- China

- /

- General Merchandise and Department Stores

- /

- SZSE:301110

Undiscovered Gems Stocks to Watch in December 2024

Reviewed by Simply Wall St

As global markets continue to experience gains, with the S&P 500 and Russell 2000 reaching record highs, small-cap stocks are drawing increased attention from investors. In this dynamic environment, identifying promising yet overlooked stocks can provide unique opportunities for those looking to diversify their portfolios. A good stock in today's market often combines solid fundamentals with the potential for growth, making it an attractive prospect amid shifting economic conditions and geopolitical developments.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Parker Drilling | 46.25% | -0.33% | 53.04% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Watt's | 73.27% | 7.85% | -1.33% | ★★★★★☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| BOSQAR d.d | 94.35% | 39.99% | 23.94% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Dana Gas PJSC (ADX:DANA)

Simply Wall St Value Rating: ★★★★★★

Overview: Dana Gas PJSC, with a market cap of AED50.79 billion, operates in the exploration, production, transportation, processing, distribution, marketing, and sale of natural gas and petroleum-related products across the United Arab Emirates, Iraq, and Egypt.

Operations: Dana Gas PJSC generates revenue primarily from its integrated oil and gas operations, amounting to $300 million.

Dana Gas, a notable player in the oil and gas sector, has shown resilience despite challenges. With a debt-to-equity ratio reduced from 17.1% to 5.8% over five years, it seems financially prudent. The company trades at 34.1% below its estimated fair value, suggesting potential upside for investors seeking undervalued opportunities. However, production dipped by 8%, averaging 55,300 boepd in the first nine months of 2024 compared to the previous year’s figures. Despite this setback and being dropped from the FTSE All-World Index recently, Dana Gas maintains high-quality earnings and forecasts a promising annual growth of over 22%.

- Click to explore a detailed breakdown of our findings in Dana Gas PJSC's health report.

Explore historical data to track Dana Gas PJSC's performance over time in our Past section.

China Leadshine Technology (SZSE:002979)

Simply Wall St Value Rating: ★★★★★☆

Overview: China Leadshine Technology Co., Ltd. designs, manufactures, and sells motion control equipment and components in China, with a market cap of CN¥9.23 billion.

Operations: Leadshine generates revenue primarily through the sale of motion control equipment and components. The company has observed fluctuations in its net profit margin, which is a key indicator of profitability.

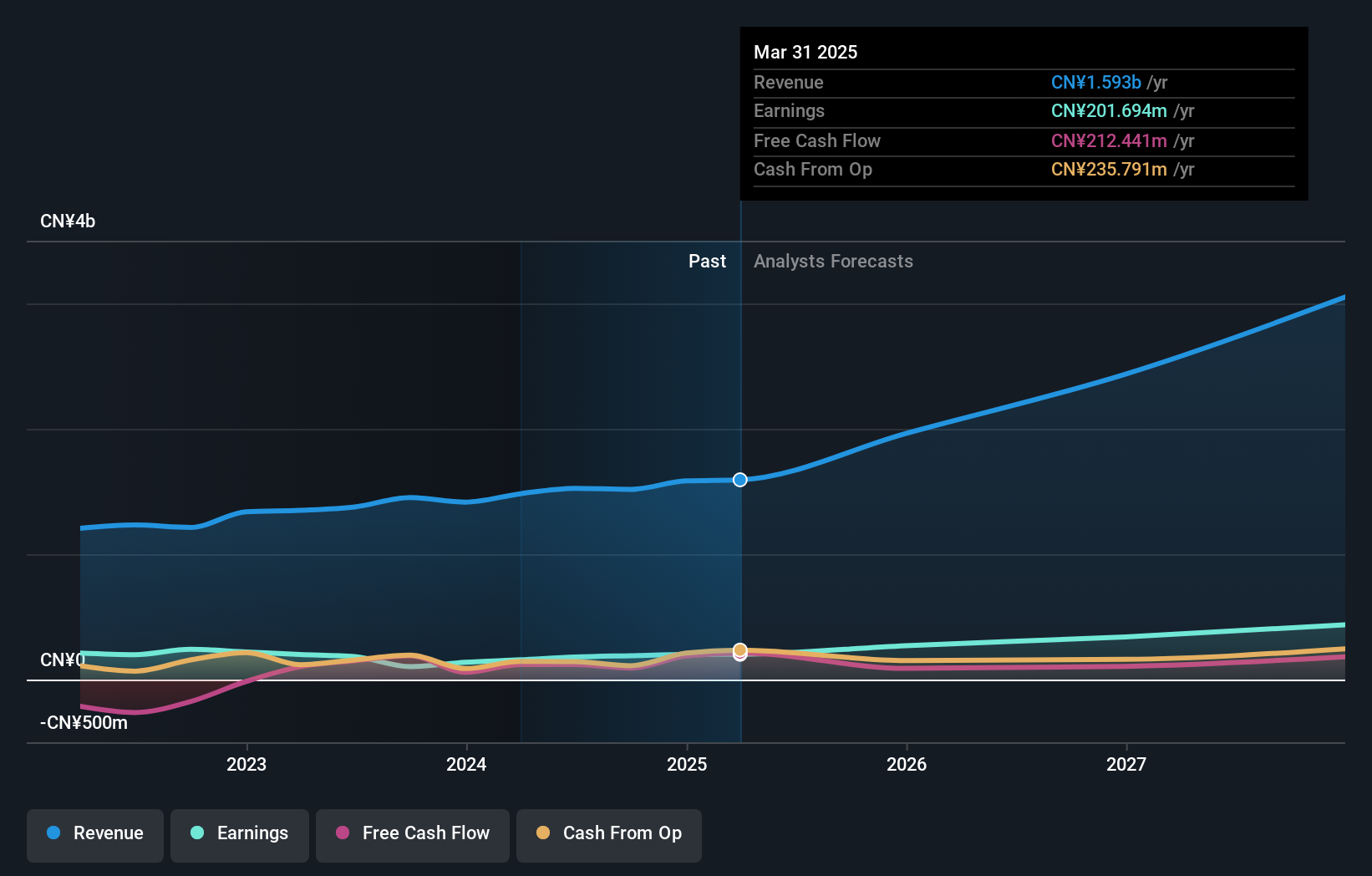

China Leadshine Technology, a smaller player in the electronics sector, has shown impressive earnings growth of 84.3% over the past year, outpacing the industry's modest 1.8%. The company reported sales of CNY 1.16 billion for nine months ending September 2024, up from CNY 1.05 billion a year earlier, with net income rising to CNY 144 million from CNY 92 million. Despite an increased debt-to-equity ratio from 1.7% to 29.2% over five years, its net debt-to-equity remains satisfactory at 9.6%. No shares were repurchased recently; however, earlier buybacks totaled CNY 28.8 million for nearly two million shares in early fiscal year activities.

Qingmu Tec (SZSE:301110)

Simply Wall St Value Rating: ★★★★★☆

Overview: Qingmu Tec Co., Ltd. specializes in providing brand retail solutions and has a market capitalization of CN¥4.70 billion.

Operations: Qingmu Tec generates revenue through its brand retail solutions. The company's market capitalization is approximately CN¥4.70 billion, reflecting its valuation in the market.

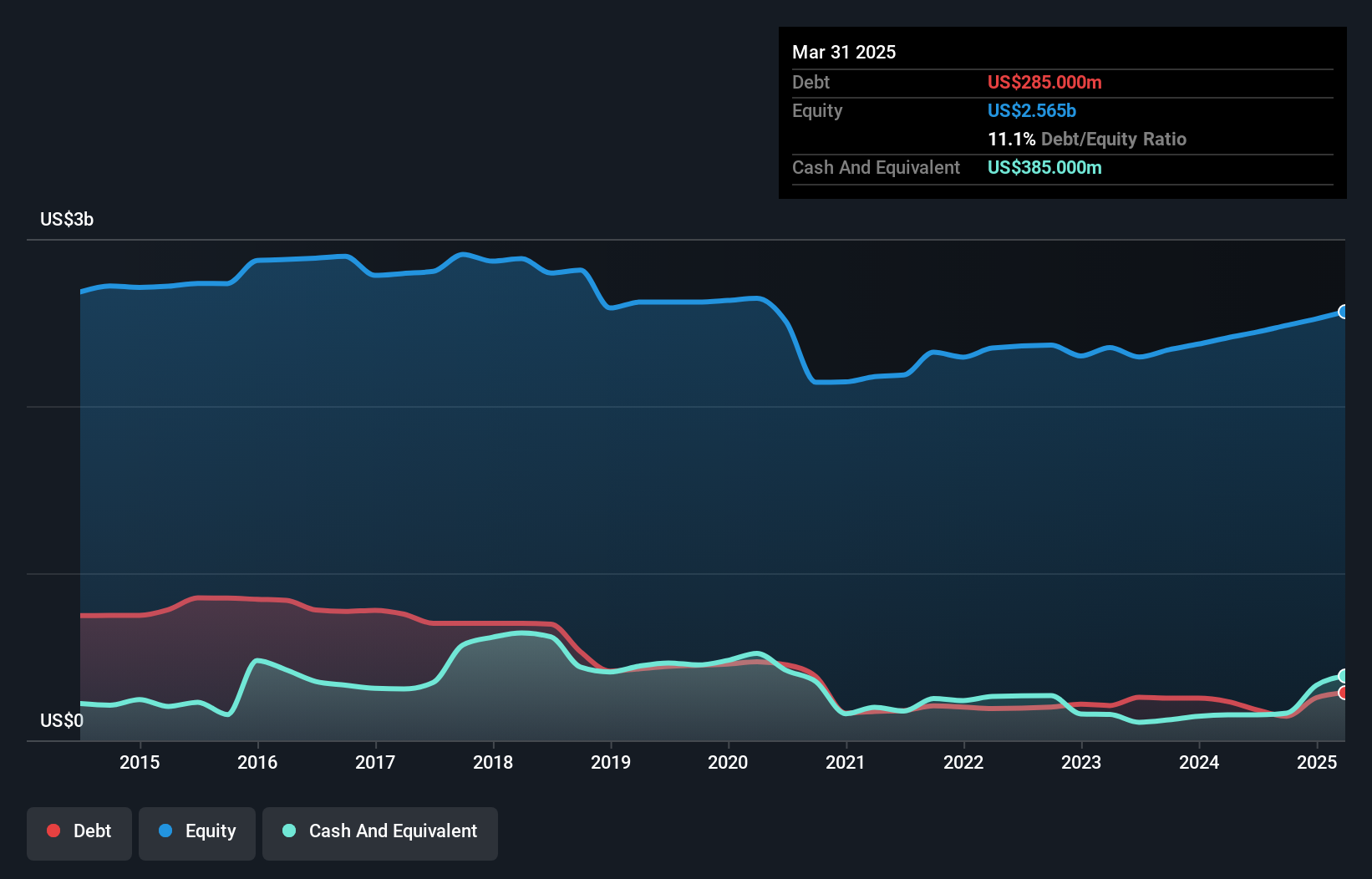

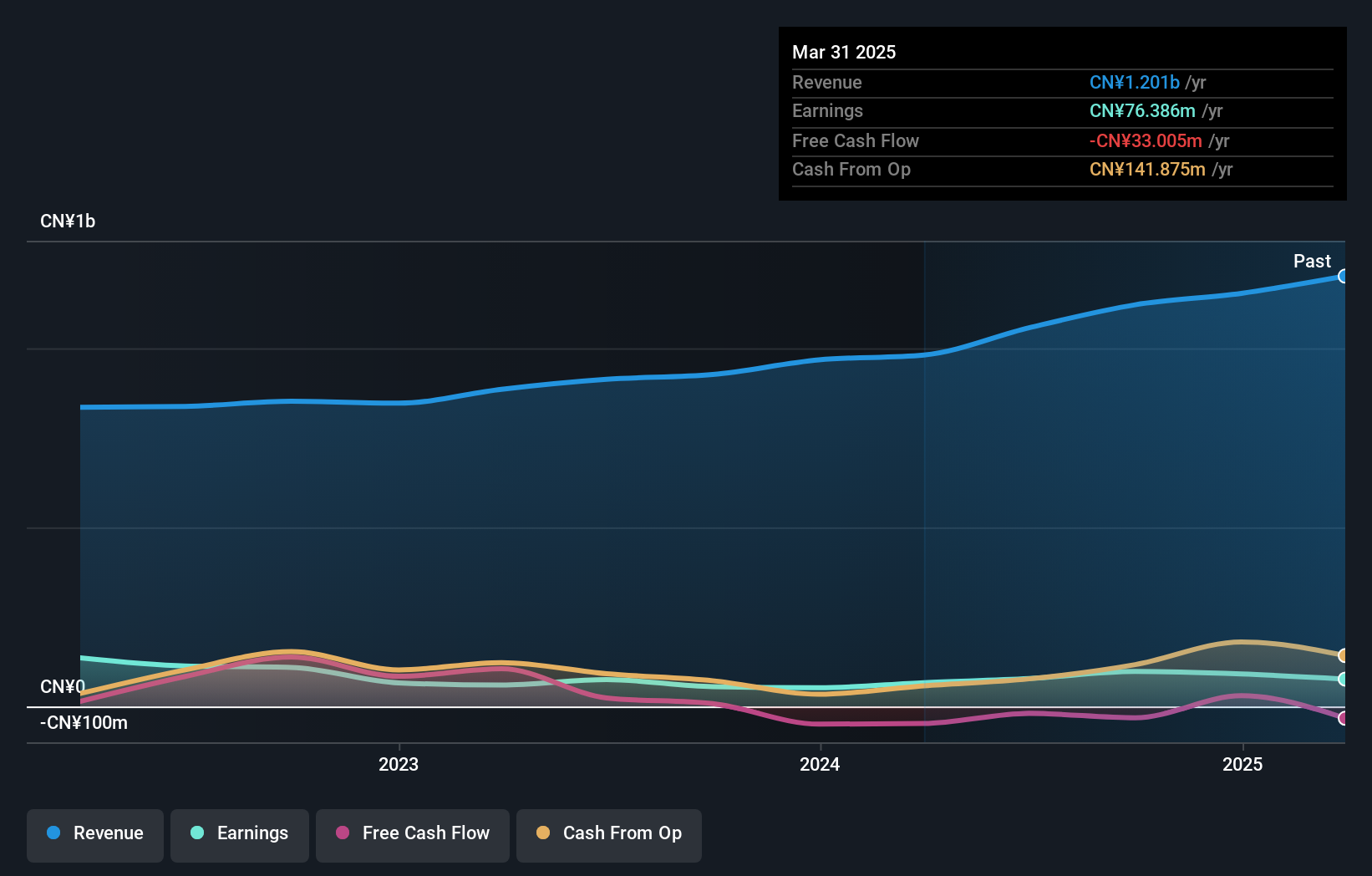

Qingmu Tec, a dynamic player in its industry, has shown notable financial progress with sales reaching CNY 807.96 million for the nine months ending September 2024, up from CNY 654.11 million the previous year. Net income also saw a significant rise to CNY 72.23 million from CNY 26.78 million, reflecting robust operational performance. The company declared an interim cash dividend of CNY 4 per 10 shares, highlighting shareholder value focus. Despite recent share price volatility and increased debt-to-equity ratio from 0.3% to 0.5% over five years, Qingmu's earnings growth outpaces industry averages by leaps and bounds at an impressive rate of over seventy-seven percent annually.

- Click here to discover the nuances of Qingmu Tec with our detailed analytical health report.

Understand Qingmu Tec's track record by examining our Past report.

Next Steps

- Discover the full array of 4643 Undiscovered Gems With Strong Fundamentals right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Qingmu Tec might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301110

High growth potential with excellent balance sheet.