- Hong Kong

- /

- Food and Staples Retail

- /

- SEHK:2517

Discovering Hong Kong's Undiscovered Gems in September 2024

Reviewed by Simply Wall St

As global markets react to the U.S. Federal Reserve's recent rate cut, Hong Kong's Hang Seng Index has shown a notable gain of 5.12%, reflecting a cautiously optimistic sentiment among investors. This environment presents an opportune moment to explore some of Hong Kong's lesser-known but promising stocks. In such dynamic conditions, a good stock often demonstrates resilience and potential for growth despite broader market fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals In Hong Kong

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| C&D Property Management Group | 1.32% | 37.15% | 41.55% | ★★★★★★ |

| Changjiu Holdings | NA | 11.84% | 2.46% | ★★★★★★ |

| COSCO SHIPPING International (Hong Kong) | NA | -3.84% | 16.33% | ★★★★★★ |

| Sundart Holdings | 0.92% | -2.32% | -3.94% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Xin Point Holdings | 1.77% | 10.88% | 22.83% | ★★★★★☆ |

| S.A.S. Dragon Holdings | 60.96% | 4.62% | 10.02% | ★★★★★☆ |

| Time Interconnect Technology | 212.50% | 27.21% | 15.01% | ★★★★☆☆ |

| Chongqing Machinery & Electric | 27.77% | 8.82% | 11.12% | ★★★★☆☆ |

| Pizu Group Holdings | 48.34% | -4.53% | -19.78% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Kinetic Development Group (SEHK:1277)

Simply Wall St Value Rating: ★★★★★☆

Overview: Kinetic Development Group Limited, with a market cap of HK$12.05 billion, is an investment holding company involved in the extraction and sale of coal products in the People’s Republic of China.

Operations: Kinetic Development Group Limited generates revenue primarily from the extraction and sale of coal products in the People’s Republic of China. The company reported a market cap of HK$12.05 billion.

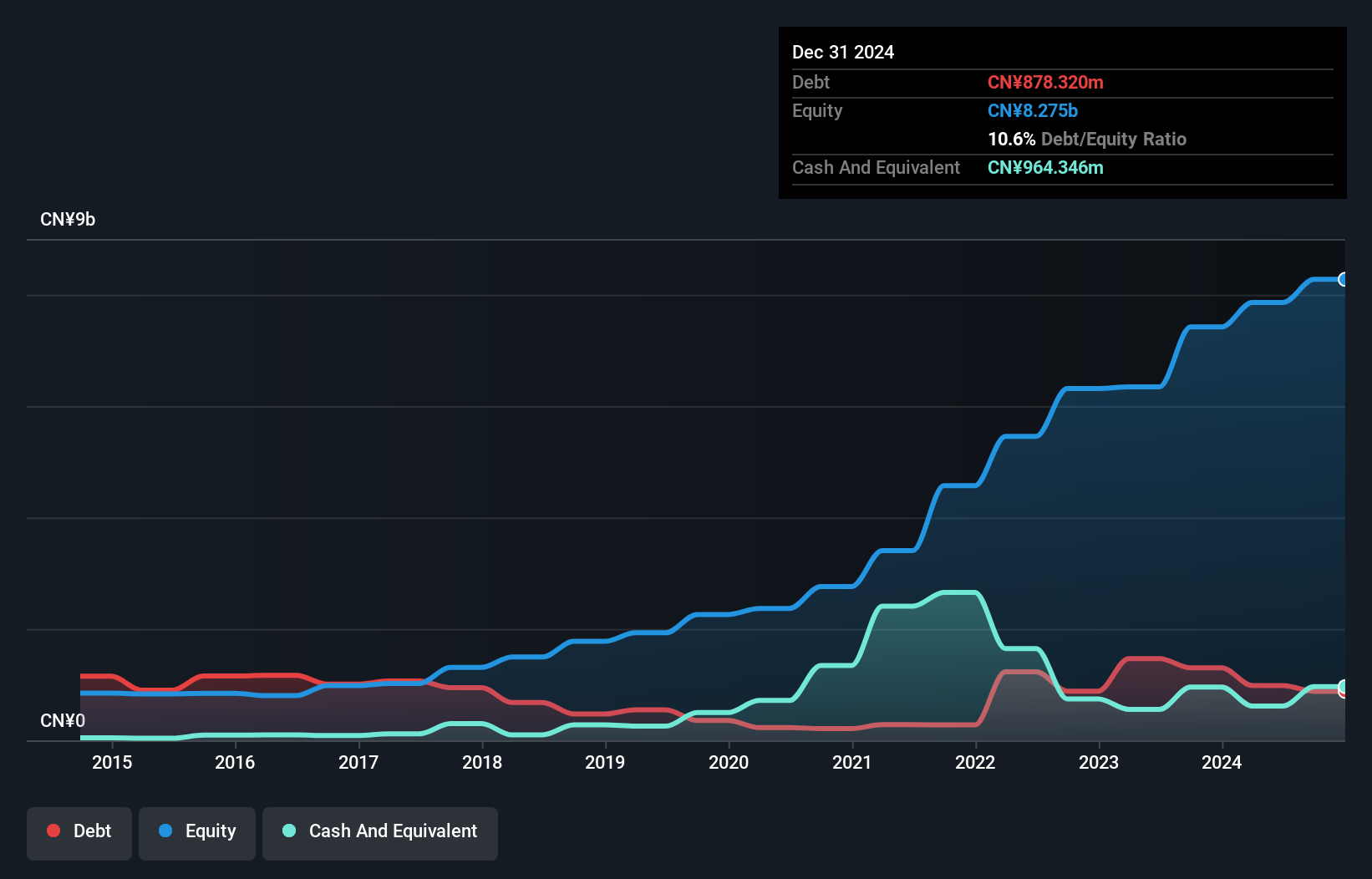

Kinetic Development Group has shown impressive financial performance, with earnings growth of 39.2% over the past year outpacing the Oil and Gas industry's 4.6%. Their debt to equity ratio has reduced significantly from 28.4% to 12.5% in five years, indicating improved financial health. The company reported sales of CNY 2.53 billion for the first half of 2024, up from CNY 1.49 billion a year ago, and net income rose to CNY 1.10 billion from CNY 570 million last year, reflecting strong operational efficiency and profitability.

- Take a closer look at Kinetic Development Group's potential here in our health report.

Understand Kinetic Development Group's track record by examining our Past report.

Time Interconnect Technology (SEHK:1729)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Time Interconnect Technology Limited, an investment holding company, manufactures and sells cable assembly and networking cable products in various international markets with a market cap of HK$8.29 billion.

Operations: Time Interconnect Technology Limited generates revenue primarily from server products (HK$2.98 billion), digital cable (HK$1.18 billion), and cable assembly (HK$2.31 billion). The company operates in multiple international markets, contributing to its diverse revenue streams.

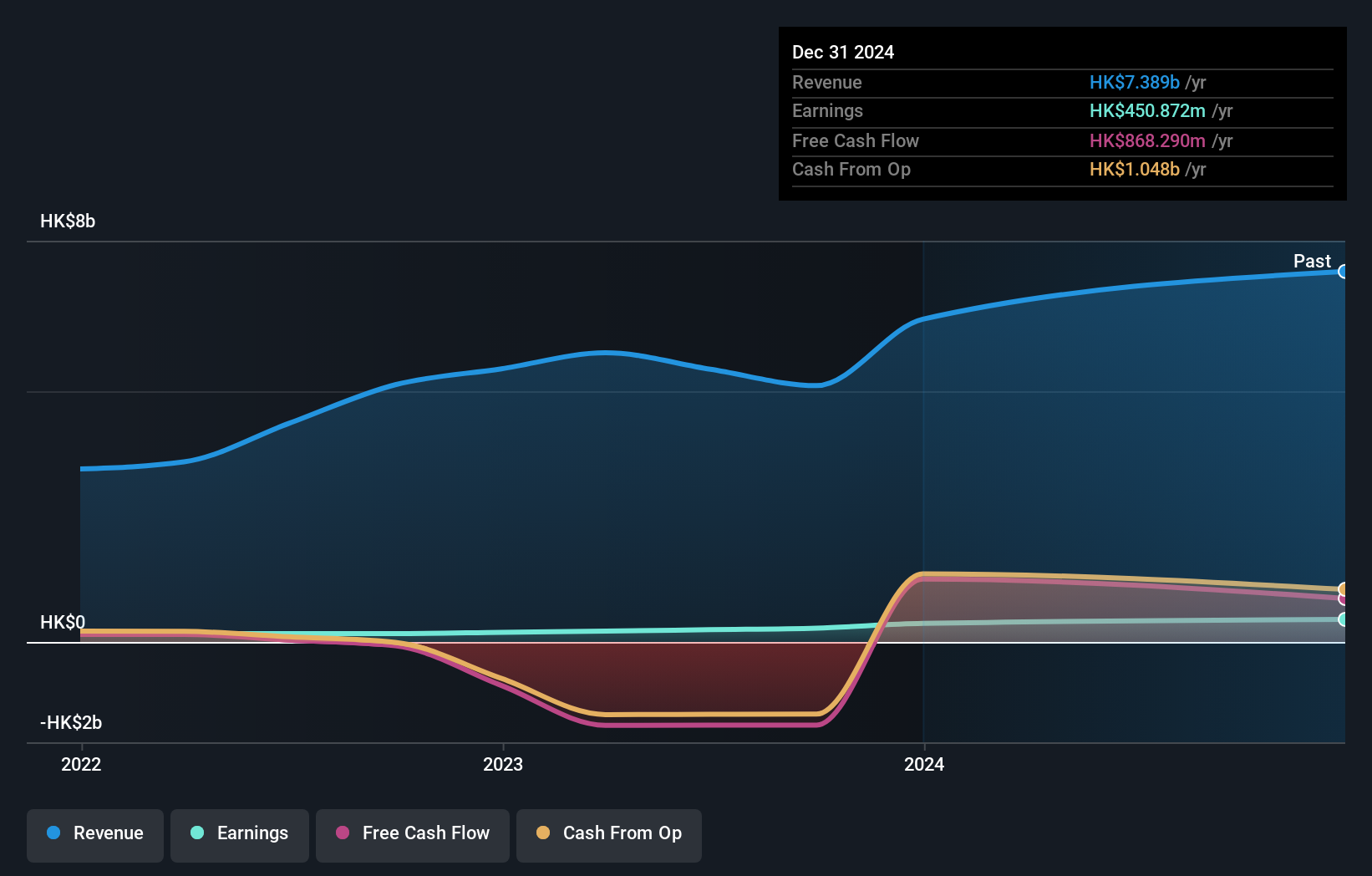

Time Interconnect Technology has shown impressive growth, with earnings increasing by 93.1% over the past year, outpacing the Electrical industry’s 15.1%. The company reported half-year sales of HK$2.67 billion and net income of HK$202.6 million, up from HK$151.11 million a year ago. Despite a high debt-to-equity ratio of 212.5%, interest payments are well covered by EBIT at 9x coverage, indicating strong financial health in managing debt obligations effectively.

- Navigate through the intricacies of Time Interconnect Technology with our comprehensive health report here.

Gain insights into Time Interconnect Technology's past trends and performance with our Past report.

Guoquan Food (Shanghai) (SEHK:2517)

Simply Wall St Value Rating: ★★★★★☆

Overview: Guoquan Food (Shanghai) Co., Ltd. operates as a home meal products company in China with a market cap of HK$7.78 billion.

Operations: Guoquan Food (Shanghai) Co., Ltd. generates revenue primarily through retail sales in grocery stores, amounting to CN¥5.998 billion. The company has a market cap of HK$7.78 billion.

