As global markets face headwinds from trade policy uncertainties and inflation concerns, Asia's tech sector continues to capture attention, particularly as Chinese markets rally on stimulus hopes. In this environment, identifying high-growth tech stocks involves looking for companies that can navigate economic challenges while capitalizing on technological advancements and consumer demand in the region.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Xi'an NovaStar Tech | 30.18% | 35.32% | ★★★★★★ |

| Seojin SystemLtd | 31.08% | 34.32% | ★★★★★★ |

| eWeLLLtd | 24.65% | 25.30% | ★★★★★★ |

| Bioneer | 26.13% | 104.84% | ★★★★★★ |

| giftee | 21.13% | 67.05% | ★★★★★★ |

| Mental Health TechnologiesLtd | 21.91% | 92.81% | ★★★★★★ |

| Ascentage Pharma Group International | 23.29% | 60.86% | ★★★★★★ |

| JNTC | 24.99% | 104.40% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Let's uncover some gems from our specialized screener.

Xiaomi (SEHK:1810)

Simply Wall St Growth Rating: ★★★★☆☆

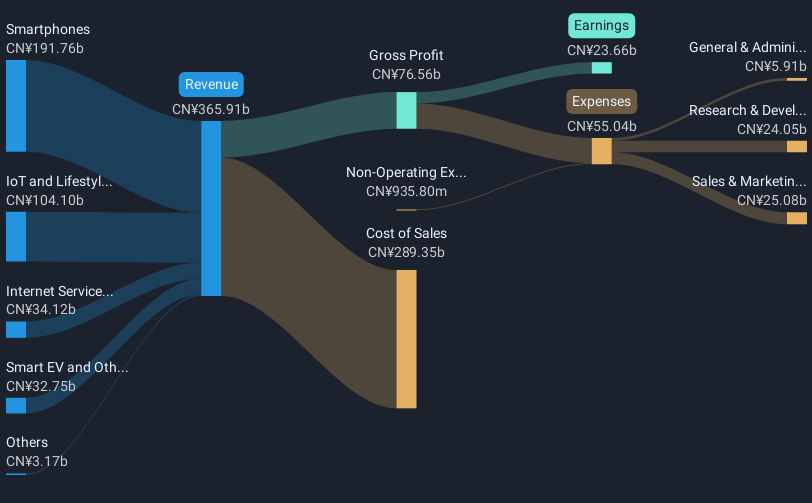

Overview: Xiaomi Corporation is an investment holding company that offers hardware and software services both in Mainland China and internationally, with a market capitalization of approximately HK$1.40 trillion.

Operations: The company generates revenue primarily from smartphones, contributing CN¥184.68 billion, and IoT and lifestyle products at CN¥93.58 billion. Internet services add another significant stream with CN¥32.66 billion in revenue.

Xiaomi's strategic partnership with NaaS Technology Inc., focusing on enhancing EV charging solutions, aligns with its expansion into the smart mobility sector and capitalizes on China's booming NEV market. This move not only broadens Xiaomi’s ecosystem but also leverages its recent entry into the auto industry, where it has already surpassed expectations with over 135,000 vehicle deliveries since 2024. With an expected earnings growth of 25.1% per year and a revenue increase forecast at 16.2% annually, Xiaomi is positioning itself strongly within high-growth sectors by integrating innovative AI-driven technologies to meet escalating market demands efficiently.

- Navigate through the intricacies of Xiaomi with our comprehensive health report here.

Evaluate Xiaomi's historical performance by accessing our past performance report.

Alphamab Oncology (SEHK:9966)

Simply Wall St Growth Rating: ★★★★★☆

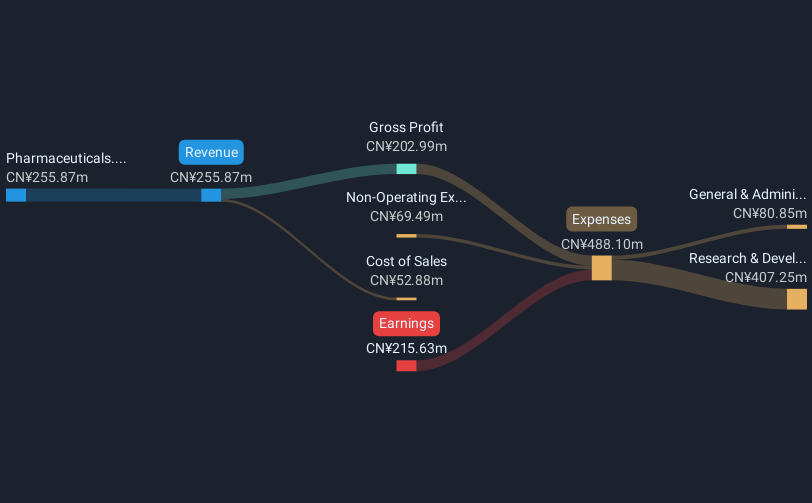

Overview: Alphamab Oncology is a clinical-stage biopharmaceutical company focused on the research, development, manufacture, and commercialization of oncology biologics with a market cap of approximately HK$5.60 billion.

Operations: The company generates revenue primarily through its pharmaceuticals segment, which reported CN¥255.87 million. As a clinical-stage biopharmaceutical entity, it is heavily involved in the oncology biologics market.

