Biosino Bio-Technology and Science Incorporation's (HKG:8247) 26% Dip In Price Shows Sentiment Is Matching Revenues

Biosino Bio-Technology and Science Incorporation (HKG:8247) shares have had a horrible month, losing 26% after a relatively good period beforehand. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 40% in that time.

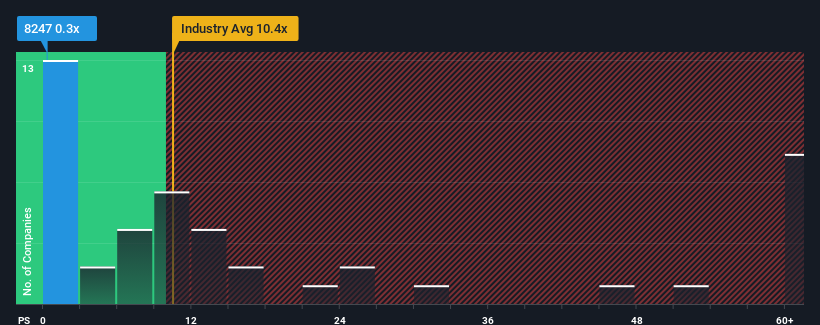

Since its price has dipped substantially, Biosino Bio-Technology and Science Incorporation may look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 0.3x, considering almost half of all companies in the Biotechs industry in Hong Kong have P/S ratios greater than 10.4x and even P/S higher than 28x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

See our latest analysis for Biosino Bio-Technology and Science Incorporation

What Does Biosino Bio-Technology and Science Incorporation's Recent Performance Look Like?

For example, consider that Biosino Bio-Technology and Science Incorporation's financial performance has been poor lately as its revenue has been in decline. One possibility is that the P/S is low because investors think the company won't do enough to avoid underperforming the broader industry in the near future. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

Although there are no analyst estimates available for Biosino Bio-Technology and Science Incorporation, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Biosino Bio-Technology and Science Incorporation's Revenue Growth Trending?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Biosino Bio-Technology and Science Incorporation's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 23%. The last three years don't look nice either as the company has shrunk revenue by 11% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 31% shows it's an unpleasant look.

In light of this, it's understandable that Biosino Bio-Technology and Science Incorporation's P/S would sit below the majority of other companies. However, we think shrinking revenues are unlikely to lead to a stable P/S over the longer term, which could set up shareholders for future disappointment. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

What We Can Learn From Biosino Bio-Technology and Science Incorporation's P/S?

Having almost fallen off a cliff, Biosino Bio-Technology and Science Incorporation's share price has pulled its P/S way down as well. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Biosino Bio-Technology and Science Incorporation revealed its shrinking revenue over the medium-term is contributing to its low P/S, given the industry is set to grow. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Given the current circumstances, it seems unlikely that the share price will experience any significant movement in either direction in the near future if recent medium-term revenue trends persist.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Biosino Bio-Technology and Science Incorporation that you should be aware of.

If you're unsure about the strength of Biosino Bio-Technology and Science Incorporation's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Biosino Bio-Technology and Science Incorporation might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:8247

Biosino Bio-Technology and Science Incorporation

Manufactures, sells, and distributes in-vitro diagnostic reagents in Mainland China.

Good value with adequate balance sheet.

Market Insights

Community Narratives