- Hong Kong

- /

- Real Estate

- /

- SEHK:173

Top 3 Undervalued Small Caps With Insider Action In Hong Kong For August 2024

Reviewed by Simply Wall St

In recent weeks, the Hong Kong market has shown resilience amid global economic uncertainties, with the Hang Seng Index gaining 0.85% despite broader concerns about deflationary pressures in China. As investors navigate these volatile conditions, small-cap stocks with insider action can present intriguing opportunities due to their potential for growth and relatively lower valuations. Identifying good stocks in this environment often involves looking at companies that demonstrate strong fundamentals and have insiders who are actively buying shares, signaling confidence in their future prospects.

Top 10 Undervalued Small Caps With Insider Buying In Hong Kong

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Ever Sunshine Services Group | 5.4x | 0.4x | 27.71% | ★★★★★☆ |

| Lee & Man Paper Manufacturing | 6.4x | 0.4x | 38.24% | ★★★★★☆ |

| Kinetic Development Group | 4.4x | 1.9x | 22.36% | ★★★★☆☆ |

| iDreamSky Technology Holdings | NA | 1.8x | 46.24% | ★★★★☆☆ |

| Wasion Holdings | 11.7x | 0.8x | 39.07% | ★★★☆☆☆ |

| Shanghai Chicmax Cosmetic | 26.5x | 2.9x | 1.20% | ★★★☆☆☆ |

| Skyworth Group | 5.3x | 0.1x | -237.30% | ★★★☆☆☆ |

| EVA Precision Industrial Holdings | 4.9x | 0.2x | 7.57% | ★★★☆☆☆ |

| China Leon Inspection Holding | 9.7x | 0.7x | 36.99% | ★★★☆☆☆ |

| Truly International Holdings | 12.1x | 0.2x | 39.36% | ★★★☆☆☆ |

Let's dive into some prime choices out of from the screener.

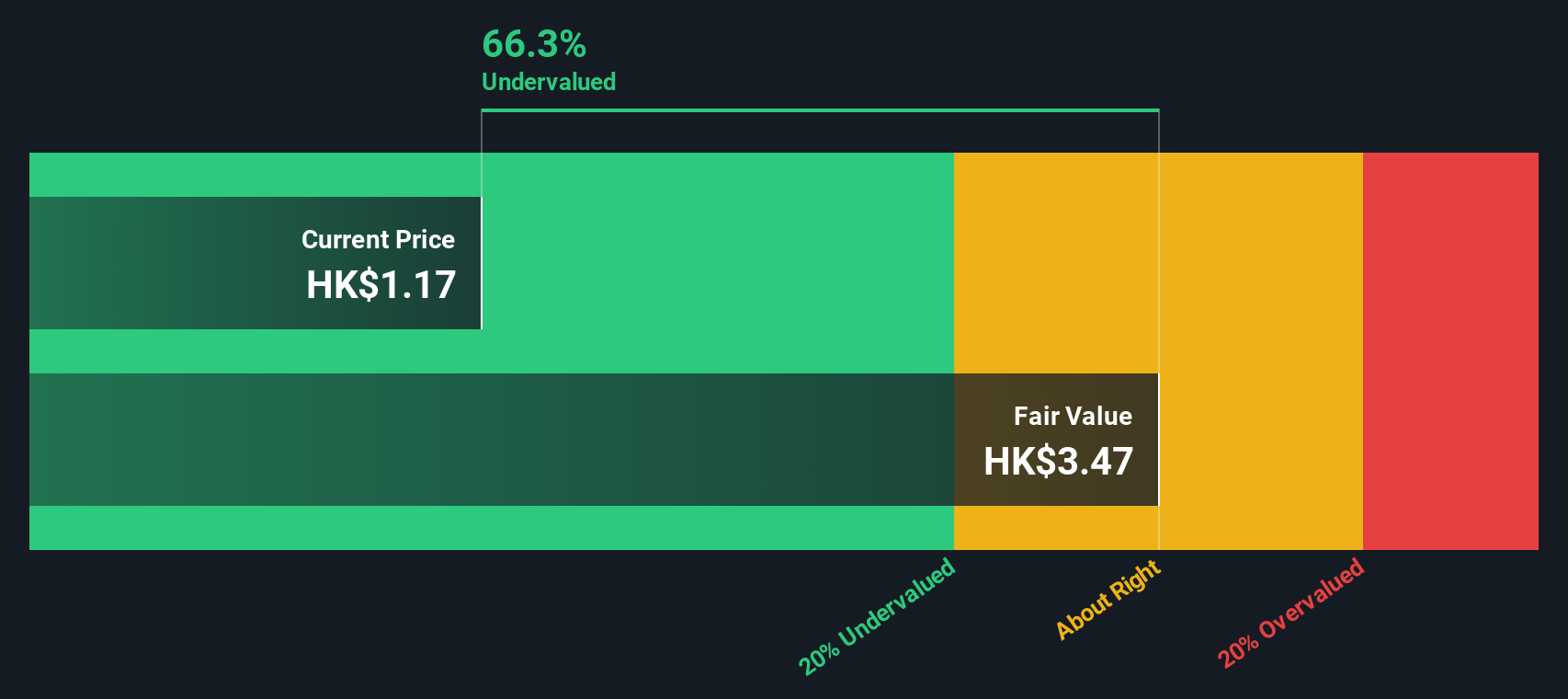

Kinetic Development Group (SEHK:1277)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Kinetic Development Group is a company engaged in property development and investment, with a market cap of approximately CN¥3.45 billion.

Operations: Kinetic Development Group's revenue streams are primarily derived from sales, with significant costs attributed to cost of goods sold (COGS). The company's gross profit margin has shown an upward trend, reaching 67.35% as of March 31, 2022. Operating expenses include general and administrative expenses and sales & marketing expenses. Net income margins have also improved over time, standing at 43.79% by December 31, 2023.

PE: 4.4x

Kinetic Development Group, a small cap in Hong Kong, recently announced a special dividend of HK$0.04 per share, with payment set for September 9, 2024. The company operates with external borrowing as its sole funding source, which is riskier than customer deposits. Notably, insider confidence has been evident with significant share purchases over the past six months. This combination of insider activity and upcoming dividends suggests potential value despite higher funding risks.

- Click here to discover the nuances of Kinetic Development Group with our detailed analytical valuation report.

Understand Kinetic Development Group's track record by examining our Past report.

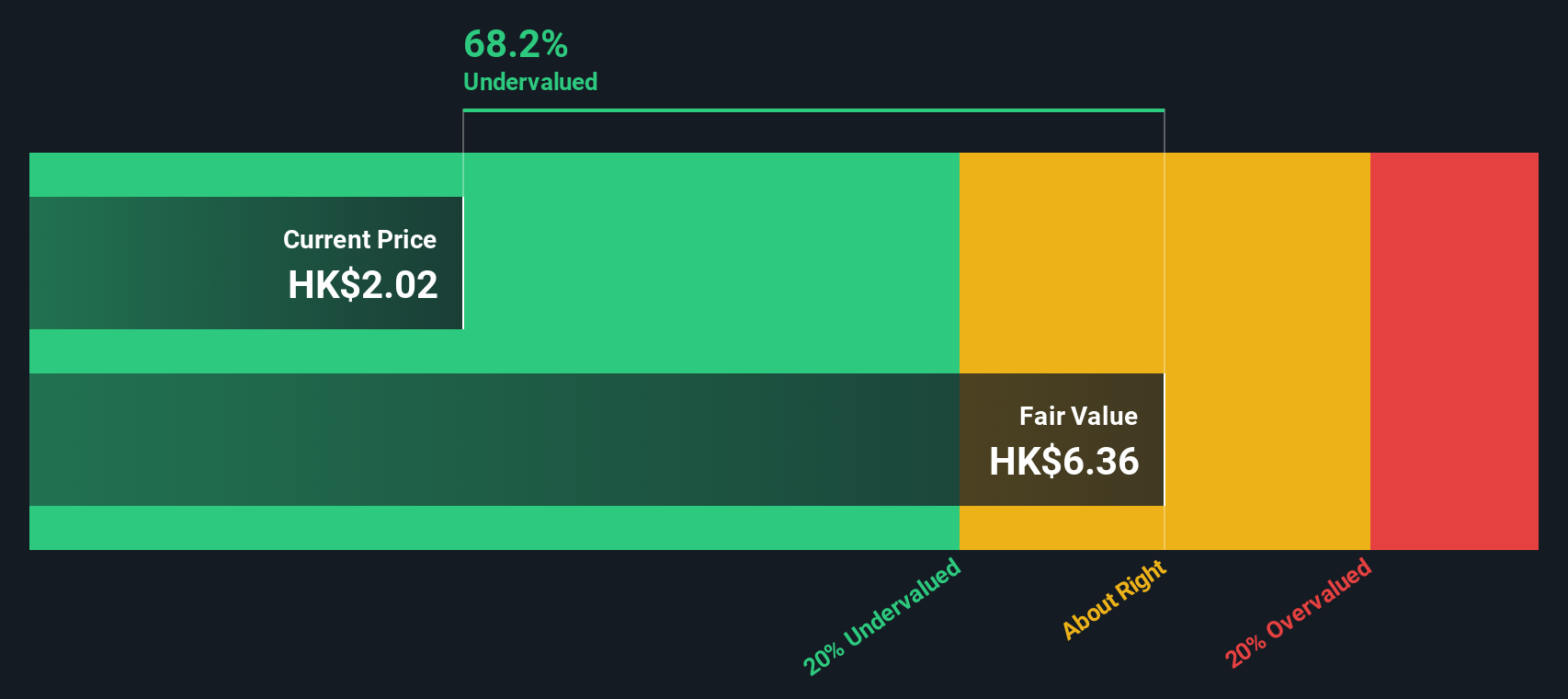

K. Wah International Holdings (SEHK:173)

Simply Wall St Value Rating: ★★★★☆☆

Overview: K. Wah International Holdings operates primarily in property development and investment across Hong Kong and Mainland China, with a market capitalization of HK$10.3 billion.

Operations: The company's primary revenue streams are derived from property development in Mainland China and Hong Kong, along with property investment. The net profit margin has shown variability, reaching 13.14% as of December 31, 2023. Operating expenses include general and administrative costs, which have fluctuated around HK$500 million to HK$600 million in recent periods.

PE: 6.9x

K. Wah International Holdings, a small-cap player in Hong Kong, has recently seen insider confidence with significant share purchases over the past quarter. The company repurchased shares worth HK$45 million in June 2024. Despite a dividend decrease to HK$0.09 per share for 2023, earnings are projected to grow at an annual rate of 8.63%. With no customer deposits and relying entirely on external borrowing, K. Wah's financial structure remains riskier but manageable given its growth outlook and insider activity.

- Click to explore a detailed breakdown of our findings in K. Wah International Holdings' valuation report.

Gain insights into K. Wah International Holdings' past trends and performance with our Past report.

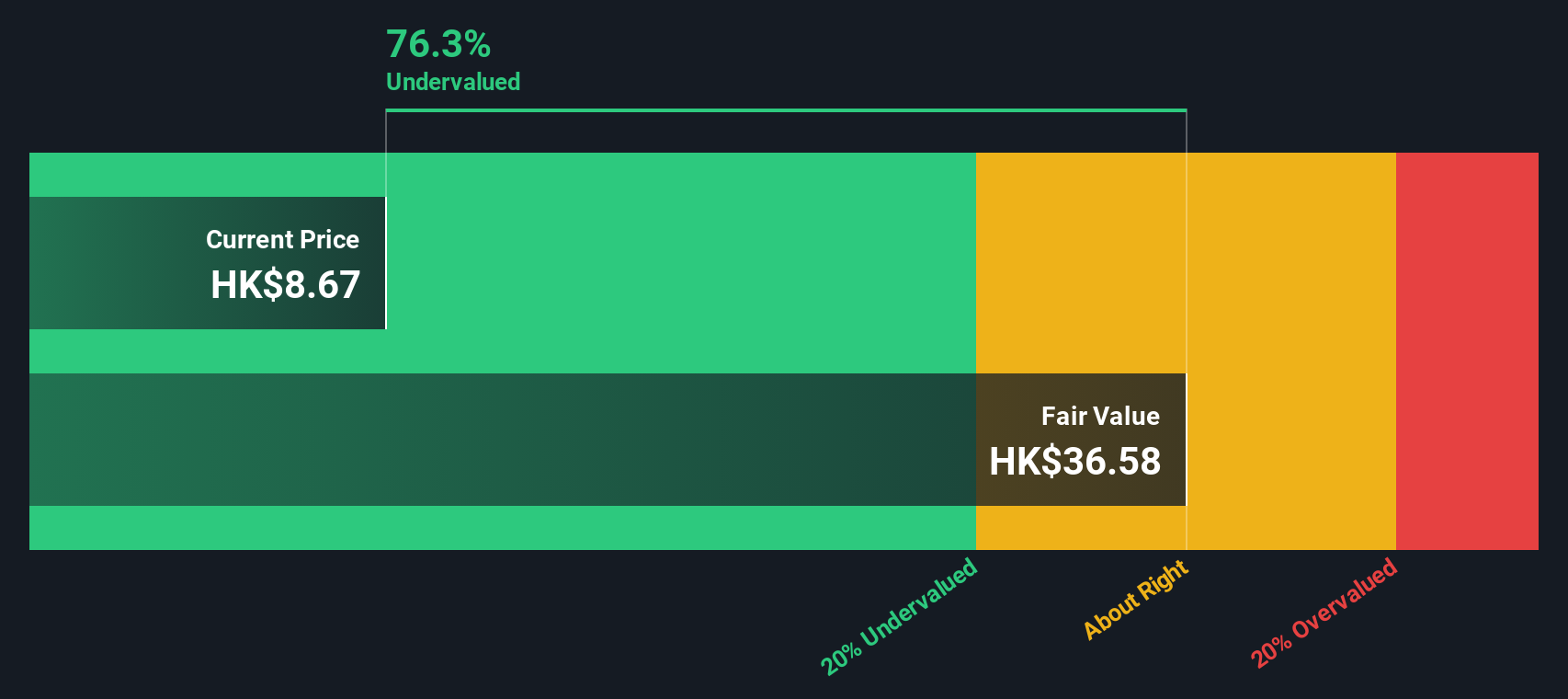

Wasion Holdings (SEHK:3393)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Wasion Holdings is engaged in the production and distribution of advanced metering infrastructure and distribution operations, with a market cap of approximately CN¥3.58 billion.

Operations: The company generates revenue primarily from three segments: Advanced Distribution Operations, Power Advanced Metering Infrastructure, and Communication and Fluid Advanced Metering Infrastructure. For the period ending September 30, 2023, it reported a gross profit margin of 34.97% on a revenue of CN¥6.89 billion.

PE: 11.7x

Wasion Holdings has caught attention due to its significant insider confidence. Founder and Executive Chairman Wei Ji purchased 500,000 shares recently, investing approximately HK$3.17 million. This move suggests strong belief in the company's future prospects. For the first half of 2024, Wasion expects a net profit of over RMB 330 million, up from RMB 213.8 million a year earlier, driven by increased sales and cost control measures. Recent contracts in Hungary (EUR 31.62 million), Singapore (USD 9.42 million), and Malaysia (USD 5.74 million) highlight its expanding international footprint and market recognition in smart grid technology.

- Click here and access our complete valuation analysis report to understand the dynamics of Wasion Holdings.

Evaluate Wasion Holdings' historical performance by accessing our past performance report.

Seize The Opportunity

- Click through to start exploring the rest of the 10 Undervalued SEHK Small Caps With Insider Buying now.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if K. Wah International Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:173

K. Wah International Holdings

An investment holding company, engages in the property development and investment businesses in Hong Kong and Mainland China.

Excellent balance sheet with reasonable growth potential.