Take Care Before Jumping Onto JW (Cayman) Therapeutics Co. Ltd (HKG:2126) Even Though It's 26% Cheaper

JW (Cayman) Therapeutics Co. Ltd (HKG:2126) shares have had a horrible month, losing 26% after a relatively good period beforehand. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 45% in that time.

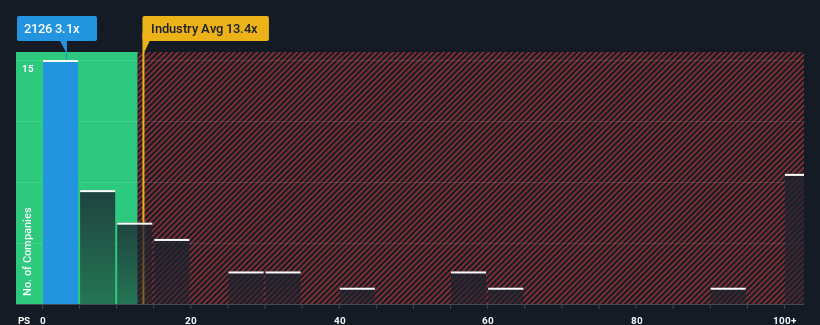

Since its price has dipped substantially, JW (Cayman) Therapeutics' price-to-sales (or "P/S") ratio of 3.1x might make it look like a strong buy right now compared to the wider Biotechs industry in Hong Kong, where around half of the companies have P/S ratios above 13.4x and even P/S above 57x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

See our latest analysis for JW (Cayman) Therapeutics

How Has JW (Cayman) Therapeutics Performed Recently?

JW (Cayman) Therapeutics could be doing better as it's been growing revenue less than most other companies lately. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Keen to find out how analysts think JW (Cayman) Therapeutics' future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, JW (Cayman) Therapeutics would need to produce anemic growth that's substantially trailing the industry.

Retrospectively, the last year delivered a decent 3.3% gain to the company's revenues. Although, the latest three year period in total hasn't been as good as it didn't manage to provide any growth at all. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Turning to the outlook, the next three years should generate growth of 58% per year as estimated by the only analyst watching the company. With the industry predicted to deliver 54% growth per annum, the company is positioned for a comparable revenue result.

With this in consideration, we find it intriguing that JW (Cayman) Therapeutics' P/S is lagging behind its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

What We Can Learn From JW (Cayman) Therapeutics' P/S?

Shares in JW (Cayman) Therapeutics have plummeted and its P/S has followed suit. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

It looks to us like the P/S figures for JW (Cayman) Therapeutics remain low despite growth that is expected to be in line with other companies in the industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. Perhaps investors are concerned that the company could underperform against the forecasts over the near term.

Having said that, be aware JW (Cayman) Therapeutics is showing 3 warning signs in our investment analysis, and 1 of those is concerning.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2126

JW (Cayman) Therapeutics

A clinical stage cell therapy company, engages in the research and development, manufacture, and marketing of cellular immunotherapy products in the People’s Republic of China.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026