Investors in CK Life Sciences Int'l. (Holdings) (HKG:775) from three years ago are still down 42%, even after 11% gain this past week

CK Life Sciences Int'l., (Holdings) Inc. (HKG:775) shareholders should be happy to see the share price up 22% in the last quarter. But that doesn't help the fact that the three year return is less impressive. After all, the share price is down 43% in the last three years, significantly under-performing the market.

On a more encouraging note the company has added HK$384m to its market cap in just the last 7 days, so let's see if we can determine what's driven the three-year loss for shareholders.

View our latest analysis for CK Life Sciences Int'l. (Holdings)

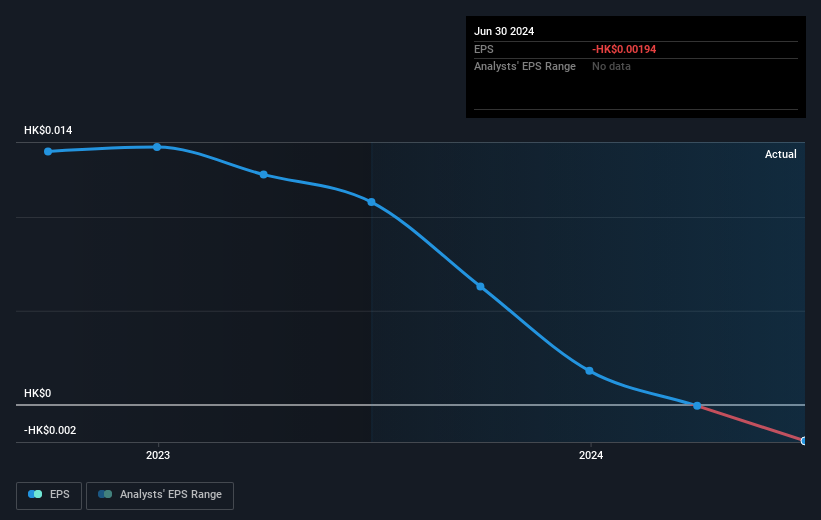

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

CK Life Sciences Int'l. (Holdings) saw its share price decline over the three years in which its EPS also dropped, falling to a loss. Due to the loss, it's not easy to use EPS as a reliable guide to the business. However, we can say we'd expect to see a falling share price in this scenario.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

A Different Perspective

Investors in CK Life Sciences Int'l. (Holdings) had a tough year, with a total loss of 41%, against a market gain of about 19%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. On the bright side, long term shareholders have made money, with a gain of 5% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with CK Life Sciences Int'l. (Holdings) , and understanding them should be part of your investment process.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:775

CK Life Sciences Int'l. (Holdings)

An investment holding company, researches, develops, manufactures, commercializes, markets, and sells health and agriculture-related products in the Asia Pacific and North America.

Fair value very low.