Sichuan Kelun-Biotech (SEHK:6990): Unpacking Its Valuation After a 170% YTD Share Price Surge

Reviewed by Simply Wall St

See our latest analysis for Sichuan Kelun-Biotech Biopharmaceutical.

Sichuan Kelun-Biotech Biopharmaceutical has experienced remarkable momentum lately, with a year-to-date share price return of over 170%. This signals growing optimism among investors following a series of sector-wide shifts. While the pace of gains has moderated from earlier highs, enthusiasm around the company’s pipeline and partnerships remains a key driver for the long term.

Thinking about where the next big biotech winner will emerge? Take the opportunity to find promising innovators by exploring our See the full list for free.

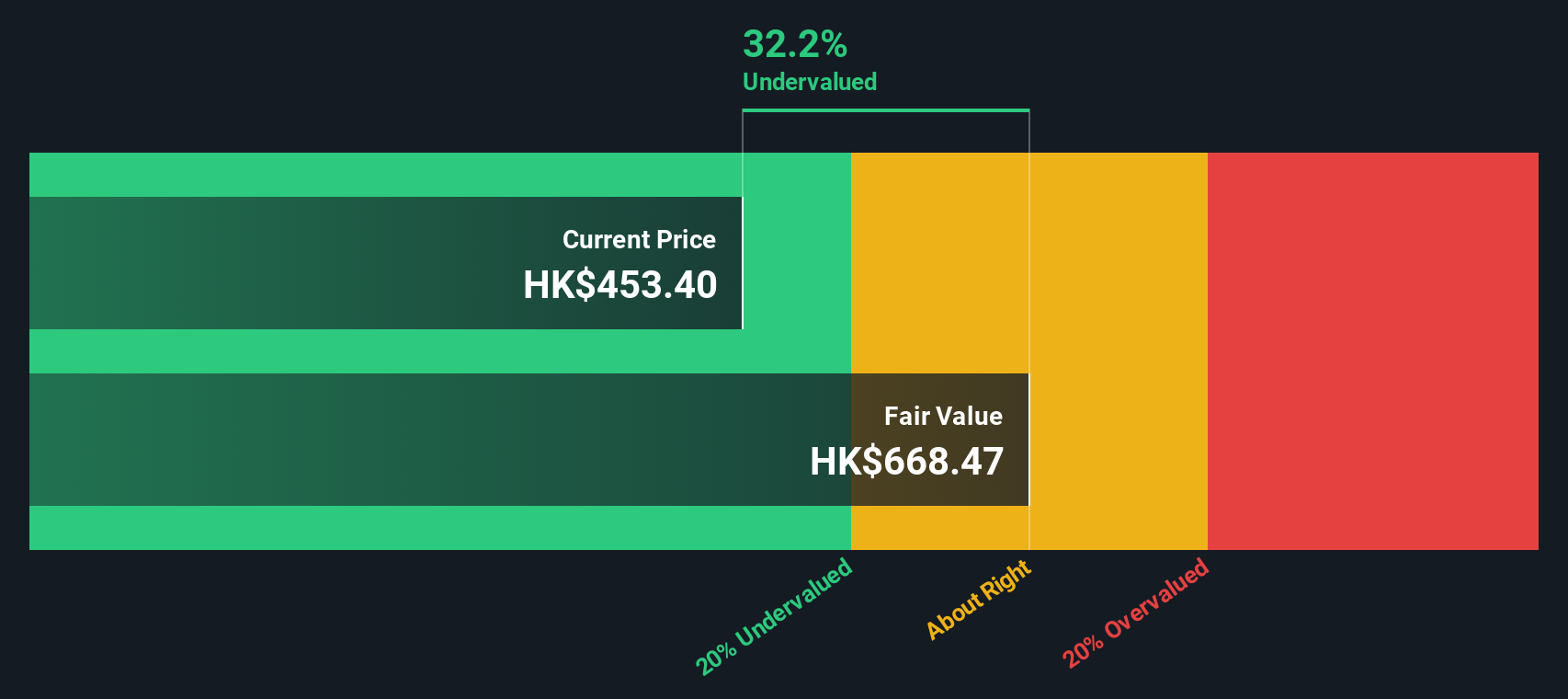

With such rapid share price gains and a significant pipeline, the key question now is whether Sichuan Kelun-Biotech remains undervalued given its growth trajectory, or if current prices already reflect all the future potential.

Price-to-Book Ratio of 19.3x: Is it justified?

Sichuan Kelun-Biotech currently trades at a price-to-book (P/B) ratio of 19.3x, significantly below the peer average of 38.6x, but well above the industry average of 5.2x. Based on this metric, the stock appears less expensive than some direct competitors, yet remains highly valued compared to the wider biotech sector.

The price-to-book ratio compares a company’s market value to its net assets. This provides insight into how much investors are willing to pay for each dollar of assets. For biopharmaceutical firms like Sichuan Kelun-Biotech, high P/B ratios often reflect strong future growth expectations, pipeline potential, or unique market positions that can lead investors to pay well above book value.

In this case, the company’s P/B of 19.3x indicates that investors are already pricing in considerable optimism, though not to the extremes seen with all peers. Compared to the broader biotech average, however, it remains notable as an expensive valuation and raises the question of whether sustained growth will support this level over time.

Relative to the Hong Kong Biotechs industry average P/B of 5.2x, Sichuan Kelun-Biotech’s ratio is more than three times higher. This suggests the market may be awarding a premium for its innovation pipeline, but also indicates limited margin for error if expectations are not met.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book Ratio of 19.3x (ABOUT RIGHT)

However, rapid revenue growth may not offset persistent net losses. High valuations also increase downside risk if upcoming clinical results disappoint.

Find out about the key risks to this Sichuan Kelun-Biotech Biopharmaceutical narrative.

Another View: Discounted Cash Flow Offers a Different Perspective

While the price-to-book ratio positions Sichuan Kelun-Biotech as expensive compared to the wider biotech sector, our DCF model offers a very different conclusion. The SWS DCF model estimates fair value at HK$731.89, which suggests the shares are trading 37.6% below this threshold and may actually be undervalued. Given this sharp contrast, which valuation should investors trust when deciding what comes next?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Sichuan Kelun-Biotech Biopharmaceutical for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 914 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Sichuan Kelun-Biotech Biopharmaceutical Narrative

If these views don't quite align with your own, you have the option to dig into the numbers and shape your own take in just minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Sichuan Kelun-Biotech Biopharmaceutical.

Looking for More Investment Ideas?

Don’t let opportunity pass you by; there are standout stocks across the market just waiting to be uncovered. Put the powerful Simply Wall Street Screener to work to help find tomorrow’s winners today.

- Target value by filtering for companies primed for strong cash flow potential in these 914 undervalued stocks based on cash flows.

- Get ahead of the curve by identifying promising tech disruptors with these 25 AI penny stocks.

- Secure consistent income streams by searching for reliable payout opportunities available through these 15 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6990

Sichuan Kelun-Biotech Biopharmaceutical

A biopharmaceutical company, engages in the research and development, manufacturing, and commercialization of novel drugs in oncology, immunology, and other therapeutic areas in the People’s Republic of China and internationally.

Exceptional growth potential with excellent balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026