- Hong Kong

- /

- Real Estate

- /

- SEHK:17

New World Development (SEHK:17): Evaluating Valuation Signals After Recent Share Price Momentum

Reviewed by Simply Wall St

New World Development (SEHK:17) Stock: Investors Watching for Signals

If you’ve been following New World Development (SEHK:17) lately, you may have noticed some movement in its share price that’s catching investor attention. Sometimes these shifts are prompted by headlines, but in this case, there’s no single event behind the latest action. The market is tuning in and trying to interpret the story behind the numbers. For investors considering what to do next, it’s natural to question whether this price activity is flashing a signal about what’s ahead for New World Development, or if it’s more a matter of the wider market adjusting its outlook.

Zooming out, the stock has bounced back by 28% over the past year, recouping some losses from tougher times a few years ago. Momentum has really picked up over the past three months, with shares up 62%, a sharp shift compared to declines over the past five years. This rally lines up with a broader trend of investors reevaluating real estate and development firms in the current market climate, even as the company continues to face challenges reflected in its profit numbers.

With that in mind, the question now is whether New World Development is offering a valuation opportunity right now, or if the market is simply factoring in all future growth possibilities already. What do you think—is there upside left?

Most Popular Narrative: 82.5% Overvalued

The most widely followed narrative currently sees New World Development as significantly overvalued. According to analyst consensus, the market price is well above what they consider a fair value, based on their projections and risk assessment.

Structural industry risks, including regulatory tightening, greater sustainability requirements, and competition from more asset-light and tech-driven developers, suggest that New World's traditional asset-heavy model may face long-term margin pressure and capex needs. This could further constrain its ability to enhance net margins and deliver consistent earnings growth.

Curious how deep the transformation needs to go for New World Development to justify today’s price? The narrative hinges on bold recovery bets and a profit turnaround most would not expect from a company still booking hefty losses. Want to see which future assumptions about profits, growth, and the industry tip the scales in this overvaluation call? Dive into the full story to discover the quantitative leaps that analysts are pricing in.

Result: Fair Value of HK$4.57 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, a recovery in China's property market or stronger performance from flagship commercial assets could quickly shift sentiment and challenge the current view that the stock is overvalued.

Find out about the key risks to this New World Development narrative.Another View: Multiples Tell a Different Story

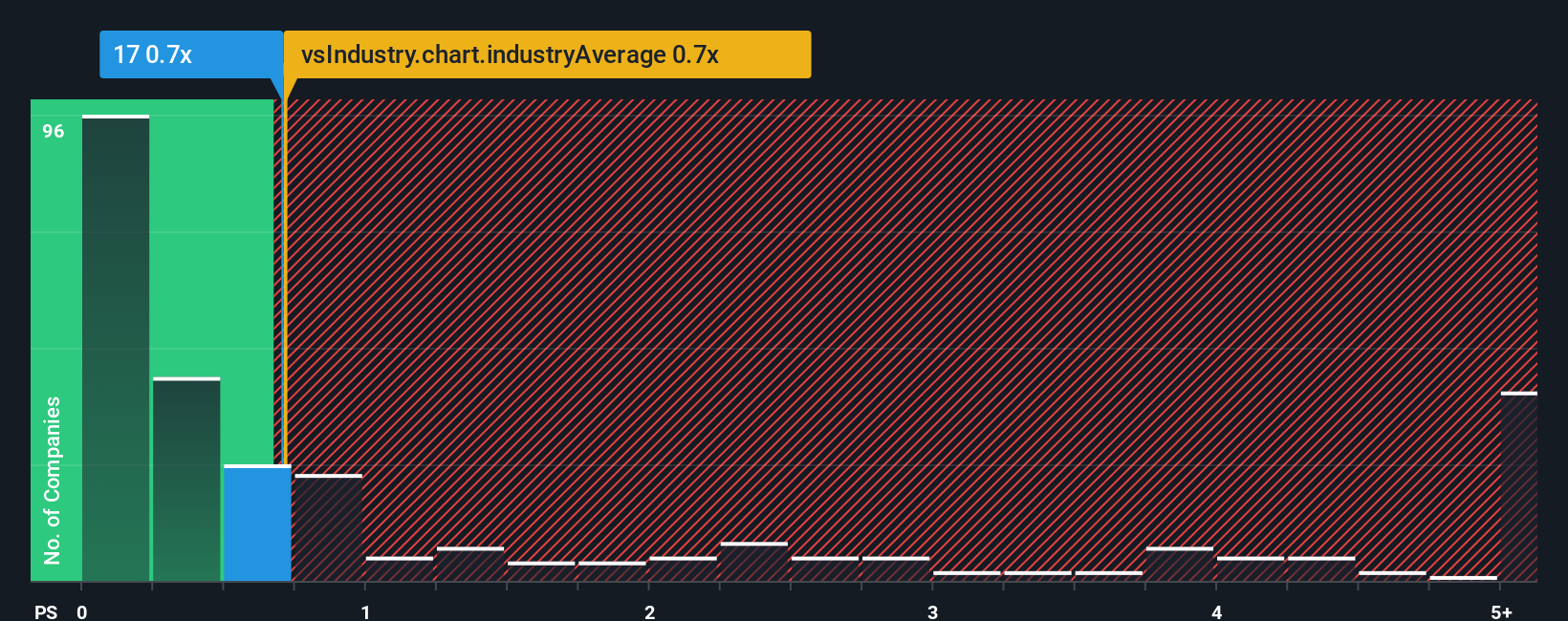

Looking at things through a different lens, our take on New World Development’s price-to-sales ratio suggests it is actually trading below the industry average. This hints at better relative value than the market may think. Could this mean the crowd is overlooking something?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own New World Development Narrative

If you see things differently or would rather dig into the numbers on your own terms, you’re only a few minutes away from building a personalized narrative yourself. Do it your way.

A great starting point for your New World Development research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don't let your research stop here. There are fresh opportunities just waiting to be uncovered. With the Simply Wall Street Screener, you'll spot investments others miss and get ahead of the curve with cutting-edge stock insights.

- Capture the high-yield advantage by seeing which companies offer attractive payouts with dividend stocks with yields > 3%.

- Seize the potential early movers in artificial intelligence by checking out firms driving tomorrow’s breakthroughs via AI penny stocks.

- Spot gems that the market undervalues and could deliver standout returns with undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if New World Development might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About SEHK:17

New World Development

An investment holding company, operates in the property development and investment business in Hong Kong and Mainland China.

Fair value with worrying balance sheet.

Similar Companies

Market Insights

Community Narratives