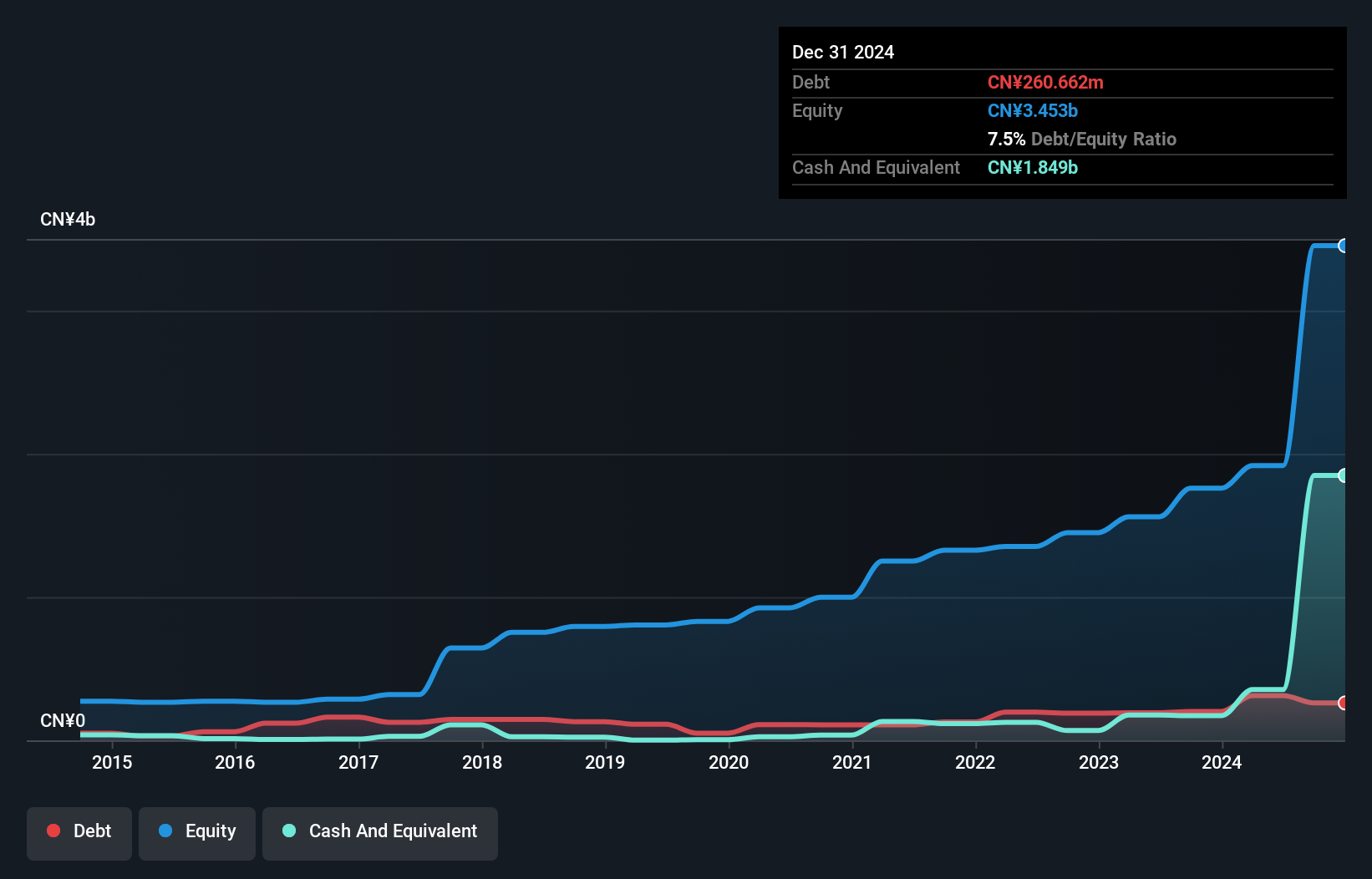

Overview: Wanguo International Mining Group Limited is an investment holding company involved in mining, ore processing, and the sale of concentrate products in China and the Solomon Islands, with a market cap of HK$7.33 billion.

Operations: The company's revenue streams primarily come from the Yifeng Project (CN¥749.25 million) and the Solomon Project (CN¥912.63 million).

Wanguo Gold Group, previously Wanguo International Mining, reported a significant earnings growth of 89.9% over the past year, outpacing the industry’s 23.1%. For the half-year ending June 2024, sales reached CNY927.86 million with net income rising to CNY254.27 million from CNY147.11 million a year ago. The company announced an interim dividend of HKD0.12 per share and recently appointed Deloitte as its new auditor to support its global expansion efforts.

Turning Ideas Into Actions

- Dive into all 172 of the SEHK Undiscovered Gems With Strong Fundamentals we have identified here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1931

IVD Medical Holding

An investment holding company, distributes In vitro diagnostic (IVD) products in Mainland China and internationally.

Solid track record with excellent balance sheet.