- Hong Kong

- /

- Real Estate

- /

- SEHK:1246

The Price Is Right For Boill Healthcare Holdings Limited (HKG:1246) Even After Diving 26%

The Boill Healthcare Holdings Limited (HKG:1246) share price has softened a substantial 26% over the previous 30 days, handing back much of the gains the stock has made lately. Of course, over the longer-term many would still wish they owned shares as the stock's price has soared 242% in the last twelve months.

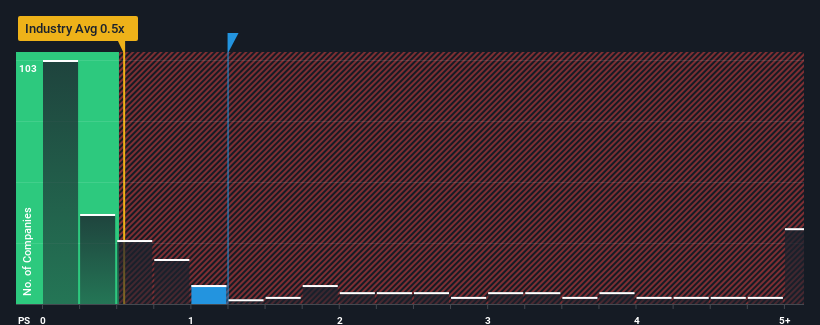

Although its price has dipped substantially, when almost half of the companies in Hong Kong's Real Estate industry have price-to-sales ratios (or "P/S") below 0.5x, you may still consider Boill Healthcare Holdings as a stock probably not worth researching with its 1.2x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Boill Healthcare Holdings

How Has Boill Healthcare Holdings Performed Recently?

For instance, Boill Healthcare Holdings' receding revenue in recent times would have to be some food for thought. Perhaps the market believes the company can do enough to outperform the rest of the industry in the near future, which is keeping the P/S ratio high. If not, then existing shareholders may be quite nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Boill Healthcare Holdings' earnings, revenue and cash flow.How Is Boill Healthcare Holdings' Revenue Growth Trending?

In order to justify its P/S ratio, Boill Healthcare Holdings would need to produce impressive growth in excess of the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 18%. In spite of this, the company still managed to deliver immense revenue growth over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company, but investors will want to ask why it is now in decline.

Comparing that to the industry, which is only predicted to deliver 4.6% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

With this in consideration, it's not hard to understand why Boill Healthcare Holdings' P/S is high relative to its industry peers. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Bottom Line On Boill Healthcare Holdings' P/S

Boill Healthcare Holdings' P/S remain high even after its stock plunged. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Boill Healthcare Holdings maintains its high P/S on the strength of its recent three-year growth being higher than the wider industry forecast, as expected. In the eyes of shareholders, the probability of a continued growth trajectory is great enough to prevent the P/S from pulling back. Barring any significant changes to the company's ability to make money, the share price should continue to be propped up.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Boill Healthcare Holdings (at least 1 which is concerning), and understanding them should be part of your investment process.

If these risks are making you reconsider your opinion on Boill Healthcare Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Boill Healthcare Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1246

Boill Healthcare Holdings

An investment holding company, undertakes contracts for foundation piling in Hong Kong and Mainland China.

Low and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026