- Hong Kong

- /

- Real Estate

- /

- SEHK:123

There's No Escaping Yuexiu Property Company Limited's (HKG:123) Muted Earnings

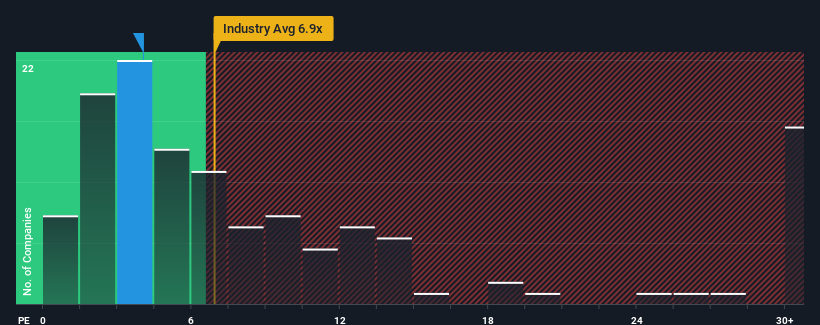

Yuexiu Property Company Limited's (HKG:123) price-to-earnings (or "P/E") ratio of 4x might make it look like a strong buy right now compared to the market in Hong Kong, where around half of the companies have P/E ratios above 10x and even P/E's above 19x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

Recent times have been pleasing for Yuexiu Property as its earnings have risen in spite of the market's earnings going into reverse. One possibility is that the P/E is low because investors think the company's earnings are going to fall away like everyone else's soon. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

See our latest analysis for Yuexiu Property

What Are Growth Metrics Telling Us About The Low P/E?

In order to justify its P/E ratio, Yuexiu Property would need to produce anemic growth that's substantially trailing the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 40% last year. However, this wasn't enough as the latest three year period has seen a very unpleasant 5.7% drop in EPS in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Shifting to the future, estimates from the analysts covering the company suggest earnings growth is heading into negative territory, declining 0.2% per year over the next three years. That's not great when the rest of the market is expected to grow by 16% per year.

In light of this, it's understandable that Yuexiu Property's P/E would sit below the majority of other companies. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Yuexiu Property maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Having said that, be aware Yuexiu Property is showing 3 warning signs in our investment analysis, and 1 of those shouldn't be ignored.

If these risks are making you reconsider your opinion on Yuexiu Property, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:123

Yuexiu Property

Develops, sells, invests, and manages properties primarily in Mainland China and Hong Kong.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives