- Hong Kong

- /

- Real Estate

- /

- SEHK:1516

Sunac Services Holdings Limited's (HKG:1516) Shares Leap 28% Yet They're Still Not Telling The Full Story

Sunac Services Holdings Limited (HKG:1516) shares have had a really impressive month, gaining 28% after a shaky period beforehand. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 15% in the last twelve months.

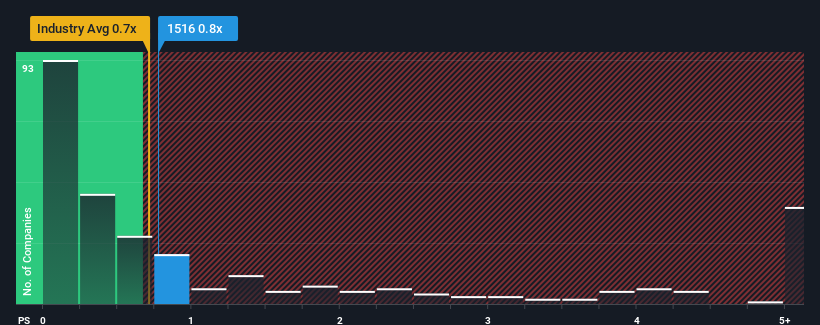

In spite of the firm bounce in price, it's still not a stretch to say that Sunac Services Holdings' price-to-sales (or "P/S") ratio of 0.8x right now seems quite "middle-of-the-road" compared to the Real Estate industry in Hong Kong, where the median P/S ratio is around 0.7x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Sunac Services Holdings

How Sunac Services Holdings Has Been Performing

Recent times haven't been great for Sunac Services Holdings as its revenue has been rising slower than most other companies. Perhaps the market is expecting future revenue performance to lift, which has kept the P/S from declining. If not, then existing shareholders may be a little nervous about the viability of the share price.

Keen to find out how analysts think Sunac Services Holdings' future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For Sunac Services Holdings?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Sunac Services Holdings' to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 8.6% last year. Revenue has also lifted 14% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 8.0% during the coming year according to the eight analysts following the company. With the industry only predicted to deliver 5.0%, the company is positioned for a stronger revenue result.

In light of this, it's curious that Sunac Services Holdings' P/S sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

What Does Sunac Services Holdings' P/S Mean For Investors?

Its shares have lifted substantially and now Sunac Services Holdings' P/S is back within range of the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Sunac Services Holdings currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Sunac Services Holdings that you should be aware of.

If you're unsure about the strength of Sunac Services Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1516

Sunac Services Holdings

An investment holding company, provides property development, cultural tourism city construction and operation, and property management services in the People’s Republic of China.

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives