As global markets continue to reach new heights, with indices like the Dow Jones Industrial Average and the S&P 500 setting record intraday highs, investors are keenly observing opportunities across various sectors. Penny stocks, though often seen as a relic of past market eras, remain an intriguing area for those interested in smaller or emerging companies. By focusing on those with strong financial health and potential for growth, these stocks can offer unique opportunities for investors seeking value in today's dynamic market landscape.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.48 | MYR2.39B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.79 | A$144.95M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.395 | MYR1.1B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.89 | MYR295.43M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.245 | £845.83M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.13 | HK$45.48B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.565 | A$66.23M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £4.335 | £431.14M | ★★★★☆☆ |

| Secure Trust Bank (LSE:STB) | £3.57 | £68.08M | ★★★★☆☆ |

Click here to see the full list of 5,688 stocks from our Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

China Fangda Group (SZSE:000055)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: China Fangda Group Co., Ltd. manufactures and sells curtain wall materials both domestically in China and internationally, with a market cap of CN¥3.58 billion.

Operations: The company has not reported any specific revenue segments.

Market Cap: CN¥3.58B

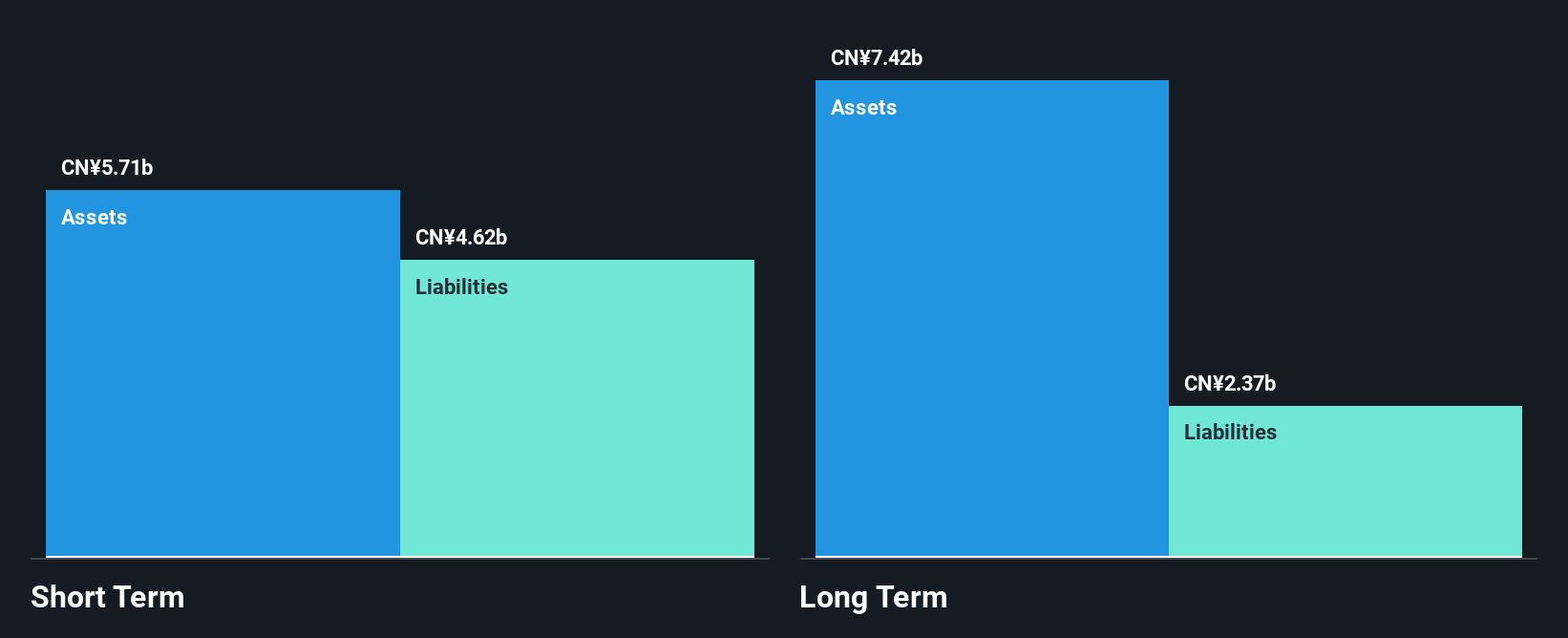

China Fangda Group, with a market cap of CN¥3.58 billion, has faced challenges as its earnings have declined by 31.5% annually over the past five years and net profit margins decreased from 7.5% to 3.6%. Despite these setbacks, the company maintains satisfactory debt levels with a net debt to equity ratio of 29.4%, and its short-term assets exceed both short-term and long-term liabilities, indicating liquidity strength. Recent earnings show sales stability at CN¥3,206.56 million for nine months ending September 2024 but a decline in net income to CN¥149.71 million from CN¥266.44 million year-on-year reflects profitability pressures.

- Get an in-depth perspective on China Fangda Group's performance by reading our balance sheet health report here.

- Gain insights into China Fangda Group's historical outcomes by reviewing our past performance report.

Nanjing Xinlian Electronics (SZSE:002546)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Nanjing Xinlian Electronics Co., Ltd specializes in manufacturing power consumption information collection systems for power grid enterprises and enterprise users in China, with a market cap of CN¥3.72 billion.

Operations: The company's revenue is primarily derived from its operations in China, totaling CN¥720.14 million.

Market Cap: CN¥3.72B

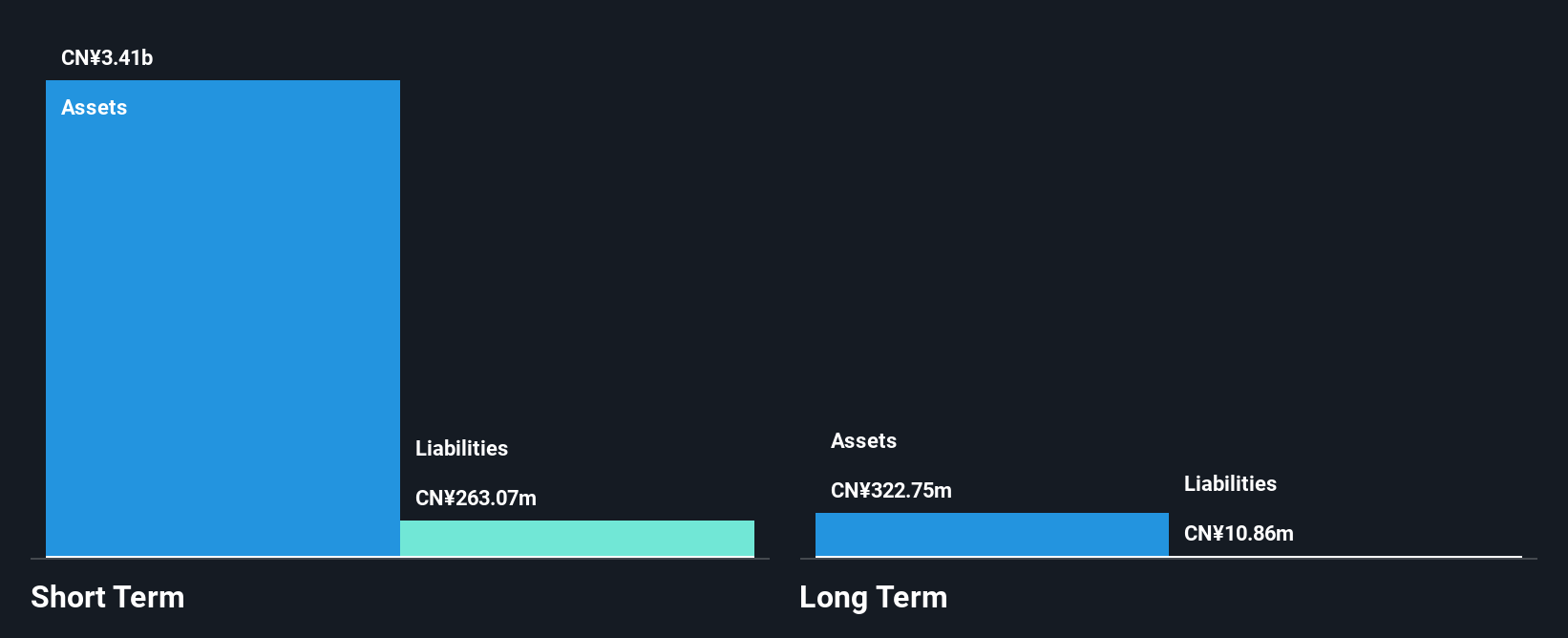

Nanjing Xinlian Electronics, with a market cap of CN¥3.72 billion, has seen its revenue increase to CN¥552.3 million for the nine months ending September 2024, up from CN¥450.65 million the previous year. However, net income decreased to CN¥102.59 million from CN¥112.58 million due to a significant one-off loss of CN¥54.7M impacting results. Despite this, the company maintains strong liquidity with short-term assets of CN¥3.2 billion exceeding both short and long-term liabilities and has more cash than total debt, although profit margins have fallen from 15.7% to 7.2%.

- Click to explore a detailed breakdown of our findings in Nanjing Xinlian Electronics' financial health report.

- Learn about Nanjing Xinlian Electronics' historical performance here.

Jiangsu Wuyang Automation Control Technology (SZSE:300420)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Jiangsu Wuyang Automation Control Technology Co., Ltd. operates in the automation control industry and has a market cap of CN¥3.84 billion.

Operations: Jiangsu Wuyang Automation Control Technology Co., Ltd. does not report specific revenue segments.

Market Cap: CN¥3.84B

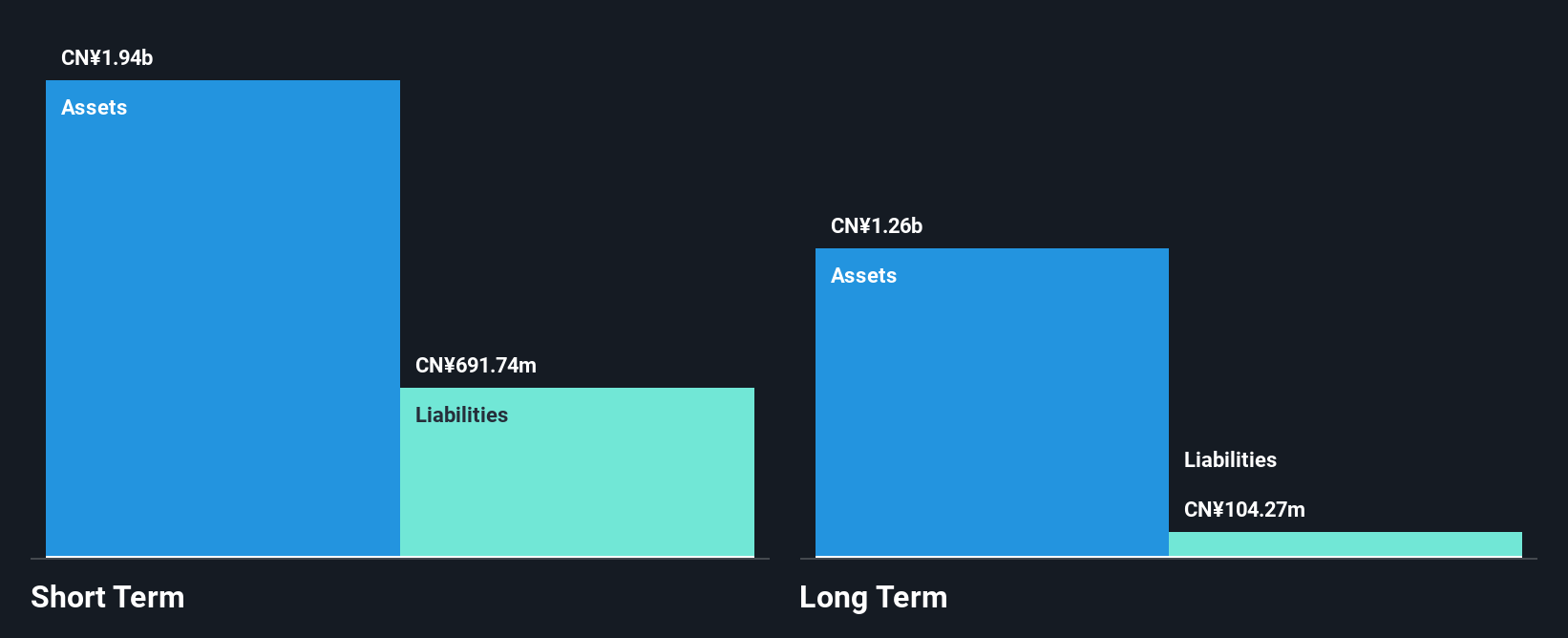

Jiangsu Wuyang Automation Control Technology, with a market cap of CN¥3.84 billion, reported sales of CN¥679.31 million for the first nine months of 2024, down from CN¥951.16 million the previous year, resulting in a net loss of CN¥12.26 million compared to a prior net income of CN¥37.41 million. Despite being unprofitable and experiencing declining earnings over five years at 32.8% annually, the company benefits from strong liquidity with short-term assets covering both short and long-term liabilities and has reduced its debt to equity ratio significantly over five years while maintaining experienced management and board teams.

- Jump into the full analysis health report here for a deeper understanding of Jiangsu Wuyang Automation Control Technology.

- Understand Jiangsu Wuyang Automation Control Technology's track record by examining our performance history report.

Where To Now?

- Navigate through the entire inventory of 5,688 Penny Stocks here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300420

Jiangsu Wuyang Automation Control Technology

Jiangsu Wuyang Automation Control Technology Co., Ltd.

Flawless balance sheet and fair value.