Stock Analysis

- Hong Kong

- /

- Real Estate

- /

- SEHK:35

Exploring Undervalued Small Caps With Insider Actions In Hong Kong June 2024

Reviewed by Simply Wall St

As of June 2024, the Hong Kong market exhibits a cautious optimism, with the Hang Seng Index showing modest gains amid mixed economic signals. This backdrop sets an intriguing stage for investors to consider the potential of undervalued small-cap stocks, particularly those with notable insider actions. In such a market environment, identifying stocks that demonstrate strong fundamentals and insider confidence can be particularly compelling. These elements often suggest a belief among those closest to the company that its shares are poised for recovery or growth.

Top 10 Undervalued Small Caps With Insider Buying In Hong Kong

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Xtep International Holdings | 11.1x | 0.8x | 41.05% | ★★★★★☆ |

| Far East Consortium International | NA | 0.3x | 38.38% | ★★★★★☆ |

| Wasion Holdings | 11.7x | 0.8x | 27.33% | ★★★★☆☆ |

| Sany Heavy Equipment International Holdings | 8.0x | 0.7x | -23.53% | ★★★★☆☆ |

| Nissin Foods | 15.0x | 1.3x | 36.46% | ★★★★☆☆ |

| China Leon Inspection Holding | 9.7x | 0.7x | 28.08% | ★★★★☆☆ |

| China Lesso Group Holdings | 4.1x | 0.3x | 6.71% | ★★★★☆☆ |

| Transport International Holdings | 11.0x | 0.6x | 45.39% | ★★★★☆☆ |

| Giordano International | 8.8x | 0.8x | 34.46% | ★★★☆☆☆ |

| China Overseas Grand Oceans Group | 3.0x | 0.1x | -10.03% | ★★★☆☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

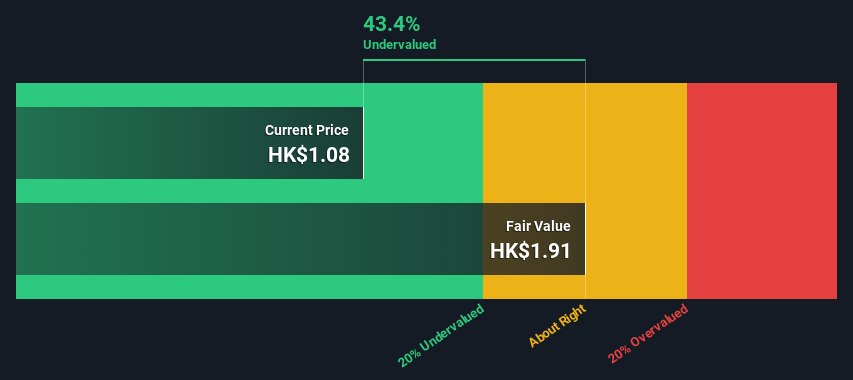

Nissin Foods (SEHK:1475)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Nissin Foods is a company specializing in the production and sale of instant noodles and related products, primarily serving markets in Mainland China, Hong Kong, and other parts of Asia.

Operations: Mainland China and Hong Kong, along with other Asian regions, significantly contribute to the company's revenue, generating HK$2.47 billion and HK$1.68 billion respectively. The gross profit margin has shown an increasing trend over recent periods, reaching 0.34% by the latest reported date in 2024.

PE: 15.0x

Recently, Nissin Foods demonstrated insider confidence as Kiyotaka Ando invested approximately HK$770,000 in the company's shares. This aligns with a positive trajectory in earnings, forecasted to grow annually by 7.04%. With new executive leadership set from July and consistent dividend increases—most recently to 15.82 HK cents per share—the firm is reinforcing its management while rewarding shareholders. These strategic moves underscore Nissin Foods' potential amidst Hong Kong’s lesser-known investment opportunities, suggesting a promising outlook despite its modest market presence.

- Dive into the specifics of Nissin Foods here with our thorough valuation report.

Explore historical data to track Nissin Foods' performance over time in our Past section.

Abbisko Cayman (SEHK:2256)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Abbisko Cayman is a company focused on the development of innovative medicines, with a market capitalization of approximately CN¥19.06 billion.

Operations: The business secures a consistent gross profit margin of 100%, reflecting full conversion of revenue to gross profit, as seen with CN¥19.06 million from developing innovative medicines. However, it faces substantial operating losses due to high R&D expenses, which reached CN¥433.74 million recently, contributing significantly to a net income margin of -22.64%.

PE: -4.4x

Abbisko Cayman, a Hong Kong-based entity, recently initiated a share repurchase program on June 18, 2024, reflecting insider confidence and potential for increased shareholder value. Despite current unprofitability with no immediate prospects for reversal, the company is experiencing significant revenue growth projections at 39% annually. Insider activities and strategic product developments like the FDA's Orphan Drug Designation for irpagratinib suggest a focused approach towards addressing niche medical markets. This blend of financial maneuvers and innovative strides could hint at latent potential amidst apparent challenges.

- Click here to discover the nuances of Abbisko Cayman with our detailed analytical valuation report.

Review our historical performance report to gain insights into Abbisko Cayman's's past performance.

Far East Consortium International (SEHK:35)

Simply Wall St Value Rating: ★★★★★☆

Overview: Far East Consortium International is a diversified company engaged in property development, investment, hotel operations, and gaming across multiple regions including Hong Kong, Australia, the UK, and Southeast Asia.

Operations: Analyzing the financial performance of Far East Consortium International, the gross profit margin has shown variability over several reporting periods, ranging from 30.99% to 54.81%. The company's revenue streams are primarily derived from its significant involvement in property development across various regions including Australia and Singapore, which together contributed HK$5.39 billion to the total revenue.

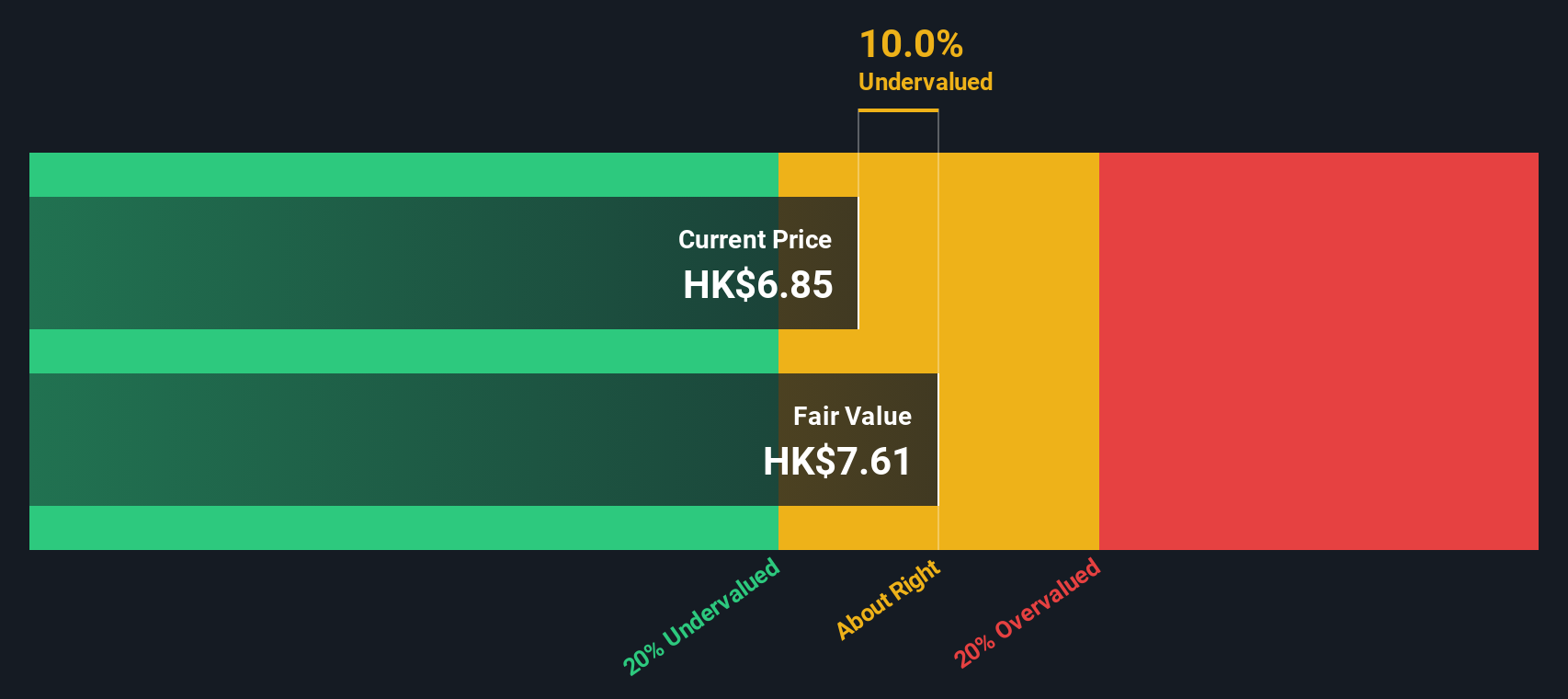

PE: -17.6x

Far East Consortium International, a lesser-known entity in Hong Kong's bustling market, recently witnessed insider confidence with significant share purchases. This move underscores a strong belief in the company’s prospects despite its reliance on external borrowing—a higher risk funding method. With earnings expected to surge by 137% annually, these strategic buys suggest potential unrecognized worth. The firm has avoided diluting shareholders over the past year, further solidifying its appeal among discerning investors looking for growth intertwined with stability.

Summing It All Up

- Get an in-depth perspective on all 19 Undervalued Small Caps With Insider Buying by using our screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:35

Far East Consortium International

An investment holding company, engages in the property development and investment, hotel operations and management, car park operations and facilities management, gaming and related operations, and securities and financial product investments.

Average dividend payer slight.