- Hong Kong

- /

- Real Estate

- /

- SEHK:16

Sun Hung Kai Properties (SEHK:16): Is the Stock’s Value Reflecting Its True Growth Potential?

Reviewed by Simply Wall St

Most Popular Narrative: 3.1% Undervalued

The most closely-watched narrative sees Sun Hung Kai Properties as currently trading at a discount to fair value, based on a blend of earnings growth forecasts, profit margin expansion, and risk factors identified by analysts.

The Group is expected to continue launching new residential projects, including YOHO WEST PARKSIDE and other major developments, which are anticipated to drive significant property sales in Hong Kong. This is likely to positively impact revenue and development profit.

Could a slate of ambitious projects be the growth engine behind Sun Hung Kai’s valuation story? What bold financial forecasts are underpinning this potential rerating? Major changes might be on the horizon. Uncover the hidden numbers powering this narrative and decide if the momentum is sustainable. The real surprise may be just beneath the surface.

Result: Fair Value of $96.49 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, a sharp drop in Mainland China property sales and negative credit outlooks could quickly challenge this optimistic case for Sun Hung Kai Properties.

Find out about the key risks to this Sun Hung Kai Properties narrative.Another View: Industry Valuation Tells a Different Story

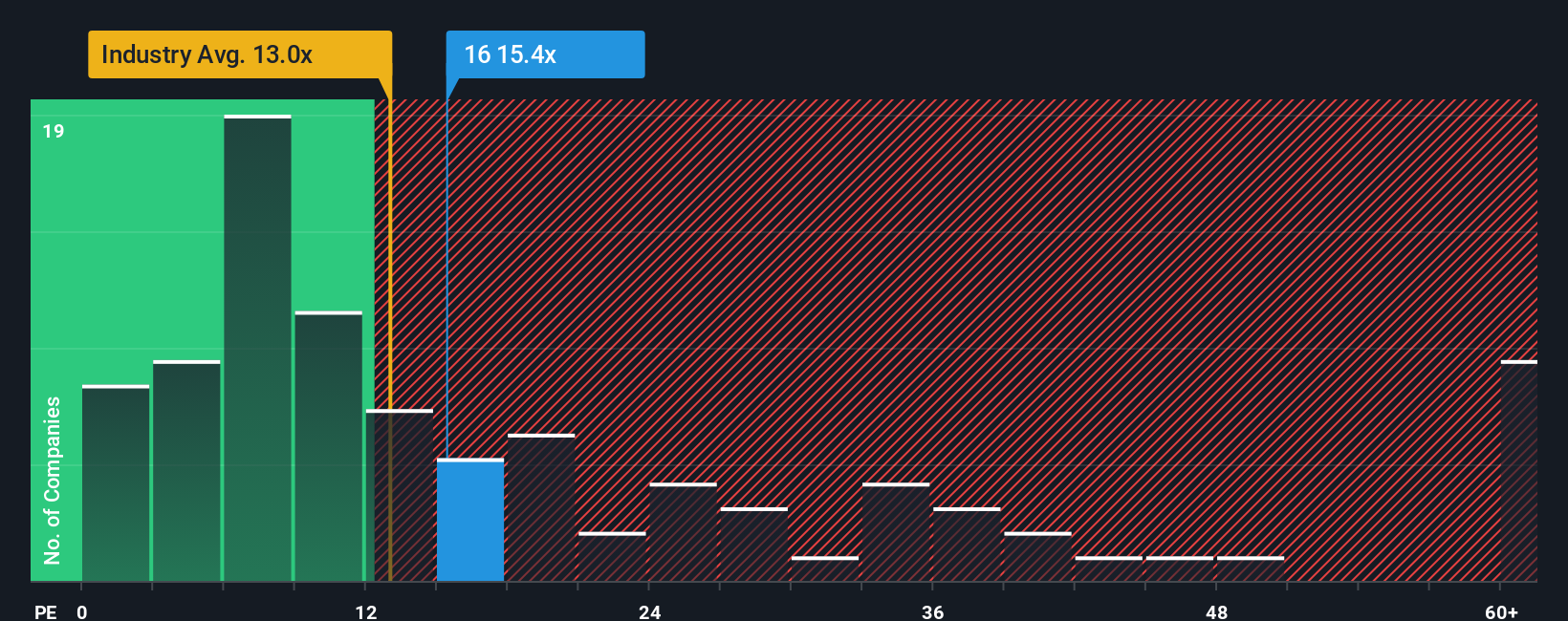

Taking a step back, comparing Sun Hung Kai Properties against the average pricing for its industry suggests the shares might actually be priced higher than the broader Hong Kong real estate sector. Are the company’s prospects bright enough to warrant this premium?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Sun Hung Kai Properties to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Sun Hung Kai Properties Narrative

Of course, if you see the story differently or prefer diving into the numbers yourself, crafting your own version takes just a few minutes. Go ahead and Do it your way.

A great starting point for your Sun Hung Kai Properties research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready to Uncover More Investment Opportunities?

Don’t stop at just one company when there are so many smart opportunities out there. Take control of your investment journey with our handpicked ideas below. You might just find your next winning portfolio move before everyone else does.

- Tap into tomorrow’s healthcare breakthroughs by screening for companies at the forefront of medical artificial intelligence, all inside our healthcare AI stocks selection.

- Maximize your portfolio income and stability. Search for shares offering yields above 3% through our exclusive dividend stocks with yields > 3% guide.

- Seize value in overlooked gems by using the platform to hunt for undervalued stocks based on cash flows investments, all analyzed with a focus on true cash flow strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About SEHK:16

Sun Hung Kai Properties

An investment holding company, develops and invests in properties for sale and rent in Hong Kong, Mainland China, and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives