Is Wuhan YZY Biopharma (HKG:2496) Using Debt In A Risky Way?

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that Wuhan YZY Biopharma Co., Ltd. (HKG:2496) does use debt in its business. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for Wuhan YZY Biopharma

How Much Debt Does Wuhan YZY Biopharma Carry?

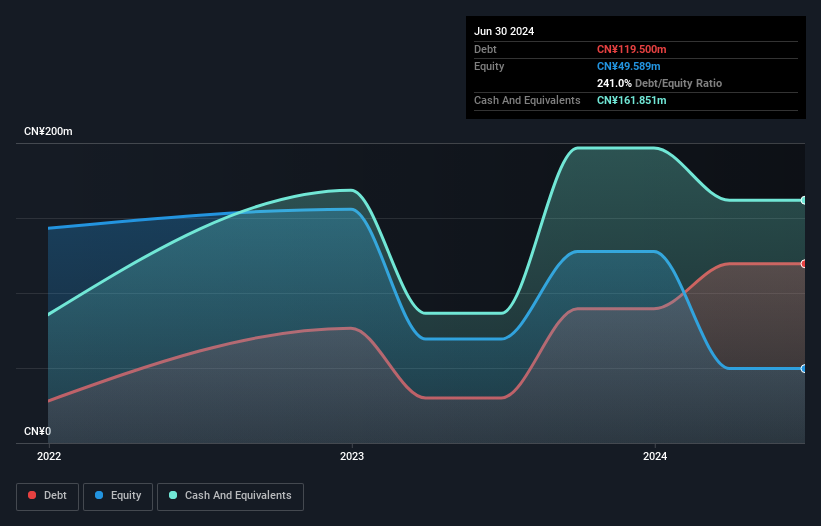

You can click the graphic below for the historical numbers, but it shows that as of June 2024 Wuhan YZY Biopharma had CN¥119.5m of debt, an increase on CN¥30.0m, over one year. But on the other hand it also has CN¥161.9m in cash, leading to a CN¥42.4m net cash position.

How Healthy Is Wuhan YZY Biopharma's Balance Sheet?

We can see from the most recent balance sheet that Wuhan YZY Biopharma had liabilities of CN¥170.1m falling due within a year, and liabilities of CN¥40.3m due beyond that. On the other hand, it had cash of CN¥161.9m and CN¥8.07m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by CN¥40.5m.

Given Wuhan YZY Biopharma has a market capitalization of CN¥1.23b, it's hard to believe these liabilities pose much threat. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward. Despite its noteworthy liabilities, Wuhan YZY Biopharma boasts net cash, so it's fair to say it does not have a heavy debt load! There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Wuhan YZY Biopharma will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Given its lack of meaningful operating revenue, Wuhan YZY Biopharma shareholders no doubt hope it can fund itself until it has a profitable product.

So How Risky Is Wuhan YZY Biopharma?

Statistically speaking companies that lose money are riskier than those that make money. And in the last year Wuhan YZY Biopharma had an earnings before interest and tax (EBIT) loss, truth be told. And over the same period it saw negative free cash outflow of CN¥173m and booked a CN¥184m accounting loss. With only CN¥42.4m on the balance sheet, it would appear that its going to need to raise capital again soon. Overall, we'd say the stock is a bit risky, and we're usually very cautious until we see positive free cash flow. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. For example Wuhan YZY Biopharma has 2 warning signs (and 1 which shouldn't be ignored) we think you should know about.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

Valuation is complex, but we're here to simplify it.

Discover if Wuhan YZY Biopharma might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2496

Wuhan YZY Biopharma

A biotechnology company, develops bispecific antibody-based therapies for the treatment of cancer, cancer-related complications, and age-related ophthalmologic diseases.

Slightly overvalued with imperfect balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026