- Hong Kong

- /

- Entertainment

- /

- SEHK:3888

Exploring Three High Growth Tech Stocks In Asia

Reviewed by Simply Wall St

As global markets navigate the complexities of new tariffs and economic indicators, Asia's tech sector remains a focal point for investors seeking growth opportunities. In this environment, identifying high-growth tech stocks involves assessing companies that can adapt to shifting trade dynamics and leverage technological advancements to maintain resilience in the face of broader market challenges.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shengyi Electronics | 22.99% | 35.16% | ★★★★★★ |

| Shanghai Huace Navigation Technology | 24.44% | 23.48% | ★★★★★★ |

| Fositek | 29.03% | 36.06% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 27.31% | 28.63% | ★★★★★★ |

| PharmaResearch | 26.50% | 29.34% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.40% | ★★★★★★ |

| Global Security Experts | 20.56% | 28.04% | ★★★★★★ |

| Marketingforce Management | 26.39% | 112.30% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 81.53% | 96.08% | ★★★★★★ |

| JNTC | 55.45% | 94.52% | ★★★★★★ |

Let's uncover some gems from our specialized screener.

Kingsoft (SEHK:3888)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kingsoft Corporation Limited operates in the entertainment and office software sectors across Mainland China, Hong Kong, and internationally with a market capitalization of HK$48.75 billion.

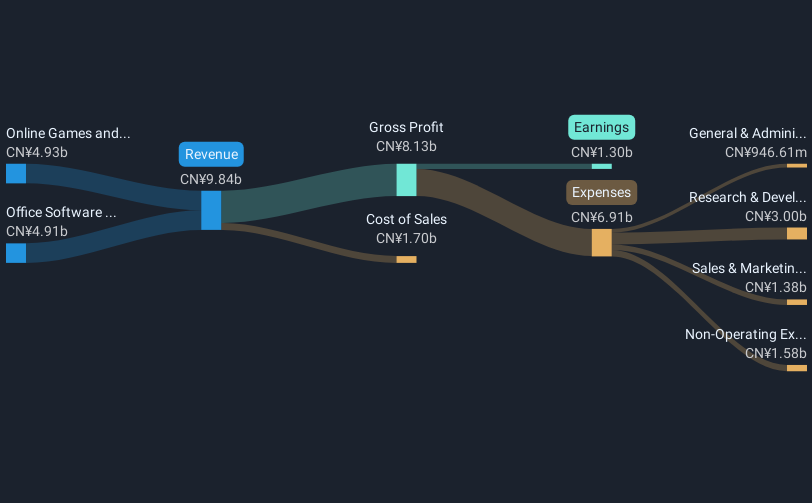

Operations: Kingsoft Corporation Limited generates revenue primarily from two segments: Online Games, contributing CN¥5.32 billion, and Office Software and Services, contributing CN¥5.20 billion.

Kingsoft, a prominent name in the Asian tech landscape, has demonstrated robust growth with a 169.4% surge in earnings over the past year, significantly outpacing the entertainment industry's 5% increase. This growth trajectory is supported by an aggressive R&D investment strategy, which is evident from its substantial allocation of resources towards innovation—highlighting a commitment to evolving within competitive markets. Moreover, recent financial disclosures reveal a revenue jump to CNY 2.338 billion in Q1 2025 from CNY 2.137 billion in the previous year, underpinning its capacity for sustained financial health and market presence. With earnings expected to grow by an impressive 22.3% annually and revenue forecasts aiming for a 13.3% increase per year, Kingsoft is strategically positioned to capitalize on expanding technological demands while enhancing shareholder value through consistent dividend payouts, recently marked by a final dividend declaration of HKD 0.15 per share.

- Take a closer look at Kingsoft's potential here in our health report.

Understand Kingsoft's track record by examining our Past report.

Alphamab Oncology (SEHK:9966)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Alphamab Oncology is a clinical stage biopharmaceutical company focused on the research, development, manufacture, and commercialization of oncology biologics with a market cap of HK$7.21 billion.

