Asian Growth Companies With High Insider Ownership Featuring Three Top Picks

Reviewed by Simply Wall St

As global markets navigate a landscape marked by mixed economic signals and geopolitical developments, investors are increasingly turning their attention to Asia, where growth prospects remain compelling despite broader uncertainties. In this context, companies with high insider ownership often stand out as attractive investment opportunities due to the alignment of interests between management and shareholders, a factor that can be particularly valuable amid fluctuating market conditions.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Zhejiang Leapmotor Technology (SEHK:9863) | 14.9% | 54.8% |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 84.6% |

| Novoray (SHSE:688300) | 23.6% | 31.4% |

| Loadstar Capital K.K (TSE:3482) | 31.2% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 24.9% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 35.2% |

| Fulin Precision (SZSE:300432) | 11.6% | 55.2% |

| Ascentage Pharma Group International (SEHK:6855) | 12.8% | 91.9% |

Below we spotlight a couple of our favorites from our exclusive screener.

Global New Material International Holdings (SEHK:6616)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Global New Material International Holdings Limited is an investment holding company that produces and sells pearlescent pigment, functional mica filler, and related products in the People’s Republic of China and South Korea, with a market cap of HK$7.63 billion.

Operations: The company generates revenue of CN¥1.48 billion from its operations in the People's Republic of China and CN¥308.71 million from its business activities in South Korea.

Insider Ownership: 10.6%

Earnings Growth Forecast: 41.9% p.a.

Global New Material International Holdings has seen significant insider buying recently, reflecting confidence in its strong growth prospects. Despite a decline in net income to CNY 62.2 million for the first half of 2025, the company's revenue is forecast to grow substantially at 41.7% annually, outpacing the Hong Kong market. However, its return on equity is projected to remain low at 10.9%, which may be a concern for some investors seeking high-quality earnings growth.

- Click to explore a detailed breakdown of our findings in Global New Material International Holdings' earnings growth report.

- Upon reviewing our latest valuation report, Global New Material International Holdings' share price might be too optimistic.

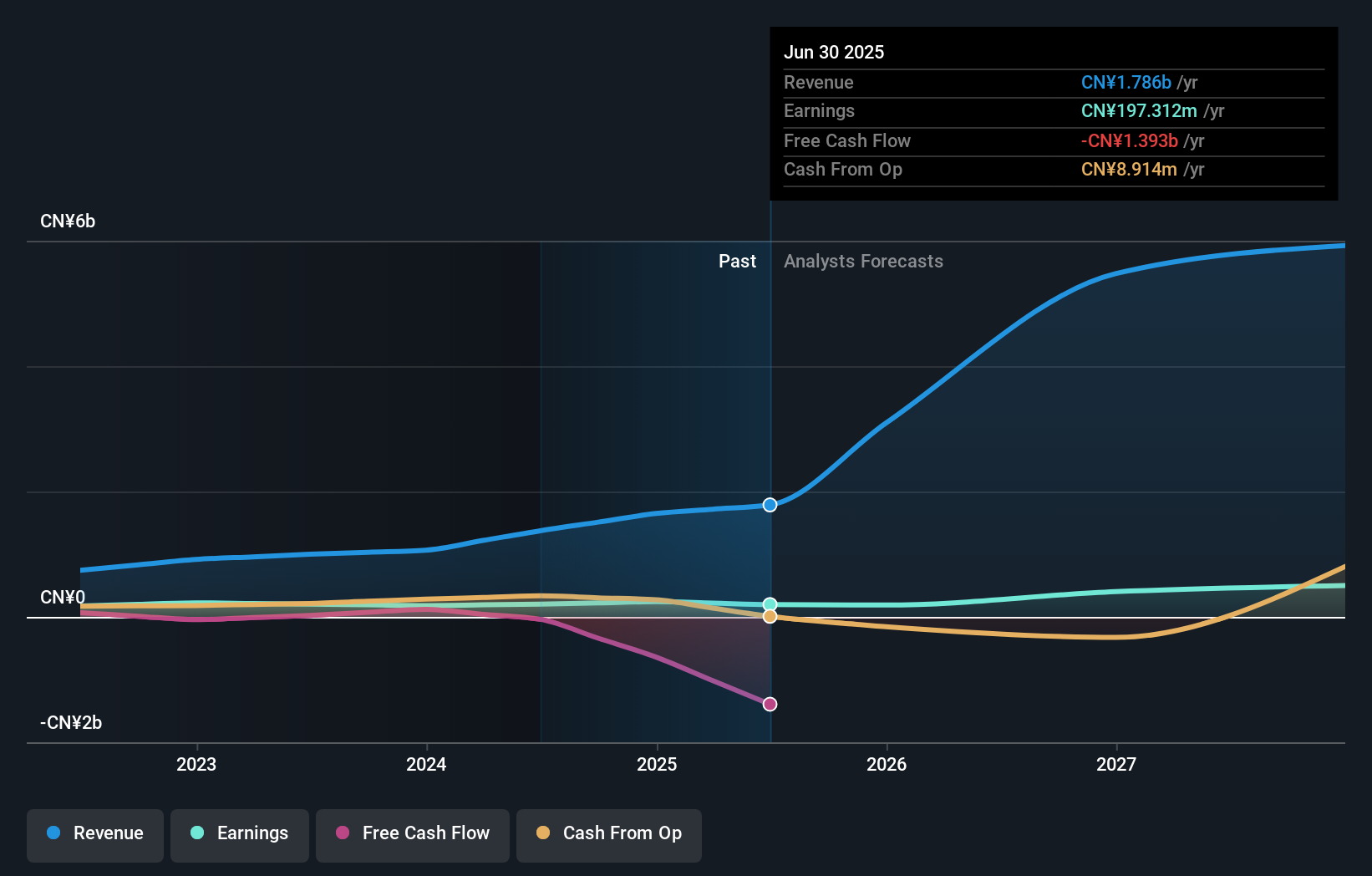

Akeso (SEHK:9926)

Simply Wall St Growth Rating: ★★★★★★

Overview: Akeso, Inc. is a biopharmaceutical company focused on the research, development, manufacture, and commercialization of antibody drugs globally, with a market cap of approximately HK$108.97 billion.

Operations: The company's revenue segment consists of CN¥2.51 billion from the research, development, production, and sale of biopharmaceutical products.

Insider Ownership: 18.1%

Earnings Growth Forecast: 52.3% p.a.

Akeso's high insider ownership aligns with its strong growth trajectory, supported by rapid revenue expansion forecasted at 34.8% annually, significantly outpacing the Hong Kong market. The company's innovative pipeline in oncology and autoimmune diseases is underscored by recent breakthroughs with ivonescimab, which has received multiple Breakthrough Therapy Designations. Despite a net loss of CNY 570.08 million in H1 2025, Akeso's strategic advancements and substantial clinical achievements position it well for future profitability within three years.

- Delve into the full analysis future growth report here for a deeper understanding of Akeso.

- Our valuation report here indicates Akeso may be overvalued.

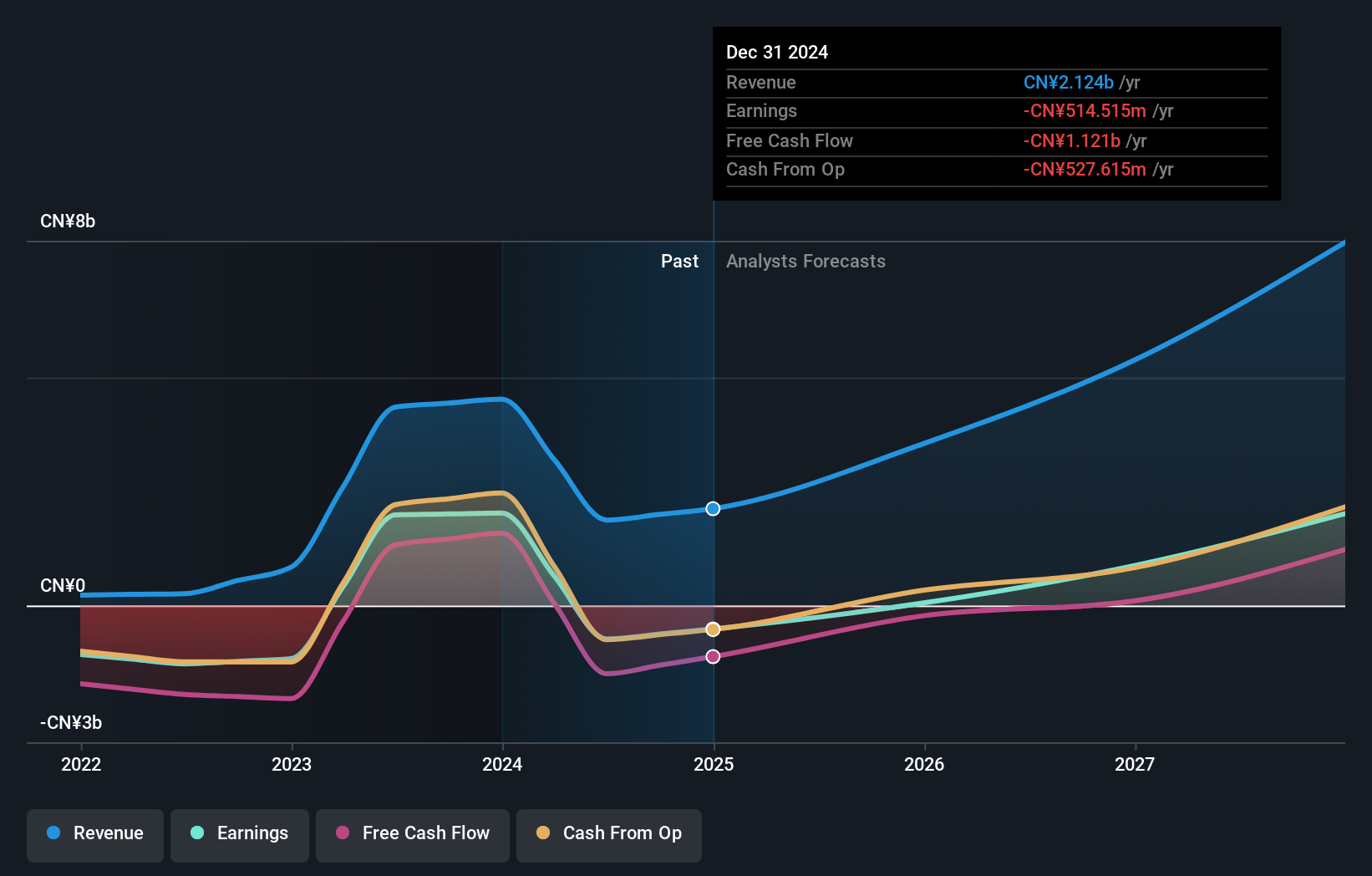

Joinn Laboratories(China)Co.Ltd (SHSE:603127)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Joinn Laboratories(China)Co., Ltd. offers preclinical and non-clinical services across the United States, the People’s Republic of China, and internationally, with a market cap of CN¥24.71 billion.

Operations: Joinn Laboratories provides preclinical and non-clinical services in various regions including the United States and China.

Insider Ownership: 39.6%

Earnings Growth Forecast: 31.8% p.a.

Joinn Laboratories' high insider ownership supports its growth potential, with earnings expected to rise significantly at 31.81% annually, surpassing the Chinese market average. Despite recent revenue declines to CNY 984.96 million for the first nine months of 2025, the company achieved profitability with a net income of CNY 80.71 million compared to last year's loss. However, its share price remains volatile and recent financial results are affected by large one-off items.

- Dive into the specifics of Joinn Laboratories(China)Co.Ltd here with our thorough growth forecast report.

- Our valuation report unveils the possibility Joinn Laboratories(China)Co.Ltd's shares may be trading at a premium.

Summing It All Up

- Discover the full array of 619 Fast Growing Asian Companies With High Insider Ownership right here.

- Ready For A Different Approach? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6616

Global New Material International Holdings

An investment holding company, produces and sells pearlescent pigment, functional mica filler, and related products in the People’s Republic of China and South Korea.

High growth potential with mediocre balance sheet.

Market Insights

Community Narratives