- Hong Kong

- /

- Real Estate

- /

- SEHK:1209

Why We Think China Resources Mixc Lifestyle Services Limited's (HKG:1209) CEO Compensation Is Not Excessive At All

Key Insights

- China Resources Mixc Lifestyle Services to hold its Annual General Meeting on 7th of June

- Salary of CN¥1.62m is part of CEO Linkang Yu's total remuneration

- The total compensation is 54% less than the average for the industry

- China Resources Mixc Lifestyle Services' three-year loss to shareholders was 34% while its EPS grew by 38% over the past three years

Shareholders may be wondering what CEO Linkang Yu plans to do to improve the less than great performance at China Resources Mixc Lifestyle Services Limited (HKG:1209) recently. At the next AGM coming up on 7th of June, they can influence managerial decision making through voting on resolutions, including executive remuneration. Voting on executive pay could be a powerful way to influence management, as studies have shown that the right compensation incentives impact company performance. In our opinion, CEO compensation does not look excessive and we discuss why.

See our latest analysis for China Resources Mixc Lifestyle Services

How Does Total Compensation For Linkang Yu Compare With Other Companies In The Industry?

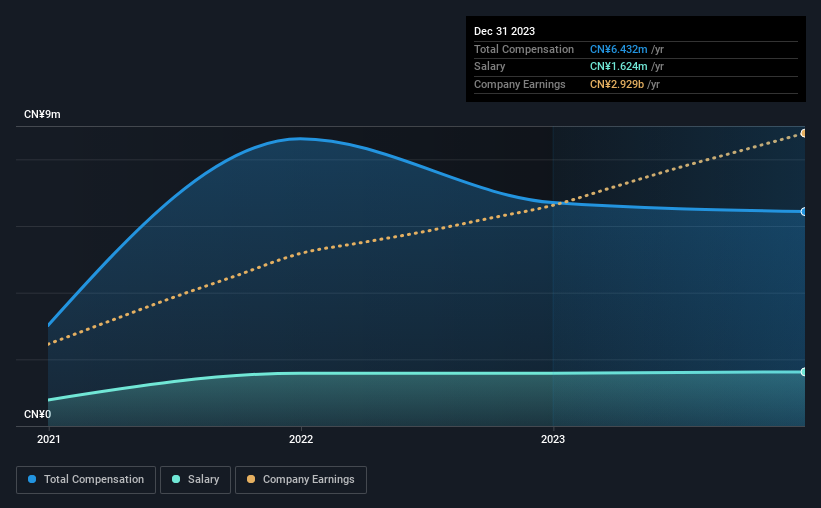

According to our data, China Resources Mixc Lifestyle Services Limited has a market capitalization of HK$62b, and paid its CEO total annual compensation worth CN¥6.4m over the year to December 2023. We note that's a small decrease of 4.0% on last year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at CN¥1.6m.

On comparing similar companies from the Hong Kong Real Estate industry with market caps ranging from HK$31b to HK$94b, we found that the median CEO total compensation was CN¥14m. Accordingly, China Resources Mixc Lifestyle Services pays its CEO under the industry median. What's more, Linkang Yu holds HK$9.7m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | CN¥1.6m | CN¥1.6m | 25% |

| Other | CN¥4.8m | CN¥5.1m | 75% |

| Total Compensation | CN¥6.4m | CN¥6.7m | 100% |

On an industry level, roughly 77% of total compensation represents salary and 23% is other remuneration. China Resources Mixc Lifestyle Services sets aside a smaller share of compensation for salary, in comparison to the overall industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

China Resources Mixc Lifestyle Services Limited's Growth

China Resources Mixc Lifestyle Services Limited has seen its earnings per share (EPS) increase by 38% a year over the past three years. It achieved revenue growth of 23% over the last year.

Shareholders would be glad to know that the company has improved itself over the last few years. It's a real positive to see this sort of revenue growth in a single year. That suggests a healthy and growing business. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has China Resources Mixc Lifestyle Services Limited Been A Good Investment?

Few China Resources Mixc Lifestyle Services Limited shareholders would feel satisfied with the return of -34% over three years. So shareholders would probably want the company to be less generous with CEO compensation.

In Summary...

The fact that shareholders have earned a negative share price return is certainly disconcerting. This diverges with the robust growth in EPS, suggesting that there is a large discrepancy between share price and fundamentals. A key question may be why the fundamentals have not yet been reflected into the share price. The upcoming AGM will provide shareholders the opportunity to raise their concerns and evaluate if the board’s judgement and decision-making is aligned with their expectations.

CEO compensation can have a massive impact on performance, but it's just one element. We did our research and spotted 1 warning sign for China Resources Mixc Lifestyle Services that investors should look into moving forward.

Important note: China Resources Mixc Lifestyle Services is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1209

China Resources Mixc Lifestyle Services

An investment holding company, engages in the provision of property management and commercial operational services in the People’s Republic of China.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives