Why We're Not Concerned Yet About Ascentage Pharma Group International's (HKG:6855) 30% Share Price Plunge

The Ascentage Pharma Group International (HKG:6855) share price has fared very poorly over the last month, falling by a substantial 30%. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 21% share price drop.

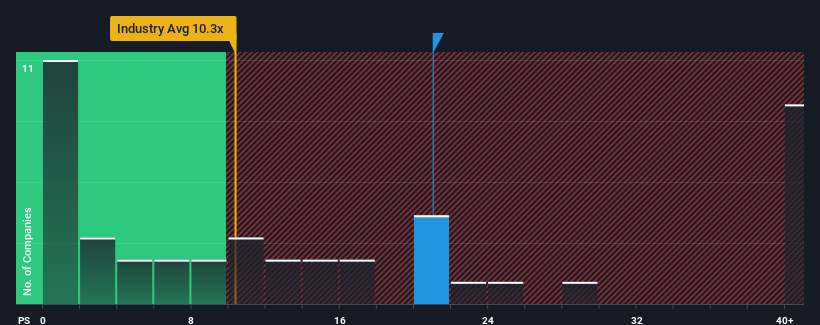

In spite of the heavy fall in price, Ascentage Pharma Group International may still be sending very bearish signals at the moment with a price-to-sales (or "P/S") ratio of 21x, since almost half of all companies in the Biotechs industry in Hong Kong have P/S ratios under 10.3x and even P/S lower than 2x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for Ascentage Pharma Group International

How Ascentage Pharma Group International Has Been Performing

Recent times haven't been great for Ascentage Pharma Group International as its revenue has been rising slower than most other companies. Perhaps the market is expecting future revenue performance to undergo a reversal of fortunes, which has elevated the P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Ascentage Pharma Group International will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, Ascentage Pharma Group International would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered a decent 5.9% gain to the company's revenues. While this performance is only fair, the company was still able to deliver immense revenue growth over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 153% during the coming year according to the three analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 70%, which is noticeably less attractive.

With this information, we can see why Ascentage Pharma Group International is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Ascentage Pharma Group International's P/S?

A significant share price dive has done very little to deflate Ascentage Pharma Group International's very lofty P/S. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our look into Ascentage Pharma Group International shows that its P/S ratio remains high on the merit of its strong future revenues. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Ascentage Pharma Group International that you need to be mindful of.

If you're unsure about the strength of Ascentage Pharma Group International's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:6855

Ascentage Pharma Group International

A clinical-stage biotechnology company, develops therapies for cancers, chronic hepatitis B virus (HBV), and age-related diseases in Mainland China.

High growth potential with mediocre balance sheet.

Market Insights

Community Narratives