Alphamab Oncology's recent pivot from a loss of RMB 210.6 million in 2023 to an expected profit of at least RMB 150.0 million in 2024 underscores its rapid trajectory within the biotech sector, largely driven by lucrative license collaborations and robust sales revenue. This turnaround is particularly significant given the company's strategic focus on developing advanced therapies like JSKN003, an anti-HER2 biparatopic antibody-drug conjugate (ADC) for cancers such as HER2-positive breast cancer and platinum-resistant ovarian cancer. The ongoing Phase III trials and partnerships, notably with CSPC Pharmaceutical Group Co., Ltd., highlight Alphamab’s commitment to innovation and market expansion in critical therapeutic areas, setting a strong foundation for future growth amidst increasing demand for effective cancer treatments.

Shanghai Suochen Information TechnologyLtd (SHSE:688507)

Simply Wall St Growth Rating: ★★★★★☆

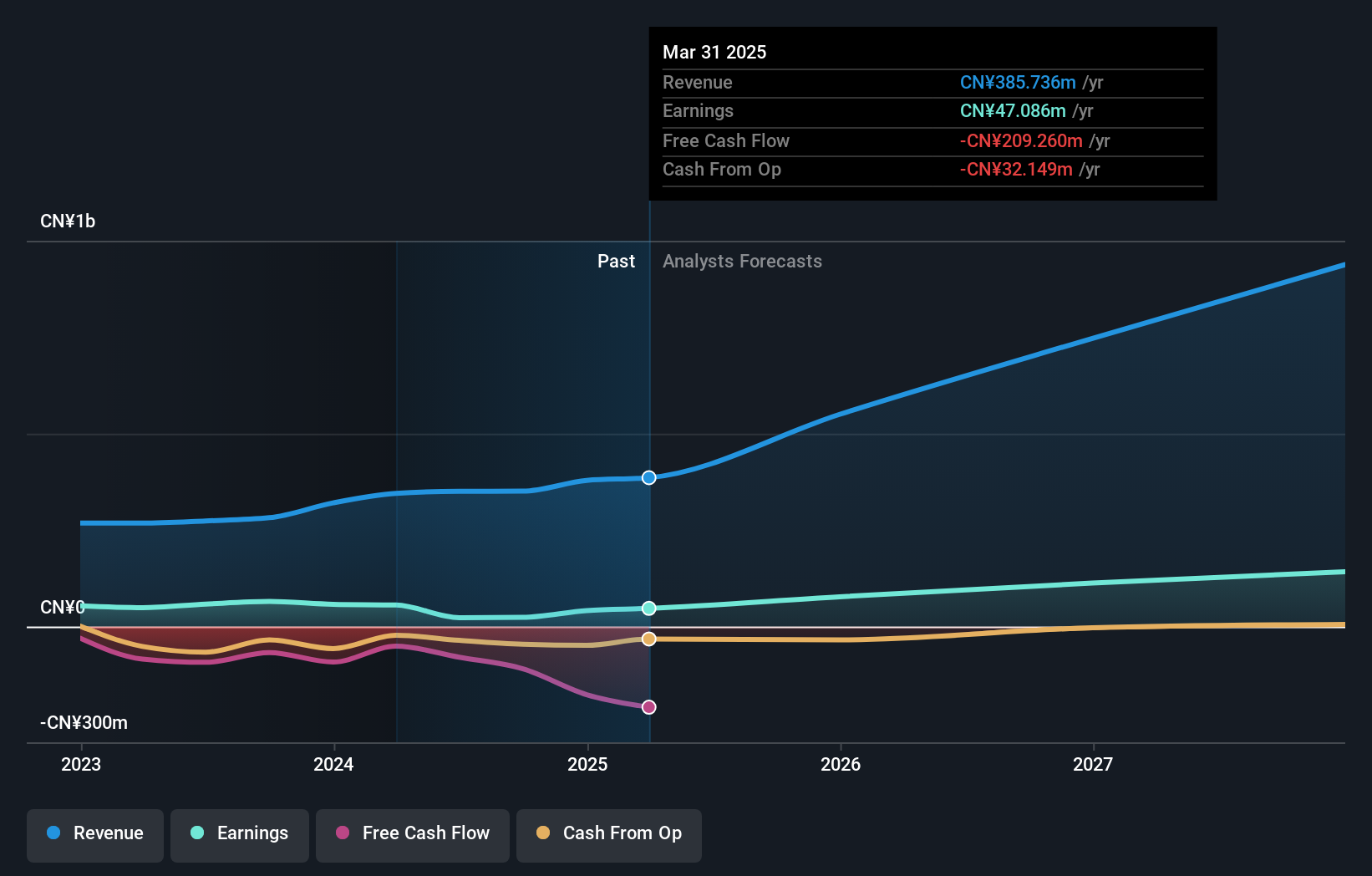

Overview: Shanghai Suochen Information Technology Ltd. is a company focused on providing technology solutions, with a market capitalization of approximately CN¥8.61 billion.

Operations: Shanghai Suochen Information Technology Ltd. generates revenue primarily through its technology solutions offerings. The company's market capitalization stands at approximately CN¥8.61 billion, reflecting its position in the industry.

Shanghai Suochen Information Technology Ltd. has demonstrated robust growth with a remarkable 36.2% annual increase in revenue and a 55.1% surge in earnings per year, outpacing the broader Chinese market averages of 13.1% and 25.2%, respectively. Despite this, R&D expenses have remained relatively stable at CNY 28 million, underscoring a strategic focus on innovation without disproportionate spending increases. Recent activities include the completion of significant share repurchases totaling CNY 50.5 million, reinforcing confidence in its financial health and future prospects amidst evolving tech landscapes.

Where To Now?

- Click here to access our complete index of 518 Asian High Growth Tech and AI Stocks.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9966

Alphamab Oncology

A biopharmaceutical company, engages in the research, development, manufacture, and commercialization of biotherapeutics for cancer treatment in the People’s Republic of China.

Excellent balance sheet and good value.

Market Insights

Community Narratives