Asian Market Insights: Lee's Pharmaceutical Holdings Among 3 Penny Stocks To Consider

Reviewed by Simply Wall St

As the Asian markets navigate a landscape marked by mixed performances and economic uncertainties, investors are exploring diverse opportunities, including those in the penny stock segment. Penny stocks, often perceived as high-risk due to their lower market capitalization, can still offer significant potential when supported by robust financials. This article will highlight three such stocks that present compelling opportunities for investors seeking growth prospects beyond the mainstream indices.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Food Moments (SET:FM) | THB3.86 | THB3.81B | ✅ 4 ⚠️ 0 View Analysis > |

| JBM (Healthcare) (SEHK:2161) | HK$3.06 | HK$2.49B | ✅ 3 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.52 | HK$940.15M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.55 | HK$2.12B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.775 | SGD314.1M | ✅ 4 ⚠️ 2 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.84 | THB2.9B | ✅ 3 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.06 | SGD12.04B | ✅ 5 ⚠️ 1 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$0.95 | NZ$135.23M | ✅ 2 ⚠️ 5 View Analysis > |

| Rojana Industrial Park (SET:ROJNA) | THB4.68 | THB9.46B | ✅ 3 ⚠️ 3 View Analysis > |

| BRC Asia (SGX:BEC) | SGD4.05 | SGD1.11B | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 976 stocks from our Asian Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Lee's Pharmaceutical Holdings (SEHK:950)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Lee's Pharmaceutical Holdings Limited is an investment holding company that develops, manufactures, markets, and sells pharmaceutical products in the People's Republic of China, Hong Kong, and internationally with a market cap of HK$1.35 billion.

Operations: The company generates revenue from Licensed-In Products amounting to HK$568.55 million and Proprietary and Generic Products totaling HK$867.89 million.

Market Cap: HK$1.35B

Lee's Pharmaceutical Holdings has demonstrated impressive earnings growth of 55.1% over the past year, significantly outpacing its five-year average decline of 43.2%. The company's financial health is bolstered by operating cash flow well covering its debt and having more cash than total debt. Despite a large one-off loss impacting recent results, short-term assets exceed liabilities, indicating solid liquidity management. Recent earnings for the half year ended June 2025 showed an increase in sales to HK$694.82 million and net income to HK$67.19 million, alongside a declared interim dividend of HKD 0.022 per share payable in October 2025.

- Jump into the full analysis health report here for a deeper understanding of Lee's Pharmaceutical Holdings.

- Explore historical data to track Lee's Pharmaceutical Holdings' performance over time in our past results report.

Wenfeng Great World Chain Development (SHSE:601010)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Wenfeng Great World Chain Development Corporation operates a commercial retail chain in China with a market cap of CN¥4.97 billion.

Operations: The company generates revenue through its various segments, including Shopping Center (CN¥160.99 million), Department Store (CN¥830.29 million), Electrical Distribution (CN¥391.64 million), and Supermarket Distribution (CN¥366.60 million).

Market Cap: CN¥4.97B

Wenfeng Great World Chain Development Corporation has faced challenges, with recent half-year earnings showing a decline in sales to CN¥707.38 million and net income dropping to CN¥37.53 million. Despite this, the company maintains high-quality earnings and covers its interest payments comfortably. Its debt is well-covered by operating cash flow, and it holds more cash than total debt, suggesting financial stability amidst market volatility. However, short-term liabilities exceed assets by a notable margin of CN¥600 million, highlighting liquidity concerns. Recent shareholder changes include an undisclosed buyer acquiring a 7.54% stake in the company as of June 2025.

- Click here to discover the nuances of Wenfeng Great World Chain Development with our detailed analytical financial health report.

- Gain insights into Wenfeng Great World Chain Development's past trends and performance with our report on the company's historical track record.

Zhejiang Jingxing Paper (SZSE:002067)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Zhejiang Jingxing Paper Joint Stock Co., Ltd. operates in the paper manufacturing industry and has a market cap of CN¥5.81 billion.

Operations: The company has not reported any specific revenue segments.

Market Cap: CN¥5.81B

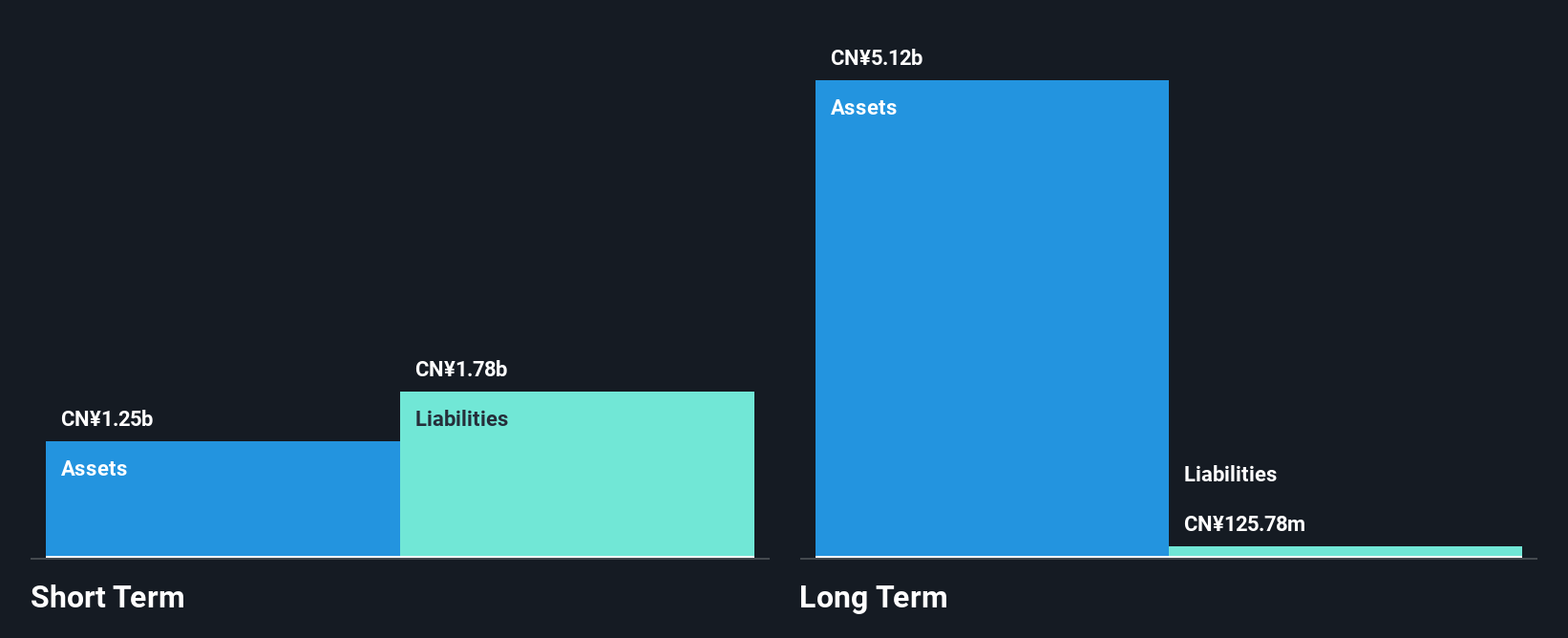

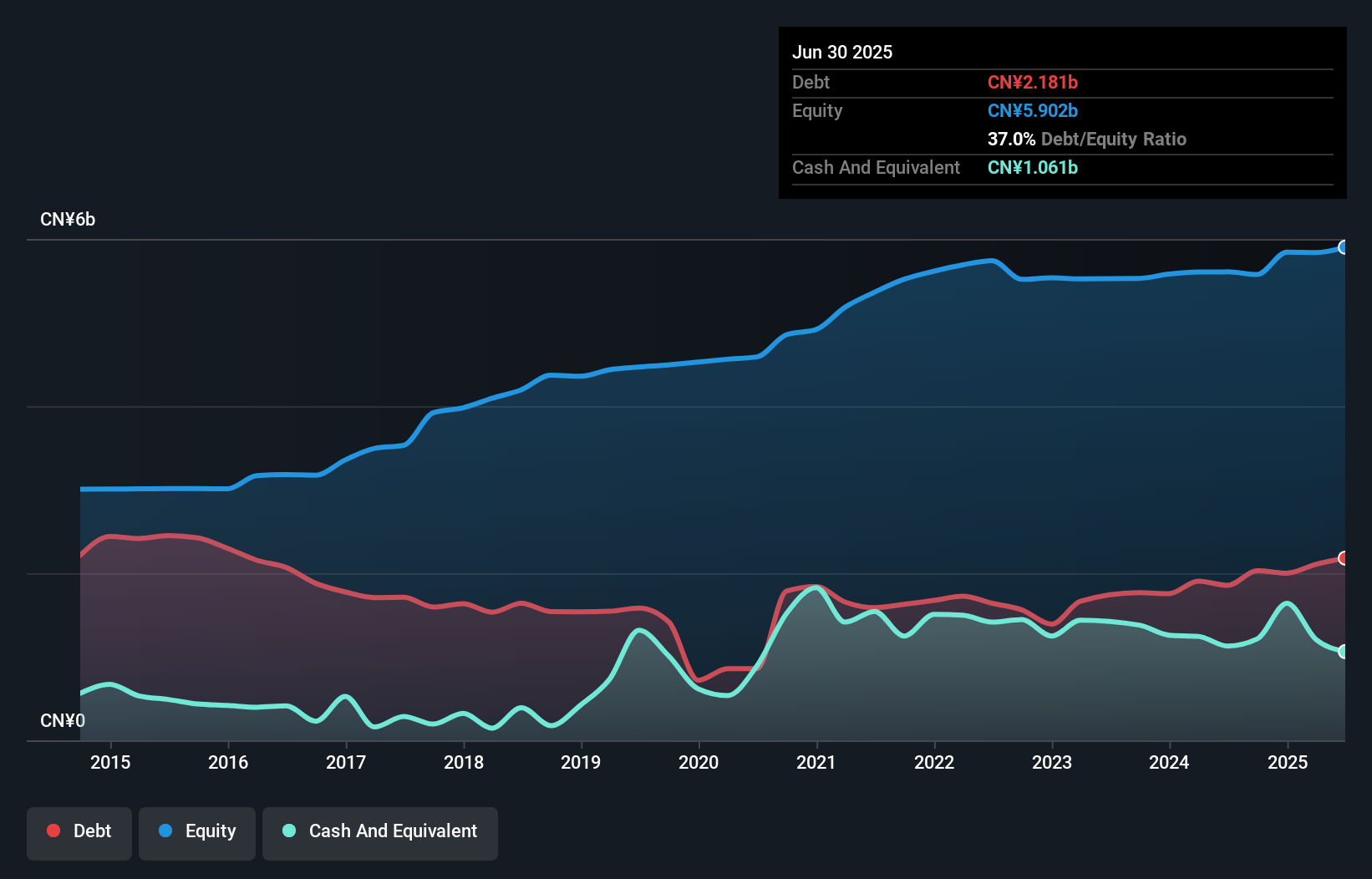

Zhejiang Jingxing Paper shows mixed financial health, with recent earnings revealing a slight increase in net income to CN¥55.03 million despite a drop in revenue. The company has stable short-term liquidity, with assets covering both short and long-term liabilities. However, its debt-to-equity ratio has risen over five years, and operating cash flow remains negative, indicating potential challenges in debt coverage. Earnings have been impacted by significant one-off gains of CN¥20.7 million over the past year, which may obscure underlying performance issues such as declining profit margins and low return on equity at 1.4%.

- Unlock comprehensive insights into our analysis of Zhejiang Jingxing Paper stock in this financial health report.

- Examine Zhejiang Jingxing Paper's past performance report to understand how it has performed in prior years.

Seize The Opportunity

- Get an in-depth perspective on all 976 Asian Penny Stocks by using our screener here.

- Interested In Other Possibilities? Rare earth metals are the new gold rush. Find out which 29 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Zhejiang Jingxing Paper might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002067

Excellent balance sheet with moderate risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion