- China

- /

- Metals and Mining

- /

- SZSE:002578

Promising Penny Stocks To Consider In December 2024

Reviewed by Simply Wall St

As global markets continue to reach record highs, with indices such as the Dow Jones and S&P 500 marking significant gains, investors are on the lookout for opportunities that align with current economic conditions. Penny stocks, a term often associated with smaller or newer companies, still hold potential for growth when these entities demonstrate strong financial health. In this article, we will explore three penny stocks that stand out due to their robust balance sheets and potential for long-term success.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.48 | MYR2.39B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.79 | A$144.95M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.395 | MYR1.1B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.89 | MYR295.43M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.245 | £845.83M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.13 | HK$45.48B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.565 | A$66.23M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £4.335 | £431.14M | ★★★★☆☆ |

| Secure Trust Bank (LSE:STB) | £3.57 | £68.08M | ★★★★☆☆ |

Click here to see the full list of 5,688 stocks from our Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

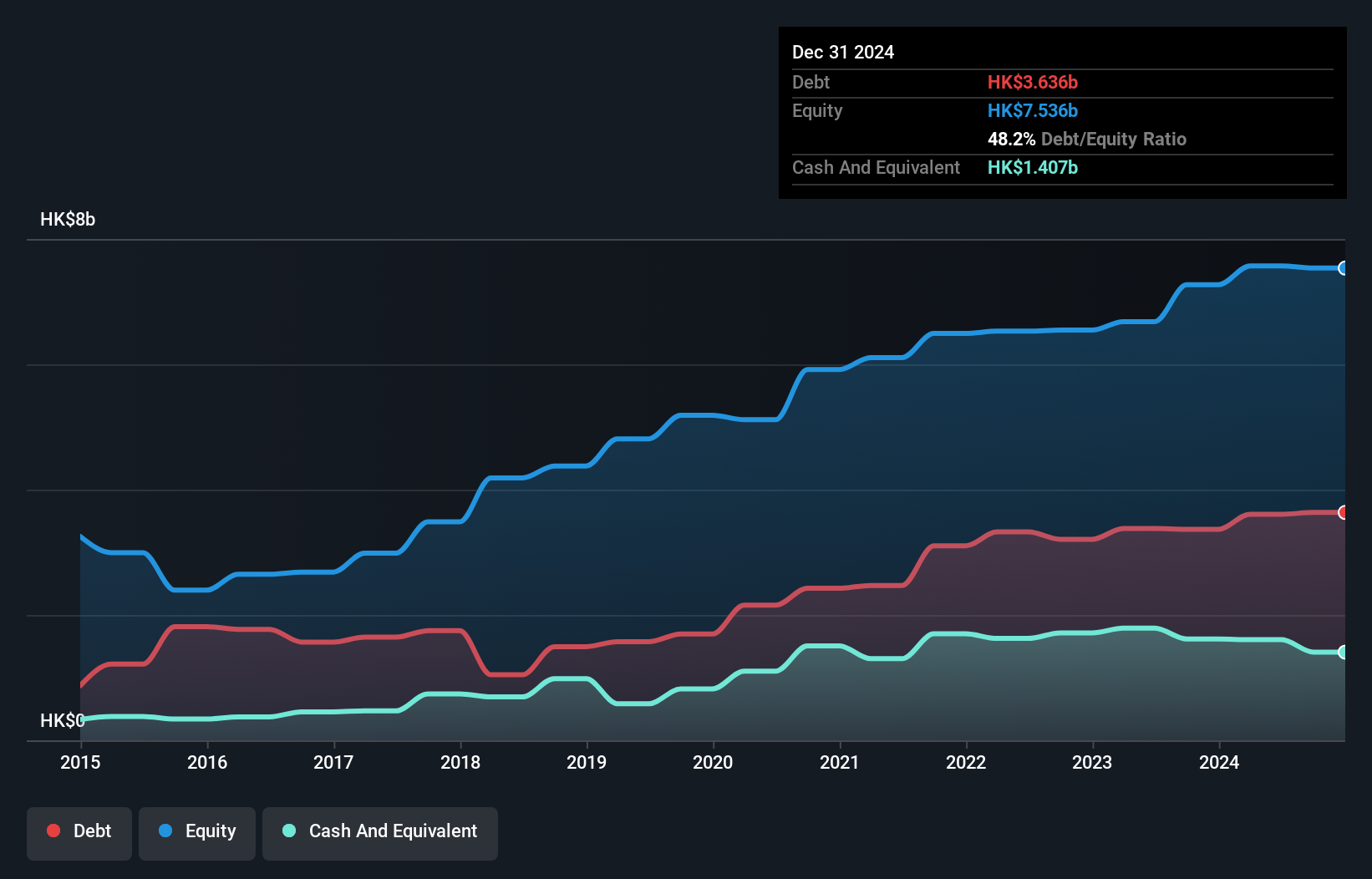

SSY Group (SEHK:2005)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: SSY Group Limited is an investment holding company that engages in the research, development, manufacturing, trading, and sale of various pharmaceutical products to hospitals and distributors both in the People's Republic of China and internationally, with a market cap of approximately HK$10.62 billion.

Operations: The company generates revenue from its Medical Materials segment, which contributes HK$402.49 million, and its Intravenous Infusion Solution and Others segment, which accounts for HK$6.30 billion.

Market Cap: HK$10.62B

SSY Group Limited has demonstrated stable earnings growth, with a 14.6% increase over the past year, surpassing both its five-year average and industry benchmarks. The company's financial health appears robust, with short-term assets exceeding liabilities and debt well covered by operating cash flow. Recent approvals from China's National Medical Products Administration for various drug products could enhance its market position. However, the dividend coverage is weak despite a low price-to-earnings ratio suggesting good value relative to peers. While the board is experienced, there is insufficient data on management tenure to assess leadership stability comprehensively.

- Unlock comprehensive insights into our analysis of SSY Group stock in this financial health report.

- Gain insights into SSY Group's outlook and expected performance with our report on the company's earnings estimates.

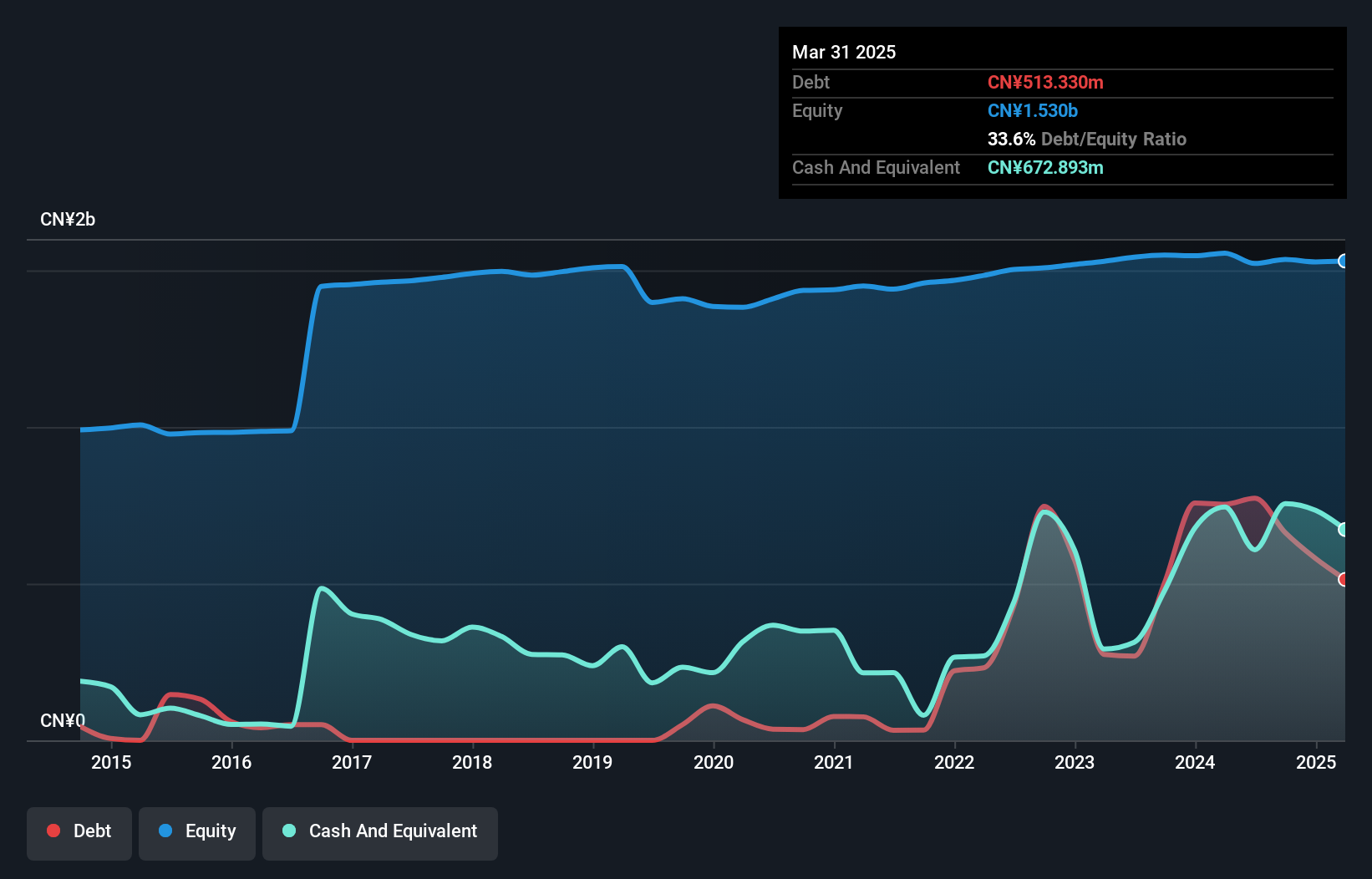

Fujian Minfa Aluminium (SZSE:002578)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Fujian Minfa Aluminium Inc. develops, processes, and sells aluminum alloy extruded profiles for architecture, general engineering, and industry fields in China with a market cap of CN¥3.19 billion.

Operations: No specific revenue segments are reported for Fujian Minfa Aluminium Inc.

Market Cap: CN¥3.19B

Fujian Minfa Aluminium Inc. has faced challenges with declining earnings, decreasing by 14.2% annually over the past five years, and negative growth of 34.5% in the last year compared to industry averages. Despite this, the company maintains a solid financial position, with short-term assets exceeding both short and long-term liabilities and more cash than total debt. However, its return on equity is low at 1.7%, and profit margins have slightly decreased from last year. Recent earnings reports show a decline in sales to CN¥1,611.19 million for the first nine months of 2024 compared to the previous year’s CN¥1,967.79 million.

- Get an in-depth perspective on Fujian Minfa Aluminium's performance by reading our balance sheet health report here.

- Evaluate Fujian Minfa Aluminium's historical performance by accessing our past performance report.

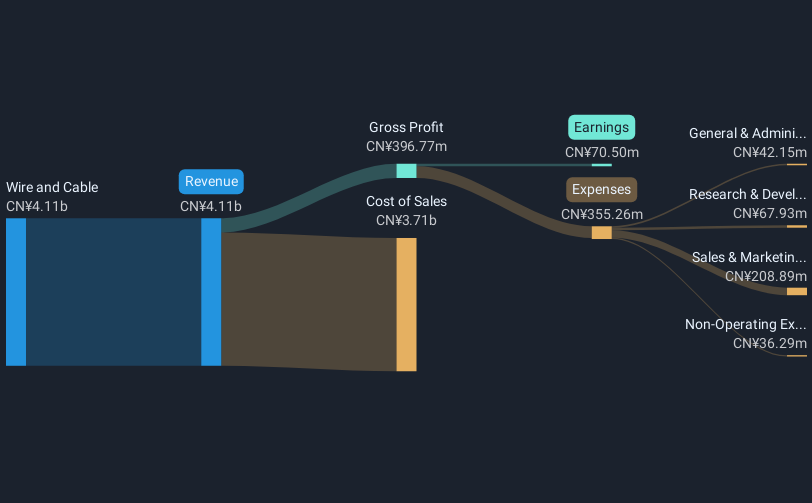

Yuan Cheng CableLtd (SZSE:002692)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Yuan Cheng Cable Co., Ltd. is involved in the design, research and development, production, and sales of wire and cable products in China with a market cap of CN¥3.25 billion.

Operations: The company's revenue is primarily generated from its wire and cable segment, amounting to CN¥4.11 billion.

Market Cap: CN¥3.25B

Yuan Cheng Cable Co., Ltd. has shown a solid revenue increase, reporting CN¥3.18 billion for the first nine months of 2024, up from CN¥2.27 billion the previous year, with net income rising to CN¥51.38 million. The company's short-term assets of CN¥2.6 billion surpass both its short and long-term liabilities, indicating financial stability despite negative operating cash flow impacting debt coverage. While earnings growth over the past year was 10.1%, below its five-year average but above industry growth, profit margins have slightly declined to 1.7%. Return on equity remains low at 6.2%, and debt levels are high with a net debt-to-equity ratio of 97.7%.

- Click to explore a detailed breakdown of our findings in Yuan Cheng CableLtd's financial health report.

- Gain insights into Yuan Cheng CableLtd's past trends and performance with our report on the company's historical track record.

Summing It All Up

- Unlock our comprehensive list of 5,688 Penny Stocks by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002578

Fujian Minfa Aluminium

Develops, processes, and sells aluminum alloy extruded profiles for architecture, general engineering, and industry fields in China.

Adequate balance sheet very low.