Ascentage Pharma (SEHK:6855): Evaluating Valuation After ASH Meeting Spotlights Pipeline Progress

Reviewed by Simply Wall St

Ascentage Pharma Group International (SEHK:6855) saw attention rise after announcing that new clinical and preclinical results on olverembatinib, lisaftoclax, and APG-5918 will be featured at the 67th ASH Annual Meeting. This recognition for its drug candidates highlights the company’s development programs and keeps them in focus for investors.

See our latest analysis for Ascentage Pharma Group International.

This spotlight at ASH comes after a year of strong momentum for Ascentage Pharma. Despite a recent pullback, with the 90-day share price return down 22.1%, the stock remains up 47.4% year-to-date and has delivered an impressive 57.1% total shareholder return over the last twelve months. The multiyear track record also stands out, with a 240.5% total return over three years. Ongoing recognition of its drug pipeline has kept growth hopes alive and helped underpin investor conviction as the story continues to develop.

If you’re looking beyond biotech, this could be a prime moment to discover See the full list for free.

With the stock still boasting strong long-term returns, yet recent gains slowing sharply, the big question now is whether Ascentage Pharma is undervalued after the pullback or if the market has already priced in its future growth potential.

Most Popular Narrative: 30.5% Undervalued

Compared to its latest close of HK$64.5, the most popular narrative sees Ascentage Pharma trading notably below its calculated fair value. This valuation draws heightened attention to the company's future earnings potential versus its current market pricing.

Ascentage Pharma's collaboration with Takeda on Olverembatinib has the potential to expand the drug's global market reach significantly. The agreement could generate substantial milestone payments and royalties, positively impacting revenue and earnings.

Want to know what drives this bold valuation call? Get a glimpse into the revenue forecasts, profit margin leaps, and growth assumptions shaping this price target. Which game-changing projections make analysts so optimistic? Dig deeper to uncover the surprising numbers behind Ascentage Pharma’s fair value.

Result: Fair Value of $92.81 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, high R&D costs and heavy reliance on Olverembatinib for revenue could present challenges to the long-term growth assumed in current forecasts.

Find out about the key risks to this Ascentage Pharma Group International narrative.

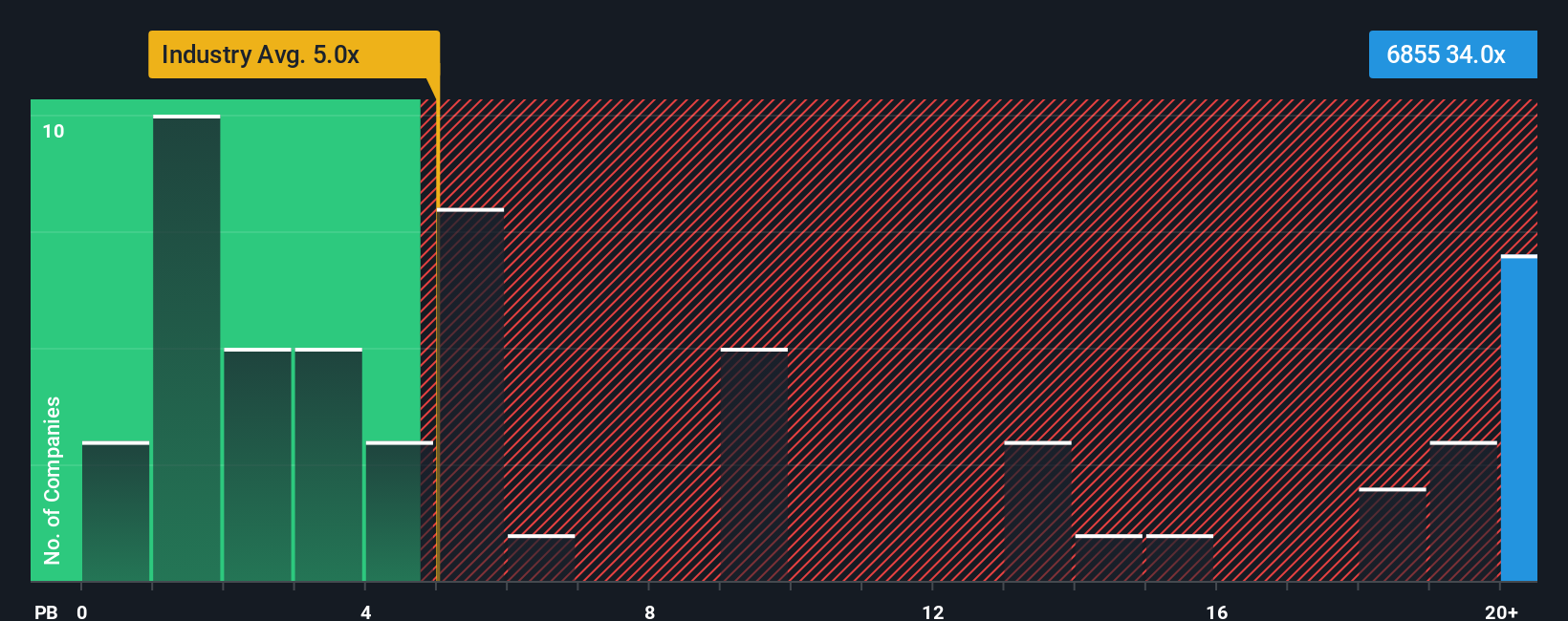

Another View: Market Ratios Tell a Different Story

Looking from a different angle, Ascentage Pharma's price-to-book ratio stands at 32.6x, far above both the Hong Kong Biotechs industry average of 5.0x and the peer average of 5.5x. This steep premium signals that the market is pricing in a lot of future growth or optimism, leaving little room for disappointment.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ascentage Pharma Group International Narrative

If you think differently or want to dig into the numbers for yourself, it’s easy and quick to develop your own perspective on Ascentage Pharma. Do it your way

A great starting point for your Ascentage Pharma Group International research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Winning Opportunities?

Unlock serious potential by targeting stocks that stand out for growth, innovation, and powerful financials. Miss these screens and you could overlook tomorrow’s top performers.

- Tap into the surge of companies harnessing artificial intelligence by checking out these 26 AI penny stocks positioned for transformative growth in the tech space.

- Boost your strategy with stable, income-generating opportunities by reviewing these 14 dividend stocks with yields > 3% offering reliable yields above 3%.

- Get ahead of the curve by scouting these 27 quantum computing stocks leading advancements in quantum computing and shaping the future of high-performance tech.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6855

Ascentage Pharma Group International

A clinical-stage biotechnology company, develops therapies for cancers, chronic hepatitis B virus (HBV), and age-related diseases in Mainland China.

Exceptional growth potential with adequate balance sheet.

Market Insights

Community Narratives