As global markets navigate through a dynamic period marked by potential rate cuts and shifting economic indicators, the Asian market presents intriguing opportunities for investors seeking growth beyond traditional large-cap stocks. With small-cap indices like the Russell 2000 showing robust returns, it's an opportune moment to explore lesser-known companies in Asia that exhibit strong fundamentals and adaptability amidst evolving market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Kyoritsu Electric | 3.87% | 6.01% | 17.16% | ★★★★★★ |

| 104 | NA | 10.13% | 11.50% | ★★★★★★ |

| Korea Ratings | NA | 0.72% | 2.33% | ★★★★★★ |

| Advanced International Multitech | 30.42% | 1.80% | -3.87% | ★★★★★★ |

| OpenWork | NA | 30.11% | 29.99% | ★★★★★★ |

| Wan Hwa Enterprise | NA | 7.79% | 10.01% | ★★★★★★ |

| Akatsuki | 241.29% | 9.74% | 13.79% | ★★★★★☆ |

| CTCI Advanced Systems | 33.93% | 20.38% | 21.25% | ★★★★★☆ |

| Gallant Precision Machining | 67.06% | -0.08% | 7.83% | ★★★★★☆ |

| Forth Smart Service | 60.42% | -5.83% | -3.47% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Dah Sing Banking Group (SEHK:2356)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Dah Sing Banking Group Limited is an investment holding company offering banking, financial, and related services across Hong Kong, Macau, and the People’s Republic of China with a market cap of approximately HK$14.83 billion.

Operations: The company's revenue is primarily derived from personal banking (HK$3.16 billion) and treasury and global markets (HK$1.91 billion), with additional contributions from corporate banking and operations in Mainland China and Macau. The net profit margin reflects the efficiency of its operations in generating profit relative to its total revenue.

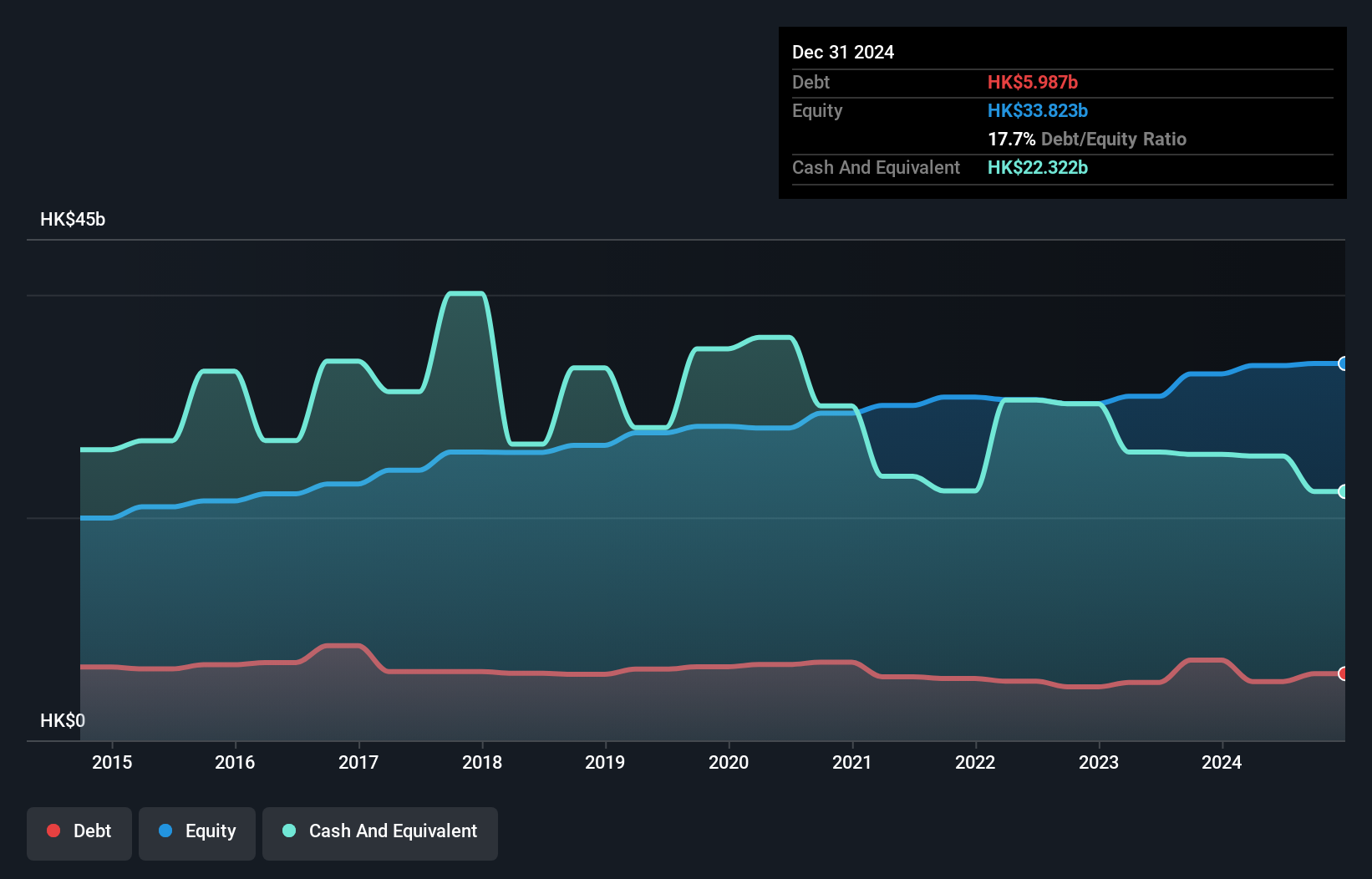

Dah Sing Banking Group, a smaller player in the Asian banking sector, has been showing some promising signs. With total assets of HK$260.7 billion and equity at HK$35.1 billion, it stands on solid ground. The bank's earnings grew by 4.6% over the past year, surpassing the industry average of 2.9%. However, its high level of bad loans at 3.1% indicates room for improvement in risk management strategies. Trading at nearly 38% below estimated fair value suggests potential upside for investors looking for undervalued opportunities in Asia's financial landscape despite forecasts indicating a slight earnings decline ahead.

Alphamab Oncology (SEHK:9966)

Simply Wall St Value Rating: ★★★★★☆

Overview: Alphamab Oncology is a biopharmaceutical company focused on the research, development, manufacture, and commercialization of cancer treatment biotherapeutics in China with a market cap of HK$10.49 billion.

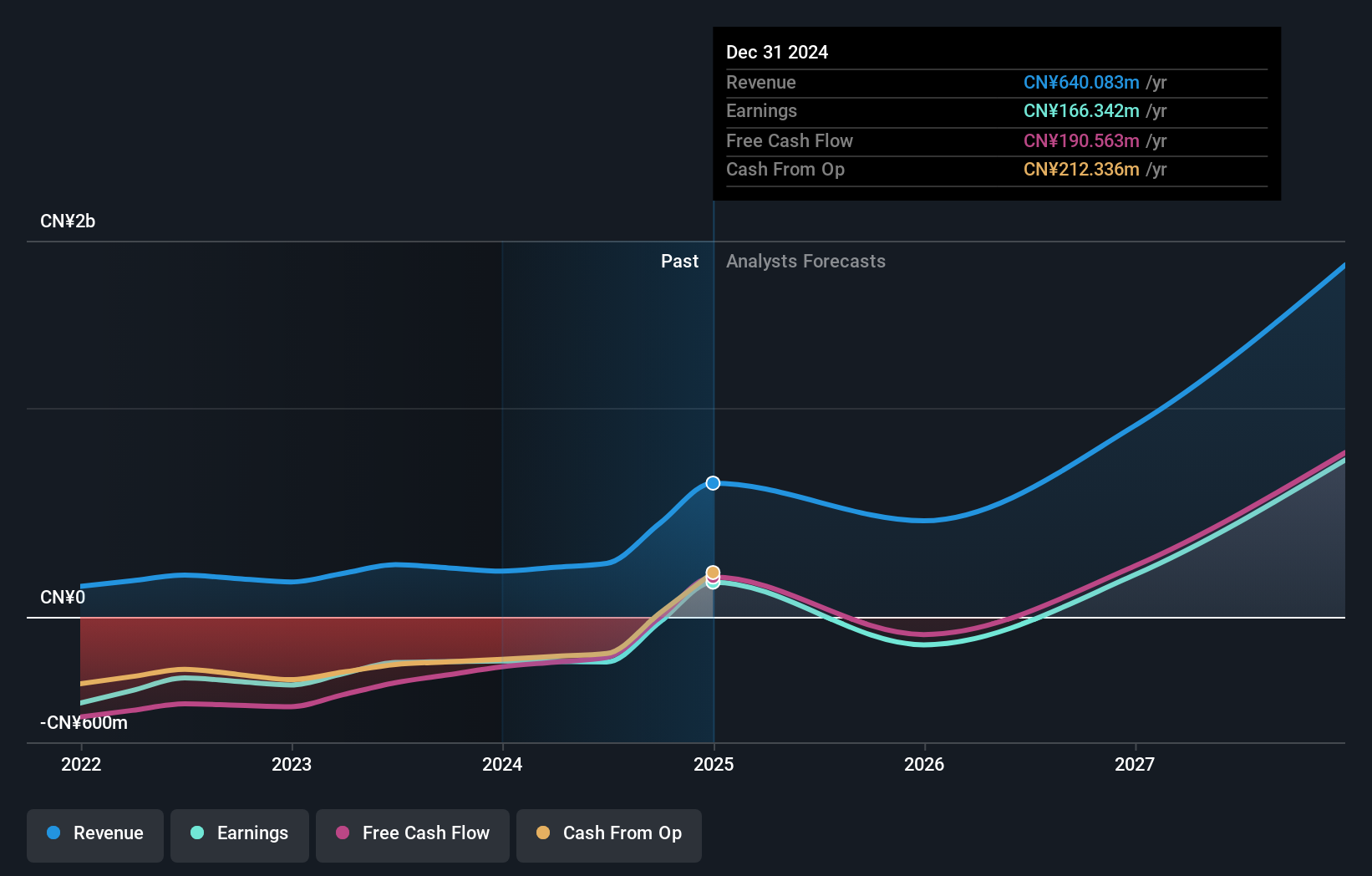

Operations: The primary revenue stream for Alphamab Oncology comes from its pharmaceuticals segment, generating CN¥640.08 million. The company's net profit margin is a key financial metric to consider when evaluating its profitability.

Alphamab Oncology, a nimble player in the biotech sector, is making waves with its recent profitability turnaround. The company reported a profit of at least RMB 20 million for the first half of 2025, bouncing back from a RMB 44.9 million loss in the same period last year. This shift is largely thanks to milestone revenues from three licensed collaborations and sales of their commercialized product. With an innovative pipeline, including JSKN022 and JSKN003 advancing through clinical trials, Alphamab's strategic moves are bolstered by strong cash positions exceeding total debt and trading at 20% below estimated fair value.

- Click to explore a detailed breakdown of our findings in Alphamab Oncology's health report.

Assess Alphamab Oncology's past performance with our detailed historical performance reports.

Sprint Precision Technologies (SHSE:688605)

Simply Wall St Value Rating: ★★★★★☆

Overview: Sprint Precision Technologies Co., Ltd. specializes in manufacturing and selling semiconductor etching and thin film deposition equipment in China, with a market cap of CN¥13.65 billion.

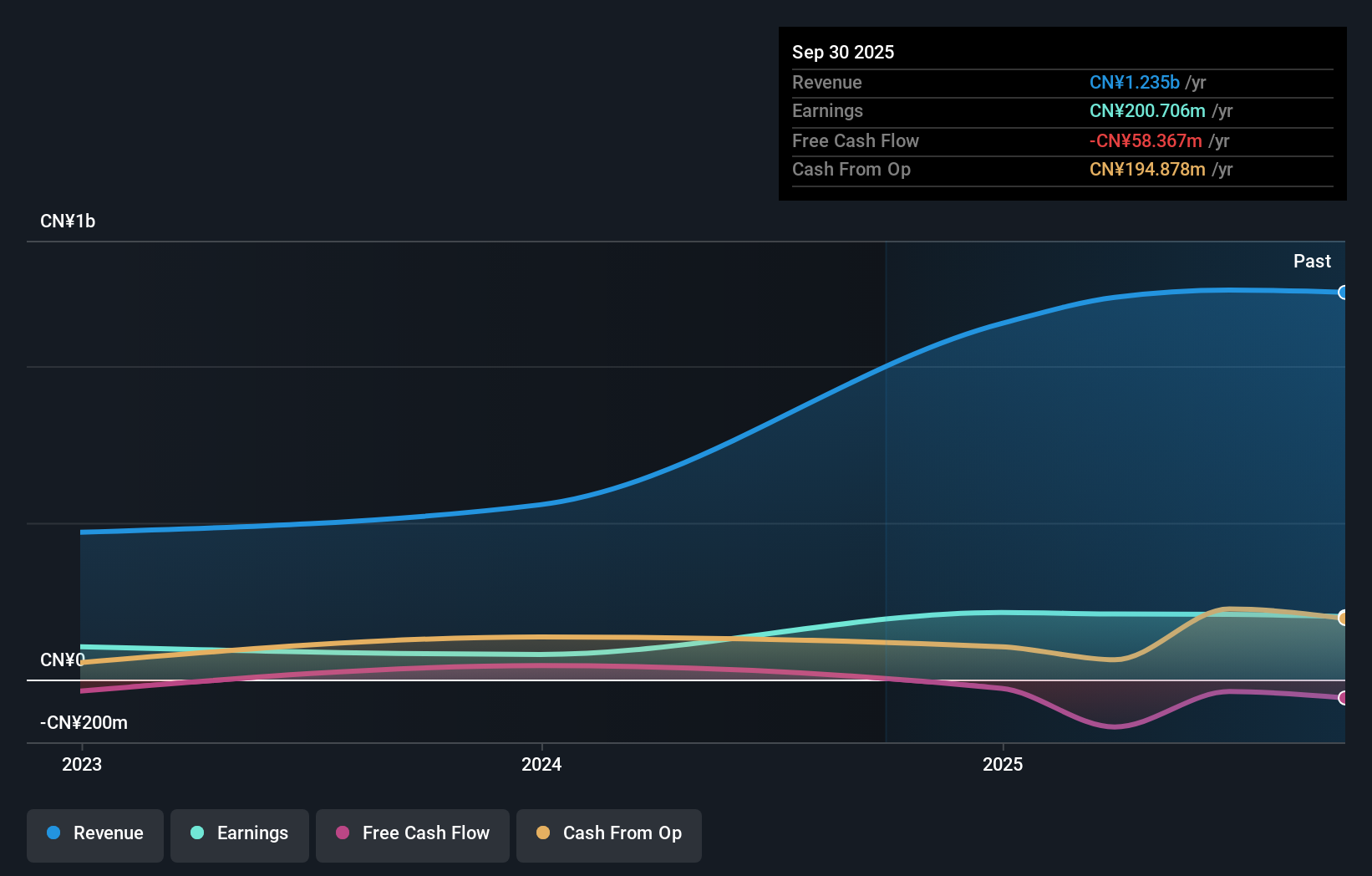

Operations: Sprint Precision Technologies generates revenue primarily from the sale of semiconductor etching and thin film deposition equipment. The company focuses on cost management to optimize its financial performance. It has demonstrated a notable trend in its gross profit margin, reflecting effective pricing strategies and operational efficiencies.

Sprint Precision Technologies, a nimble player in the semiconductor industry, has shown impressive earnings growth of 84% over the past year, outpacing the industry's 10.6%. The company's P/E ratio stands at 65.3x, offering better value compared to the industry average of 75.7x. Despite not being free cash flow positive recently, Sprint's interest payments are well covered by EBIT with a coverage of 1017x, indicating robust financial health in this regard. While there's insufficient data on debt reduction over five years, it holds more cash than total debt presently.

Turning Ideas Into Actions

- Unlock more gems! Our Asian Undiscovered Gems With Strong Fundamentals screener has unearthed 2417 more companies for you to explore.Click here to unveil our expertly curated list of 2420 Asian Undiscovered Gems With Strong Fundamentals.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2356

Dah Sing Banking Group

An investment holding company, provides banking, financial, and other related services in Hong Kong, Macau, and the People’s Republic of China.

Adequate balance sheet average dividend payer.

Market Insights

Community Narratives