- China

- /

- Electronic Equipment and Components

- /

- SZSE:002869

Undiscovered Gems None And 2 Promising Small Caps For Your Portfolio

Reviewed by Simply Wall St

In the current market landscape, small-cap stocks have finally joined their larger counterparts in reaching record highs, as evidenced by the Russell 2000 Index's recent peak. This surge reflects broader market optimism and economic resilience, even amid geopolitical tensions and tariff concerns. Identifying promising small-cap stocks requires a keen understanding of their potential for growth within this dynamic environment, where economic stability and strategic government policies play crucial roles.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Parker Drilling | 46.25% | -0.33% | 53.04% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Watt's | 73.27% | 7.85% | -1.33% | ★★★★★☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| BOSQAR d.d | 94.35% | 39.99% | 23.94% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

We'll examine a selection from our screener results.

IFE Elevators (SZSE:002774)

Simply Wall St Value Rating: ★★★★★★

Overview: IFE Elevators Co., Ltd. is engaged in the research, design, development, manufacturing, and sale of elevators, escalators, moving walks, and related products both in China and internationally with a market cap of CN¥2.95 billion.

Operations: IFE Elevators generates revenue primarily from the sale of elevators, escalators, and moving walks. The company focuses on both domestic and international markets for its product sales.

IFE Elevators, a smaller player in the machinery sector, showcases some intriguing financial characteristics. Its price-to-earnings ratio of 22x is notably below the broader CN market's 36.3x, suggesting potential undervaluation. Over the past year, earnings have grown by 8.4%, outpacing the industry average of -0.4%, and indicating robust performance despite challenges. The company operates debt-free, which eliminates concerns about interest coverage and highlights prudent financial management over five years without any debt burden. However, recent figures show a slight dip in net income to CNY 85 million from CNY 95 million last year, reflecting some revenue pressures that might need addressing moving forward.

- Navigate through the intricacies of IFE Elevators with our comprehensive health report here.

Assess IFE Elevators' past performance with our detailed historical performance reports.

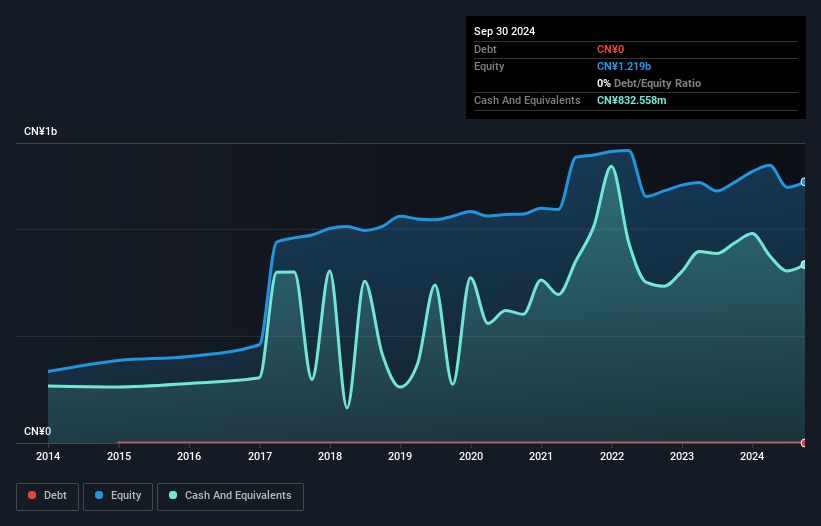

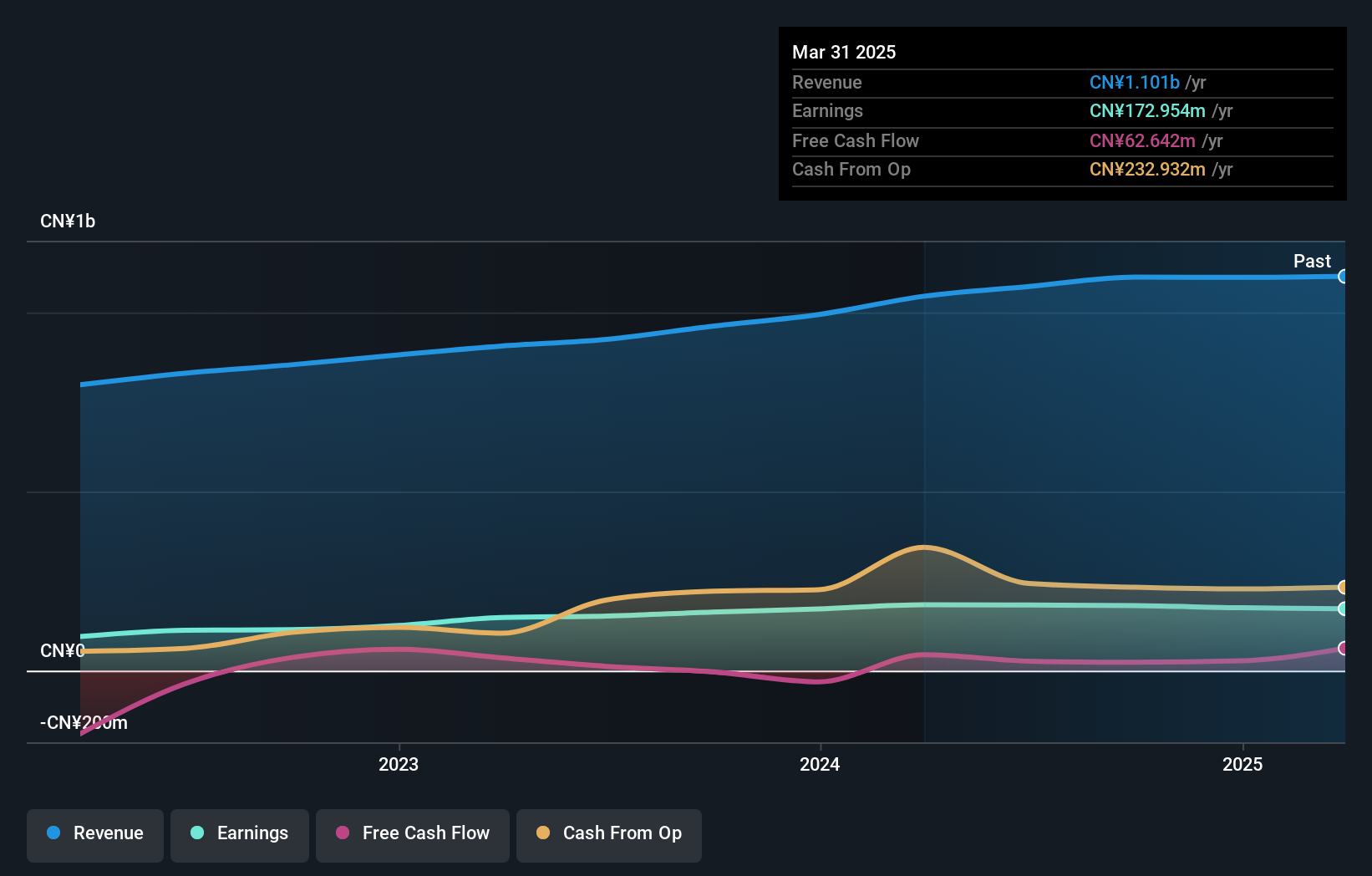

Shenzhen Genvict Technologies (SZSE:002869)

Simply Wall St Value Rating: ★★★★★★

Overview: Shenzhen Genvict Technologies Co., Ltd., along with its subsidiaries, focuses on the research, development, and industrialization of smart transportation technology in China, with a market cap of approximately CN¥5.30 billion.

Operations: Genvict Technologies generates revenue primarily from the Intelligent Traffic Industry, amounting to CN¥514.77 million. The company's market cap stands at approximately CN¥5.30 billion.

Genvict Technologies, a smaller player in the electronics sector, has shown notable performance with earnings surging 65% over the past year, outpacing the industry average of 1.8%. Despite a significant one-off gain of CN¥34.5 million affecting its recent financials, the company remains debt-free and thus unaffected by interest payment concerns. For the nine months ending September 2024, Genvict reported sales of CNY 352.44 million and net income of CNY 31.09 million, reflecting an increase from last year's figures. Basic earnings per share rose to CNY 0.1791 from CNY 0.1475 previously, highlighting operational strength amidst market challenges.

- Take a closer look at Shenzhen Genvict Technologies' potential here in our health report.

Learn about Shenzhen Genvict Technologies' historical performance.

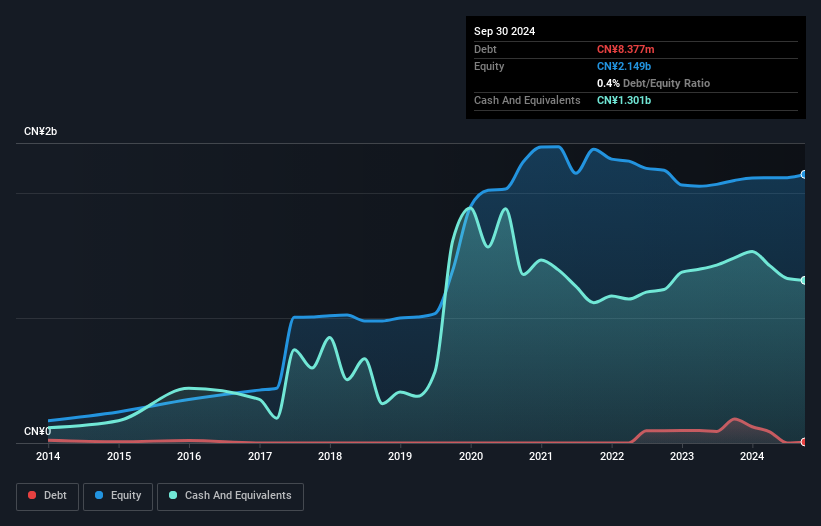

Zhongjing Food (SZSE:300908)

Simply Wall St Value Rating: ★★★★★★

Overview: Zhongjing Food Co., Ltd. focuses on the research, development, production, and sale of seasoning food and ingredients in China with a market cap of CN¥5 billion.

Operations: Zhongjing Food generates revenue primarily from its seasoning food and ingredient products in China. The company has a market cap of CN¥5 billion.

Zhongjing Food, a notable player in the food industry, has demonstrated robust financial health with its debt to equity ratio plummeting from 10.5% to 0.6% over five years. Its earnings growth of 10.9% last year outpaced the industry’s -5.8%, showcasing resilience and competitive edge. The company also recently announced a cash dividend of CNY 2 per 10 shares, reflecting strong profitability and shareholder value focus. With a price-to-earnings ratio of 27.6x below the CN market average, Zhongjing appears undervalued relative to peers, suggesting potential for future appreciation as earnings are forecasted to grow by nearly 14%.

- Unlock comprehensive insights into our analysis of Zhongjing Food stock in this health report.

Explore historical data to track Zhongjing Food's performance over time in our Past section.

Where To Now?

- Navigate through the entire inventory of 4643 Undiscovered Gems With Strong Fundamentals here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002869

Shenzhen Genvict Technologies

Engages in the research, development, and industrialization of smart transportation technology in China.

Flawless balance sheet with high growth potential.