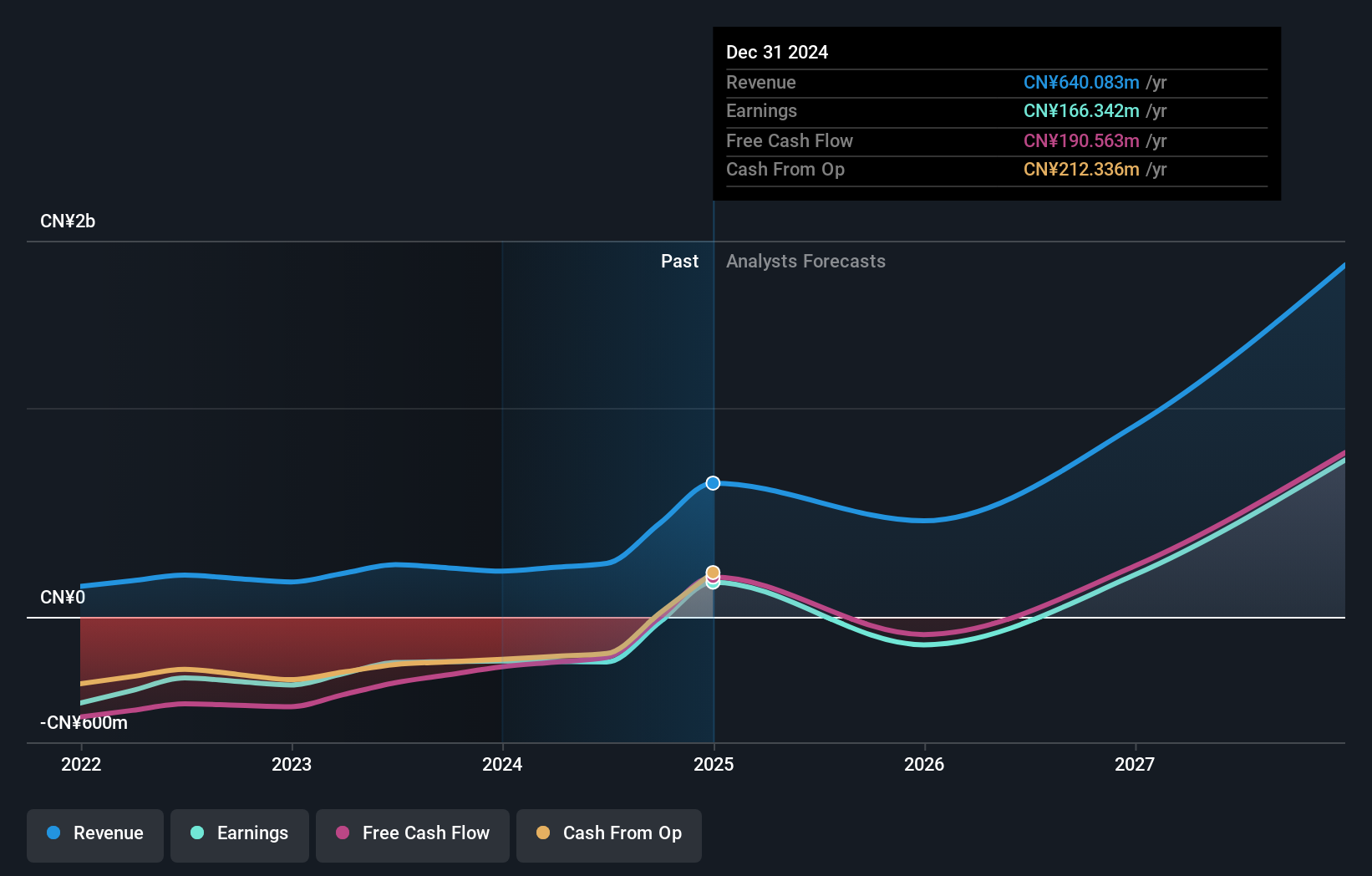

Operations: The company generates revenue primarily from its pharmaceuticals segment, amounting to CN¥640.08 million. Alphamab Oncology focuses on oncology biologics, emphasizing research and development in this area.

Alphamab Oncology, a rising star in Asia's biotech sector, has shown promising developments with its innovative cancer treatments. The company recently announced significant progress in clinical trials, such as the successful interim analysis of KN026, indicating improved progression-free survival rates for HER2-positive gastric cancers. This follows an expansion in their executive board, adding seasoned professionals like Ms. Wong and Dr. Gao to strengthen governance and strategic direction. With a robust annual revenue growth rate of 31.5% and earnings growth projected at 46.5%, Alphamab is not only outpacing many peers but also reinforcing its position through strategic R&D investments that underscore its commitment to addressing critical oncological needs.

- Click here to discover the nuances of Alphamab Oncology with our detailed analytical health report.

Gain insights into Alphamab Oncology's past trends and performance with our Past report.

RemeGen (SEHK:9995)

Simply Wall St Growth Rating: ★★★★★★

Overview: RemeGen Co., Ltd. is a biopharmaceutical company focused on the discovery, development, and commercialization of biologics for autoimmune, oncology, and ophthalmic diseases in Mainland China and the United States, with a market cap of approximately HK$40.74 billion.