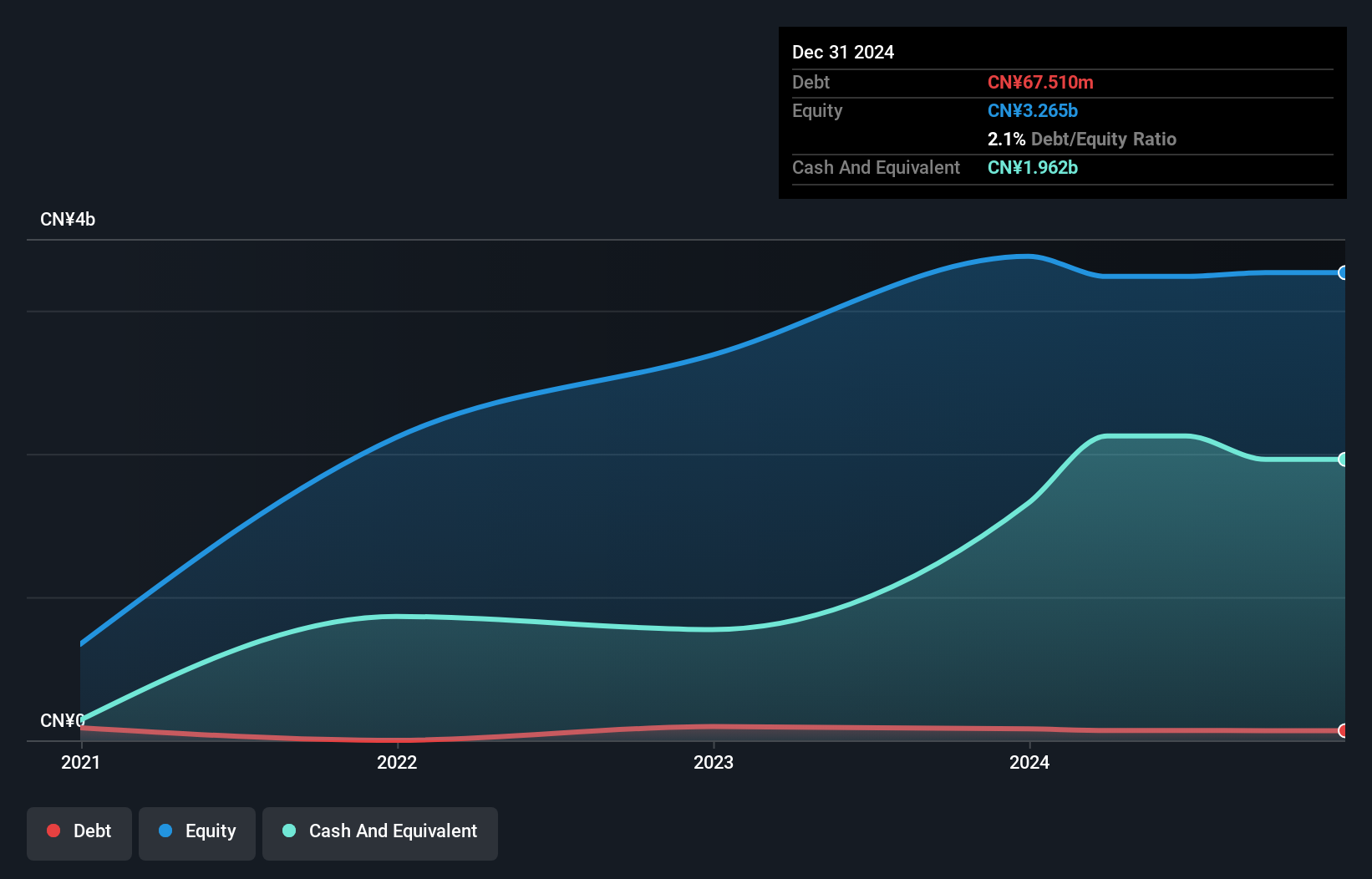

Guoquan Food (Shanghai) recently reported half-year sales of CNY 2.67 billion, down from CNY 2.76 billion last year, with net income at CNY 85.98 million compared to CNY 107.7 million previously. The company trades at a significant discount of 63.5% below estimated fair value and has more cash than total debt, indicating strong financial health despite recent earnings growth challenges (-7.2%). Additionally, Guoquan is free cash flow positive and profitable, ensuring no immediate concerns about its cash runway.

- Click here and access our complete health analysis report to understand the dynamics of Guoquan Food (Shanghai).

Assess Guoquan Food (Shanghai)'s past performance with our detailed historical performance reports.

Taking Advantage

- Delve into our full catalog of 171 SEHK Undiscovered Gems With Strong Fundamentals here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2517

Guoquan Food (Shanghai)

Operates as a home meal products company in Mainland China.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.