- Japan

- /

- Construction

- /

- TSE:1975

Top Asian Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

As global markets grapple with concerns over AI valuations and economic uncertainties, the Asian market has also experienced fluctuations, particularly influenced by investor sentiment toward technology stocks. Amidst this backdrop, dividend stocks in Asia can offer a measure of stability and income potential for investors seeking to balance their portfolios.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 3.65% | ★★★★★★ |

| Torigoe (TSE:2009) | 3.83% | ★★★★★★ |

| NCD (TSE:4783) | 4.51% | ★★★★★★ |

| Kyoritsu Electric (TSE:6874) | 3.66% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.15% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.18% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.77% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.77% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.79% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.57% | ★★★★★★ |

Click here to see the full list of 1026 stocks from our Top Asian Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Dawnrays Pharmaceutical (Holdings) (SEHK:2348)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Dawnrays Pharmaceutical (Holdings) Limited is an investment holding company that develops, manufactures, and sells non-patented pharmaceutical medicines in Mainland China and internationally, with a market cap of HK$1.86 billion.

Operations: Dawnrays Pharmaceutical (Holdings) Limited generates revenue from its Finished Drugs segment amounting to CN¥1.05 billion and from Intermediates and Bulk Medicines totaling CN¥164.60 million.

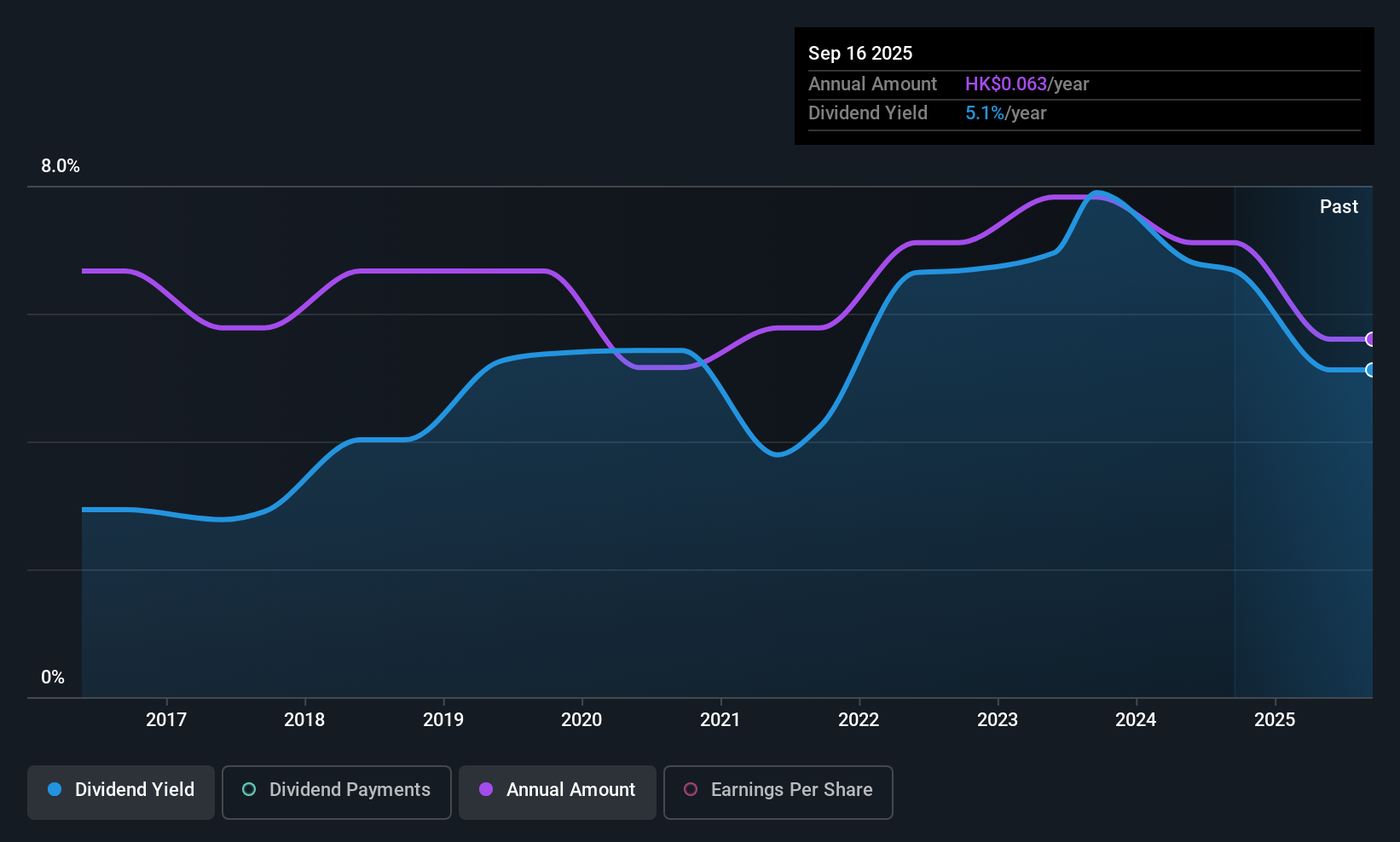

Dividend Yield: 5.1%

Dawnrays Pharmaceutical's dividend yield of 5.08% is below the top 25% in Hong Kong, and its dividend history has been volatile with significant annual drops. Despite this, dividends have grown over the past decade and are covered by both earnings (50.3% payout ratio) and cash flows (45.3%). The stock's price-to-earnings ratio of 9.6x suggests it may be undervalued compared to the market average of 12.2x, offering potential value for investors seeking income stability improvements.

- Unlock comprehensive insights into our analysis of Dawnrays Pharmaceutical (Holdings) stock in this dividend report.

- Our valuation report unveils the possibility Dawnrays Pharmaceutical (Holdings)'s shares may be trading at a premium.

Asahi Kogyosha (TSE:1975)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Asahi Kogyosha Co., Ltd. primarily engages in air-conditioning and sanitation installation works in Japan, with a market cap of ¥81.70 billion.

Operations: Asahi Kogyosha Co., Ltd. generates its revenue primarily from air-conditioning and sanitation installation services in Japan.

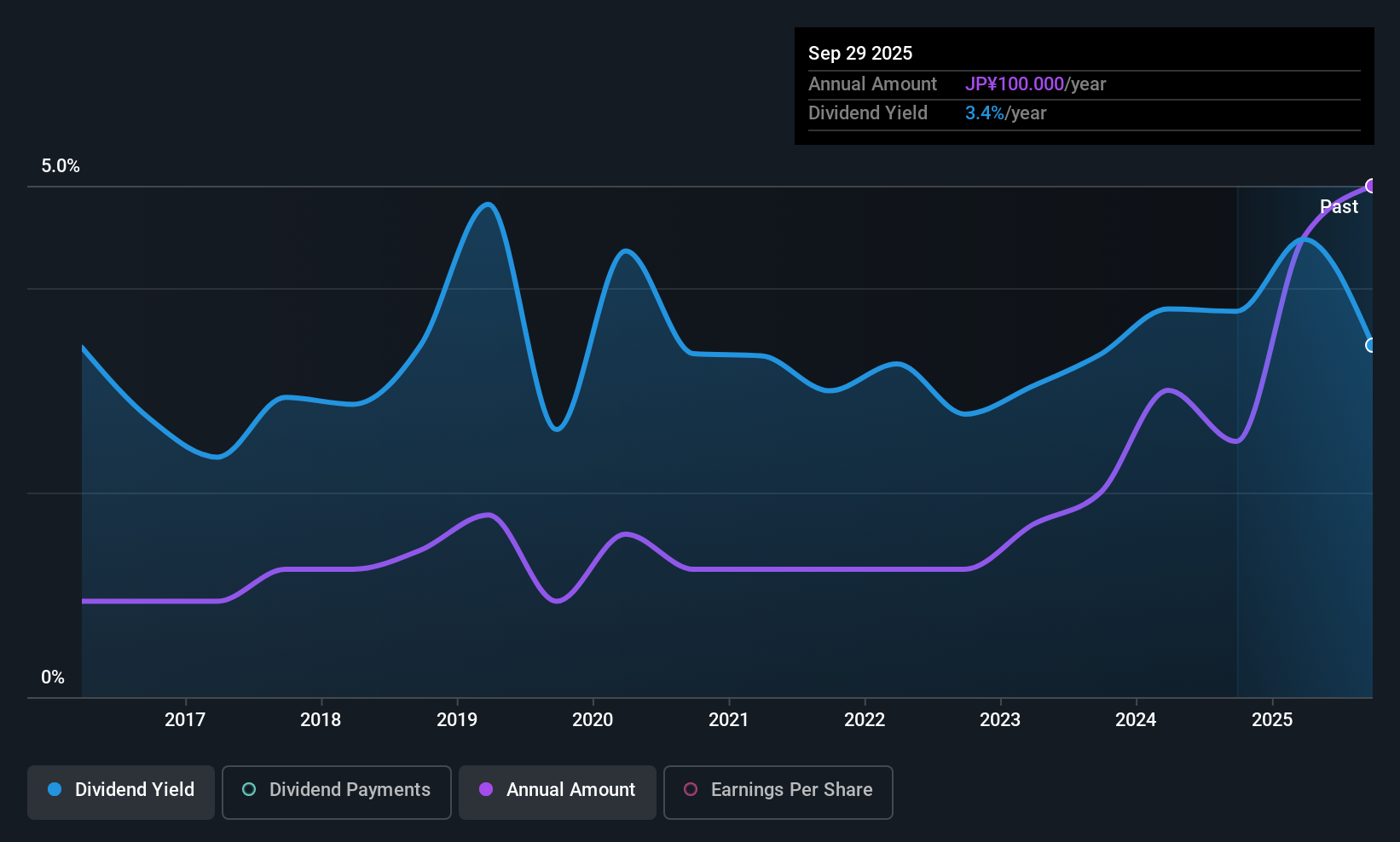

Dividend Yield: 3.2%

Asahi Kogyosha's dividend yield of 3.15% is below Japan's top quartile, with a history of volatility and unreliability over the past decade. However, recent increases in dividends from ¥25 to ¥50 per share signal potential improvement. The company's dividends are well-covered by earnings (9.1% payout ratio) and cash flows (68.1% cash payout ratio). Trading at 48.1% below estimated fair value, Asahi Kogyosha could offer value despite its historically unstable dividend track record.

- Navigate through the intricacies of Asahi Kogyosha with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, Asahi Kogyosha's share price might be too pessimistic.

Toyo Seikan Group Holdings (TSE:5901)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Toyo Seikan Group Holdings, Ltd. and its subsidiaries manufacture and sell packaging containers in Japan, the rest of Asia, and internationally, with a market cap of ¥559.99 billion.

Operations: Toyo Seikan Group Holdings generates revenue through its Steel Plate Business (¥115.14 million), Real Estate Related Business (¥9.78 million), Functional Material Related Business (¥54.64 million), and Engineering / Filling / Logistics Business (¥204.05 million).

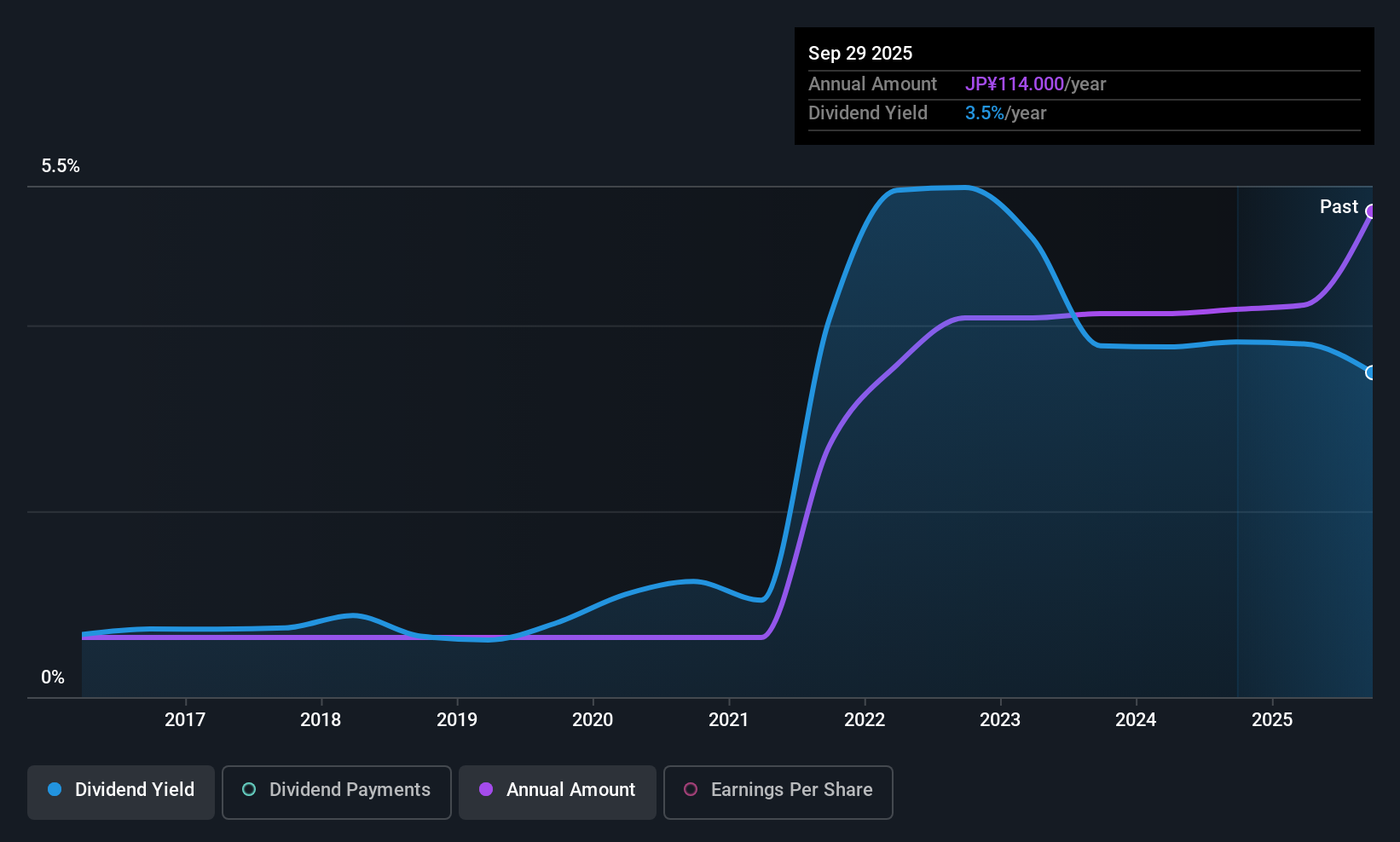

Dividend Yield: 3.1%

Toyo Seikan Group Holdings has shown volatility in its dividend payments over the past decade, but recent increases from ¥45 to ¥57 per share suggest a positive shift. The dividends are well-supported by earnings (36.8% payout ratio) and cash flows (28.6% cash payout ratio). Despite trading at 46.1% below estimated fair value, the stock's dividend yield of 3.06% remains below Japan's top quartile, indicating room for improvement in overall dividend appeal.

- Click here to discover the nuances of Toyo Seikan Group Holdings with our detailed analytical dividend report.

- The valuation report we've compiled suggests that Toyo Seikan Group Holdings' current price could be inflated.

Key Takeaways

- Reveal the 1026 hidden gems among our Top Asian Dividend Stocks screener with a single click here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1975

Asahi Kogyosha

Primarily engages in the air-conditioning and sanitation installation works in Japan.

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success