Can CStone Pharmaceuticals' (SEHK:2616) Novel Antibody Drive a New Era in Allergy Treatment Innovation?

Reviewed by Sasha Jovanovic

- On November 7, 2025, CStone Pharmaceuticals presented promising preclinical data on its novel bispecific antibody, CS2015, at the ACAAI Annual Scientific Meeting in Orlando, showcasing its dual targeting of OX40L and TSLP in type 2 inflammation diseases.

- This marks the first time CS2015 has been presented at an international conference, highlighting potential advancements in therapies for allergies, asthma, and related conditions.

- We'll now explore how the innovative attributes of CS2015 could shape CStone Pharmaceuticals' investment narrative following recent company developments.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

What Is CStone Pharmaceuticals' Investment Narrative?

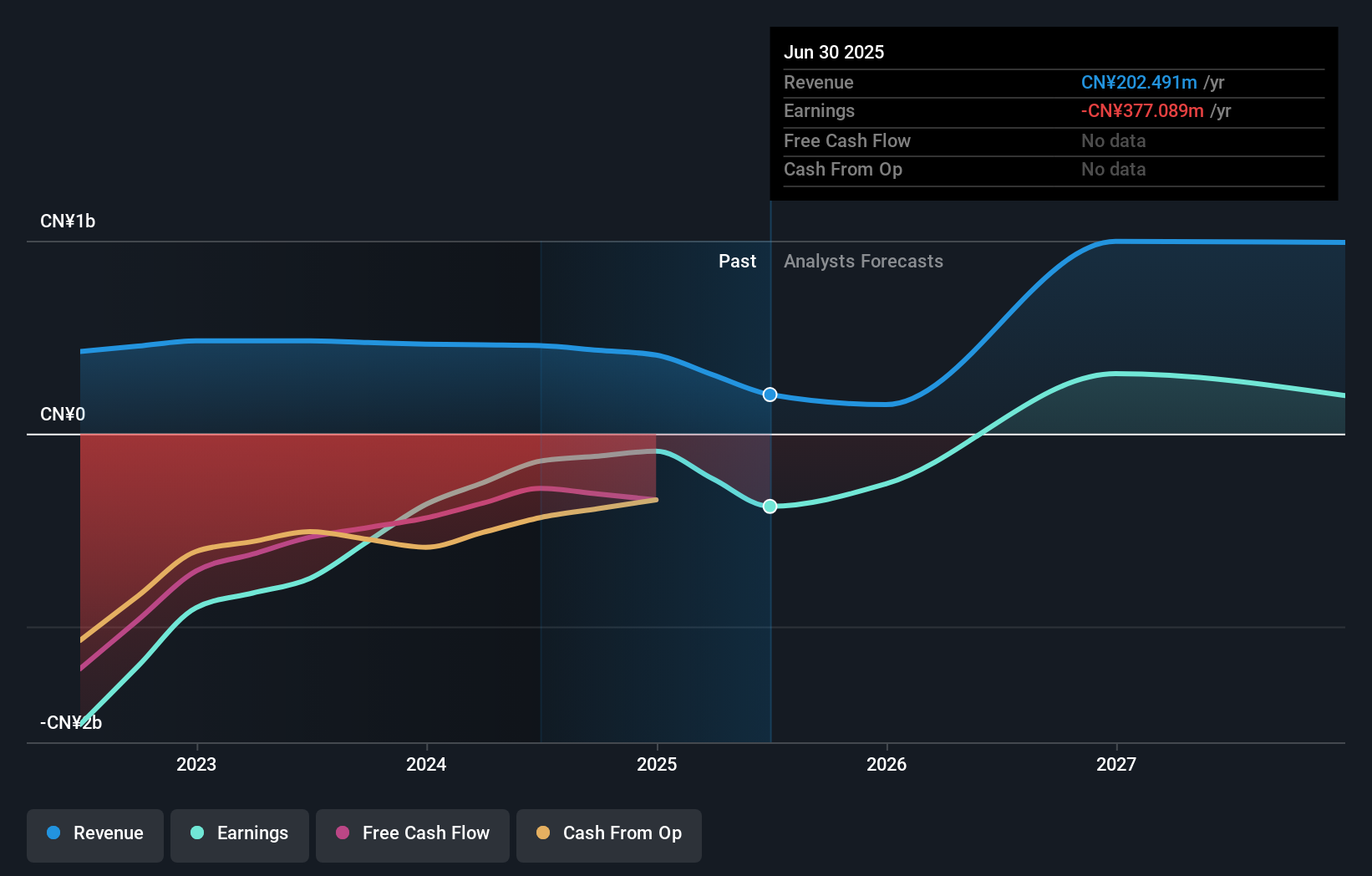

CStone Pharmaceuticals’ investment case centers around faith in its R&D engine and commercial execution, balanced by caution around ongoing losses and market volatility. The recent first international presentation of CS2015 at the ACAAI meeting, highlighting its dual-targeting design and promising preclinical results, boosts CStone’s innovation profile and could enhance near-term sentiment. However, this development is still at the preclinical stage, so while it adds scientific credibility and potential future catalysts to CStone’s pipeline, it does not fundamentally alter the company’s immediate risk profile or financial picture. Key short-term catalysts, like regulatory approvals and data readouts for pipeline assets, remain unchanged, though some investor attention may shift toward CS2015’s progress. The biggest risks still stem from unprofitability, share price swings and dependence on pipeline conversion.

Yet, potential funding needs remain an important item for investors to keep in mind. CStone Pharmaceuticals' shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 2 other fair value estimates on CStone Pharmaceuticals - why the stock might be worth over 3x more than the current price!

Build Your Own CStone Pharmaceuticals Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CStone Pharmaceuticals research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free CStone Pharmaceuticals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CStone Pharmaceuticals' overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2616

CStone Pharmaceuticals

A biopharmaceutical company, researches and develops anti-cancer therapies to address the unmet medical needs of cancer patients in Mainland China and internationally.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives