How InnoCare Pharma’s Revenue Growth and Lower Losses Will Impact Investors (SEHK:9969)

Reviewed by Sasha Jovanovic

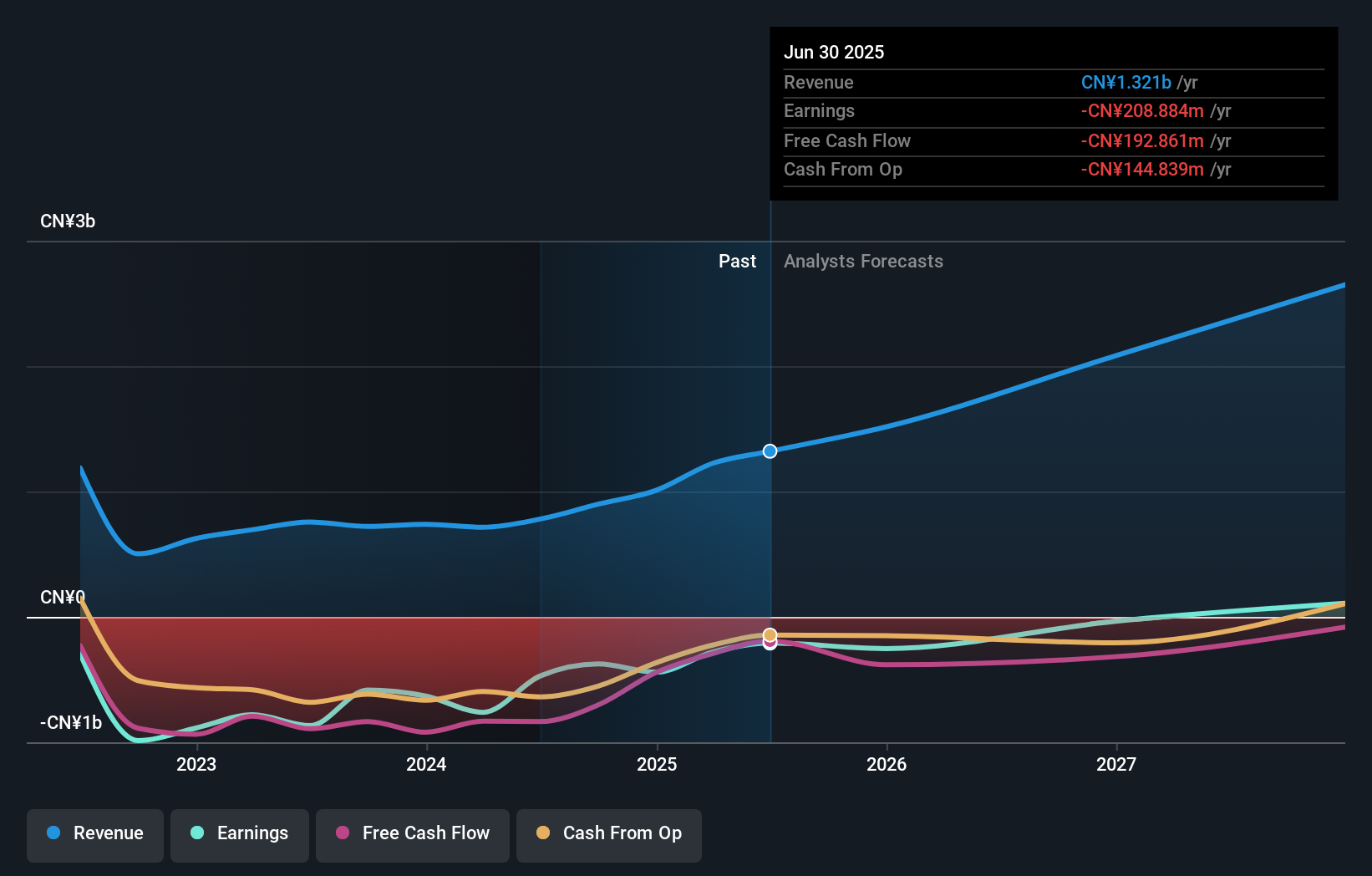

- InnoCare Pharma Limited recently reported earnings for the nine months ended September 30, 2025, posting revenue of CNY 1,115.33 million and a net loss of CNY 64.41 million, both showing improvement compared to the previous year.

- This improved financial performance, marked by significant revenue growth and a substantially reduced net loss, signals progress in InnoCare’s efforts to commercialize its therapies and optimize operations.

- To assess the impact on InnoCare’s investment narrative, we’ll explore how its accelerated revenue growth and narrower losses could shape future prospects.

Find companies with promising cash flow potential yet trading below their fair value.

InnoCare Pharma Investment Narrative Recap

To be a shareholder in InnoCare Pharma, you have to believe in the company’s ability to turn its accelerated revenue growth and improving earnings into long-term, sustainable profitability, while managing high R&D spending and competing in a crowded biotech field. The recent earnings report confirms meaningful progress, revenue and net loss figures improved over last year, but it does not fundamentally alter the short-term catalysts or top risks. Building on product launches and pipeline advances remains central, while concerns about heavy investment and market competition persist. Among recent announcements, the late-October launch of a clinical trial for InnoCare’s B7-H3-targeted ADC (ICP-B794) stands out as most relevant to current catalysts. This move aligns with the company’s goal to boost new revenue streams and lessen reliance on existing blockbuster products, but also sharpens execution risk around the ADC platform, a significant focus for InnoCare’s growth ambitions. In contrast, investors should be aware that the scale of ongoing R&D commitments could still pressure margins if...

Read the full narrative on InnoCare Pharma (it's free!)

InnoCare Pharma's outlook anticipates CN¥2.9 billion in revenue and CN¥70.2 million in earnings by 2028. This is based on a projected 30.6% annual revenue growth rate and marks a CN¥279.1 million increase in earnings from the current level of CN¥-208.9 million.

Uncover how InnoCare Pharma's forecasts yield a HK$18.33 fair value, a 25% upside to its current price.

Exploring Other Perspectives

Only one member of the Simply Wall St Community released a fair value estimate at CN¥18.33 per share. Market participants continue to weigh the impact of heavy R&D spending on the company's future earnings and long-term financial health.

Explore another fair value estimate on InnoCare Pharma - why the stock might be worth as much as 25% more than the current price!

Build Your Own InnoCare Pharma Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your InnoCare Pharma research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free InnoCare Pharma research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate InnoCare Pharma's overall financial health at a glance.

Contemplating Other Strategies?

Our top stock finds are flying under the radar-for now. Get in early:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9969

InnoCare Pharma

A biopharmaceutical company, engages in discovering, developing, and commercializing drugs for the treatment of cancer and autoimmune diseases in China.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success