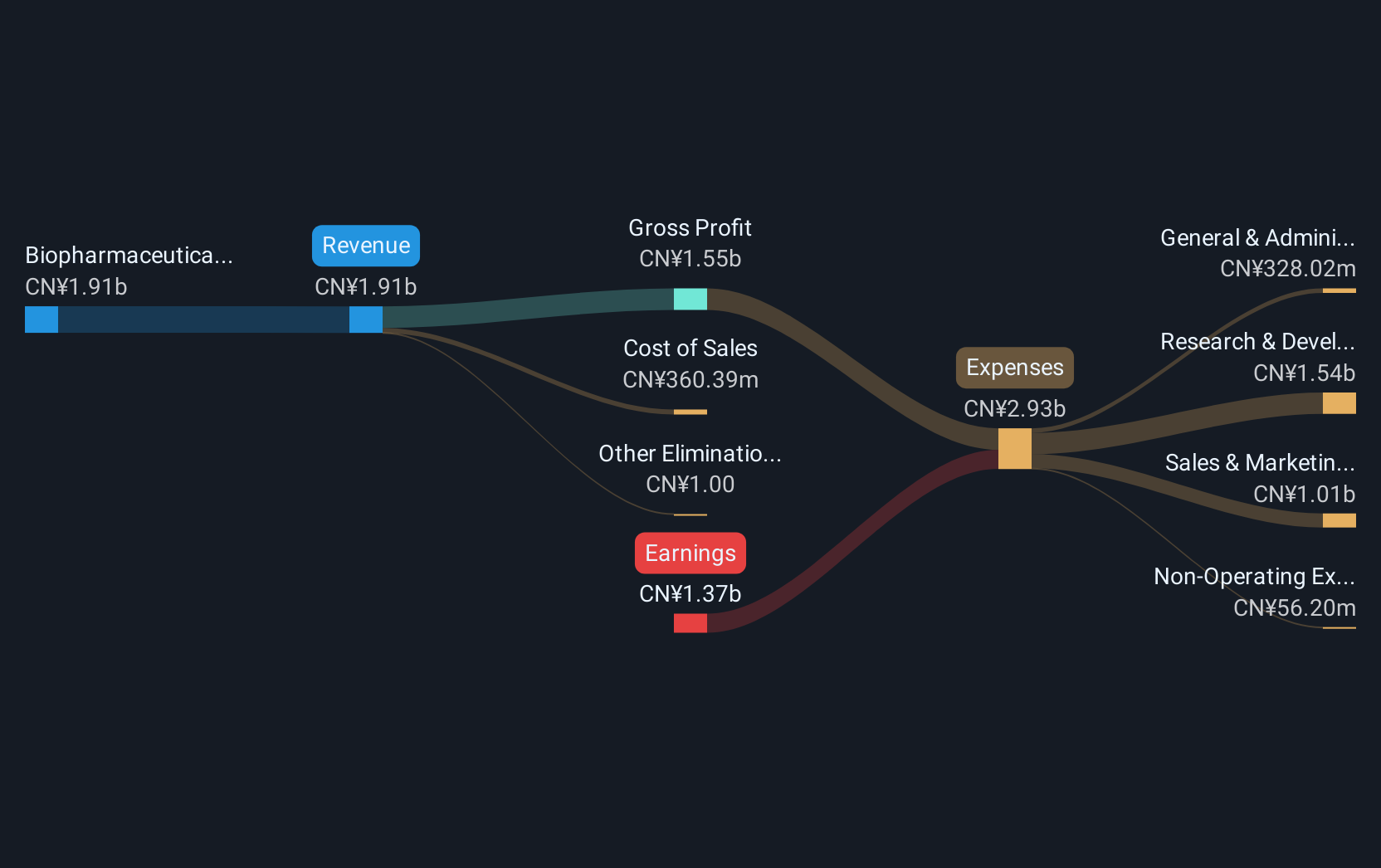

Operations: RemeGen Co., Ltd. generates revenue primarily through its biopharmaceutical research, service, production, and sales activities amounting to CN¥1.91 billion. The company's operations focus on addressing unmet medical needs in autoimmune, oncology, and ophthalmic diseases across Mainland China and the United States.

RemeGen, a biotech firm in Asia, is making strides with its innovative treatments such as Telitacicept, which has shown promising results in clinical trials for autoimmune diseases. Recently, the company secured a lucrative licensing deal potentially worth over $4 billion with Vor Bio, enhancing its financial stability and global reach. Despite being removed from the Shanghai Stock Exchange Health Care Sector Index recently, RemeGen's robust projected revenue growth of 24.9% annually and an anticipated profitability within three years underscore its potential in high-growth markets. With R&D expenses aimed at pioneering treatments like Telitacicept approved in China for multiple indications, RemeGen is poised to impact both domestic and international healthcare landscapes significantly.

- Delve into the full analysis health report here for a deeper understanding of RemeGen.

Examine RemeGen's past performance report to understand how it has performed in the past.

Where To Now?

- Access the full spectrum of 481 Asian High Growth Tech and AI Stocks by clicking on this link.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kingsoft might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3888

Kingsoft

Engages in the entertainment and office software and services businesses in Mainland China, Hong Kong, and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives