Is Shenzhen Neptunus Interlong Bio-technique (HKG:8329) A Risky Investment?

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Shenzhen Neptunus Interlong Bio-technique Company Limited (HKG:8329) does use debt in its business. But the real question is whether this debt is making the company risky.

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Shenzhen Neptunus Interlong Bio-technique

How Much Debt Does Shenzhen Neptunus Interlong Bio-technique Carry?

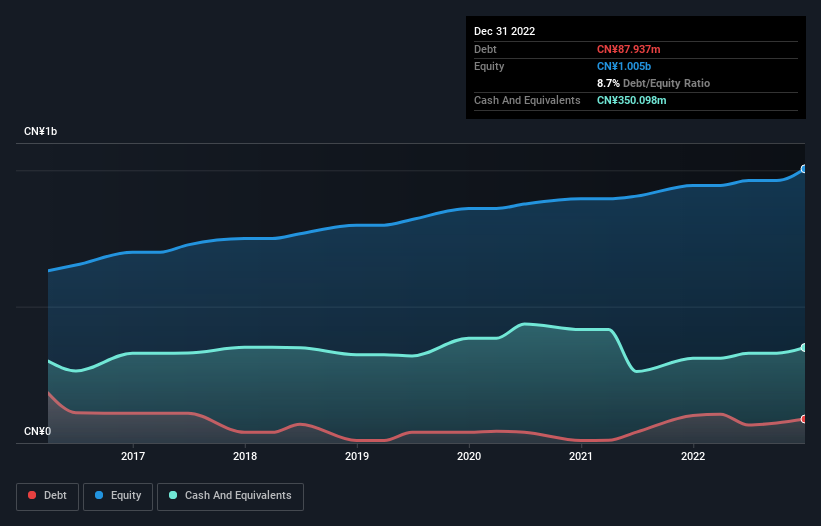

You can click the graphic below for the historical numbers, but it shows that Shenzhen Neptunus Interlong Bio-technique had CN¥87.9m of debt in December 2022, down from CN¥101.1m, one year before. But it also has CN¥350.1m in cash to offset that, meaning it has CN¥262.2m net cash.

How Healthy Is Shenzhen Neptunus Interlong Bio-technique's Balance Sheet?

According to the last reported balance sheet, Shenzhen Neptunus Interlong Bio-technique had liabilities of CN¥412.7m due within 12 months, and liabilities of CN¥30.2m due beyond 12 months. Offsetting these obligations, it had cash of CN¥350.1m as well as receivables valued at CN¥277.1m due within 12 months. So it actually has CN¥184.3m more liquid assets than total liabilities.

This luscious liquidity implies that Shenzhen Neptunus Interlong Bio-technique's balance sheet is sturdy like a giant sequoia tree. On this view, lenders should feel as safe as the beloved of a black-belt karate master. Succinctly put, Shenzhen Neptunus Interlong Bio-technique boasts net cash, so it's fair to say it does not have a heavy debt load!

Even more impressive was the fact that Shenzhen Neptunus Interlong Bio-technique grew its EBIT by 132% over twelve months. If maintained that growth will make the debt even more manageable in the years ahead. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Shenzhen Neptunus Interlong Bio-technique will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. Shenzhen Neptunus Interlong Bio-technique may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. In the last three years, Shenzhen Neptunus Interlong Bio-technique created free cash flow amounting to 9.3% of its EBIT, an uninspiring performance. For us, cash conversion that low sparks a little paranoia about is ability to extinguish debt.

Summing Up

While we empathize with investors who find debt concerning, you should keep in mind that Shenzhen Neptunus Interlong Bio-technique has net cash of CN¥262.2m, as well as more liquid assets than liabilities. And we liked the look of last year's 132% year-on-year EBIT growth. So is Shenzhen Neptunus Interlong Bio-technique's debt a risk? It doesn't seem so to us. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. To that end, you should learn about the 2 warning signs we've spotted with Shenzhen Neptunus Interlong Bio-technique (including 1 which shouldn't be ignored) .

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:8329

Shenzhen Neptunus Interlong Bio-technique

Engages in the research and development, manufacturing, and selling of medicines and medical devices in the People’s Republic of China.

Excellent balance sheet with moderate risk.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026