- Hong Kong

- /

- Real Estate

- /

- SEHK:1195

Market Might Still Lack Some Conviction On Kingwell Group Limited (HKG:1195) Even After 27% Share Price Boost

Kingwell Group Limited (HKG:1195) shares have had a really impressive month, gaining 27% after a shaky period beforehand. Looking further back, the 12% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

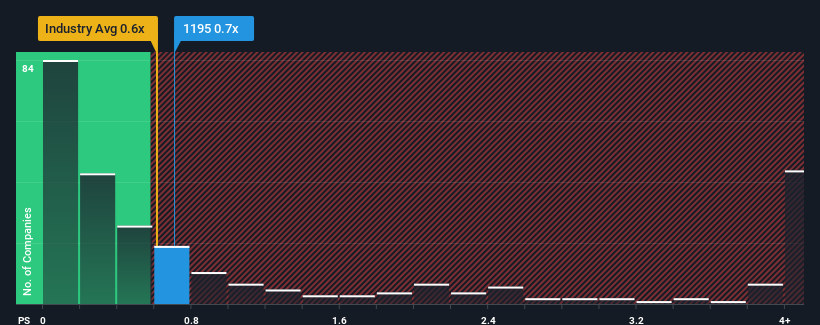

In spite of the firm bounce in price, there still wouldn't be many who think Kingwell Group's price-to-sales (or "P/S") ratio of 0.7x is worth a mention when the median P/S in Hong Kong's Real Estate industry is similar at about 0.6x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Our free stock report includes 3 warning signs investors should be aware of before investing in Kingwell Group. Read for free now.See our latest analysis for Kingwell Group

How Kingwell Group Has Been Performing

Kingwell Group has been doing a decent job lately as it's been growing revenue at a reasonable pace. Perhaps the expectation moving forward is that the revenue growth will track in line with the wider industry for the near term, which has kept the P/S subdued. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Kingwell Group's earnings, revenue and cash flow.How Is Kingwell Group's Revenue Growth Trending?

In order to justify its P/S ratio, Kingwell Group would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a decent 6.7% gain to the company's revenues. This was backed up an excellent period prior to see revenue up by 251% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Comparing that to the industry, which is only predicted to deliver 6.7% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

In light of this, it's curious that Kingwell Group's P/S sits in line with the majority of other companies. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

What We Can Learn From Kingwell Group's P/S?

Its shares have lifted substantially and now Kingwell Group's P/S is back within range of the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

To our surprise, Kingwell Group revealed its three-year revenue trends aren't contributing to its P/S as much as we would have predicted, given they look better than current industry expectations. When we see strong revenue with faster-than-industry growth, we can only assume potential risks are what might be placing pressure on the P/S ratio. It appears some are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

Before you take the next step, you should know about the 3 warning signs for Kingwell Group (2 are potentially serious!) that we have uncovered.

If these risks are making you reconsider your opinion on Kingwell Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Kingwell Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1195

Kingwell Group

An investment holding company, engages in the property development, property leasing, and property management services business in Mainland China.

Adequate balance sheet with very low risk.

Market Insights

Community Narratives