Discovering Undiscovered Gems with Potential in December 2024

Reviewed by Simply Wall St

As global markets reach record highs, with the Russell 2000 Index hitting a new peak, small-cap stocks are finally gaining traction alongside their larger peers. In this environment of robust market sentiment, identifying undiscovered gems requires a keen eye for companies that can navigate both domestic policy shifts and economic indicators such as consumer spending and manufacturing trends.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Parker Drilling | 46.25% | -0.33% | 53.04% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Watt's | 73.27% | 7.85% | -1.33% | ★★★★★☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| BOSQAR d.d | 94.35% | 39.99% | 23.94% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

JoeoneLtd (SHSE:601566)

Simply Wall St Value Rating: ★★★★★★

Overview: Joeone Co., Ltd specializes in the production and sale of men's business casual wear in China, with a market capitalization of CN¥5.38 billion.

Operations: Joeone Co., Ltd generates revenue primarily from the clothing industry, amounting to CN¥3.18 billion. The company's gross profit margin is a key financial metric to consider when evaluating its profitability.

Joeone Ltd, a smaller player in the luxury industry, has shown promising financial performance with its earnings growing by 94% over the past year. The company's price-to-earnings ratio stands at 23.4x, which is below the CN market average of 36.3x, suggesting potential undervaluation. Joeone's net income for the first nine months of 2024 reached CN¥135 million, up from CN¥96 million in the previous year. Additionally, basic earnings per share increased to CN¥0.24 from CN¥0.17 a year ago. Despite a large one-off gain impacting recent results, Joeone seems poised for continued growth with forecasted earnings expansion of 28% annually.

- Dive into the specifics of JoeoneLtd here with our thorough health report.

Explore historical data to track JoeoneLtd's performance over time in our Past section.

Actions Technology (SHSE:688049)

Simply Wall St Value Rating: ★★★★★★

Overview: Actions Technology Co., Ltd. is a fabless semiconductor company that designs and produces system-on-chips (SoCs) for portable multimedia products in China, with a market capitalization of approximately CN¥5.66 billion.

Operations: Actions Technology generates revenue primarily from its semiconductor segment, amounting to CN¥610.57 million.

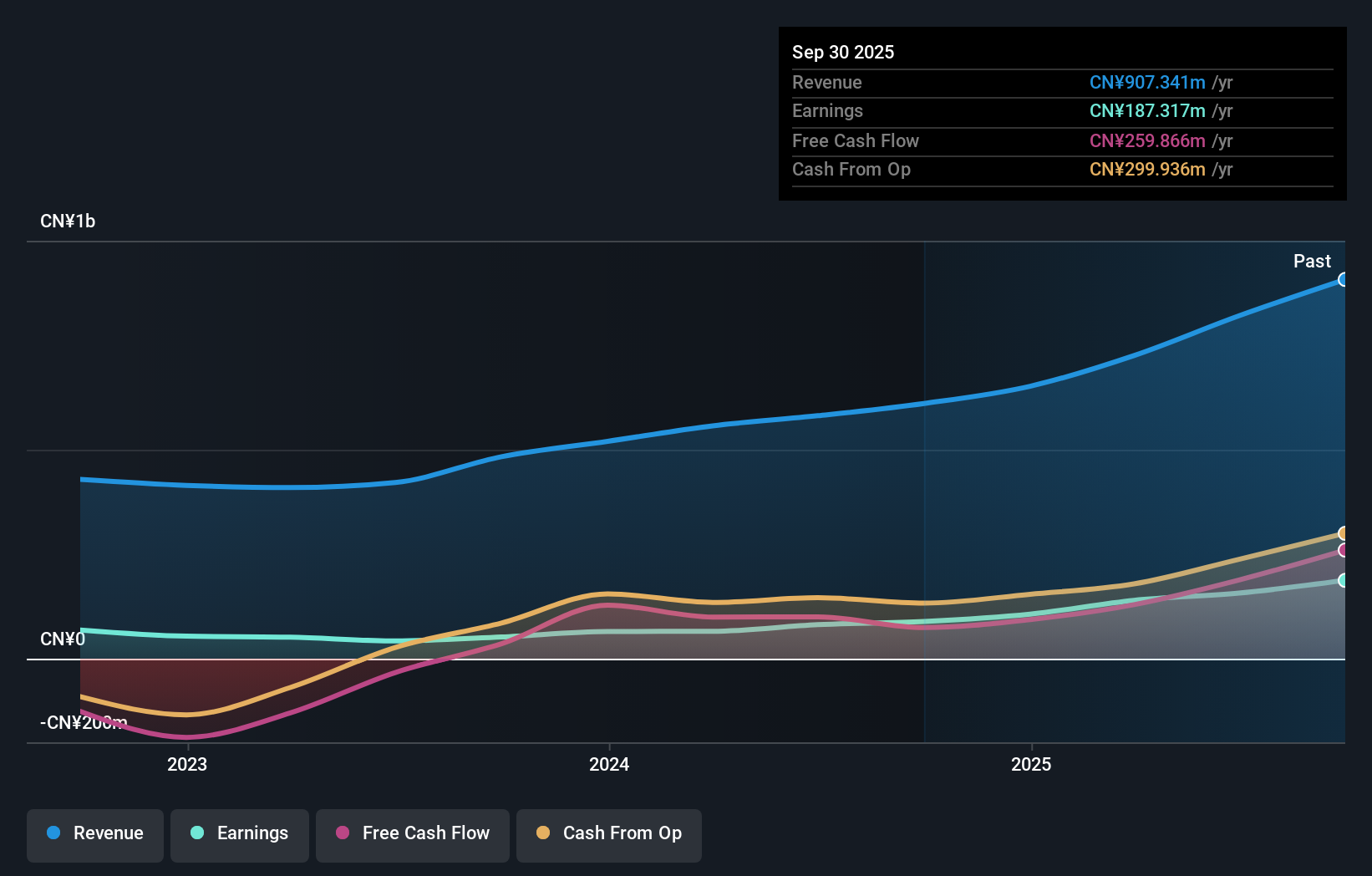

Actions Technology, a nimble player in the semiconductor space, has seen impressive earnings growth of 71.2% over the past year, outpacing the industry average of 12.1%. Despite a volatile share price recently, its profitability is underscored by a positive free cash flow and interest coverage that ensures financial stability. The company also boasts more cash than total debt and has reduced its debt-to-equity ratio from 7.5 to 6.2 over five years. With sales reaching CN¥466 million for nine months ending September 2024 and net income rising to CN¥70 million from CN¥47 million last year, Actions Technology seems poised for continued growth despite some large one-off gains impacting results this year.

Shenzhen Riland Industry Group (SZSE:300154)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shenzhen Riland Industry Group Co., Ltd engages in the research, development, manufacturing, sales, and servicing of inverter welding and cutting equipment, welding automated devices, welding accessories, and protective articles globally with a market cap of CN¥3.88 billion.

Operations: Riland generates revenue primarily from the sale of inverter welding and cutting equipment, along with welding automated devices and accessories. The company's financial performance is influenced by its gross profit margin, which has shown variability over recent periods.

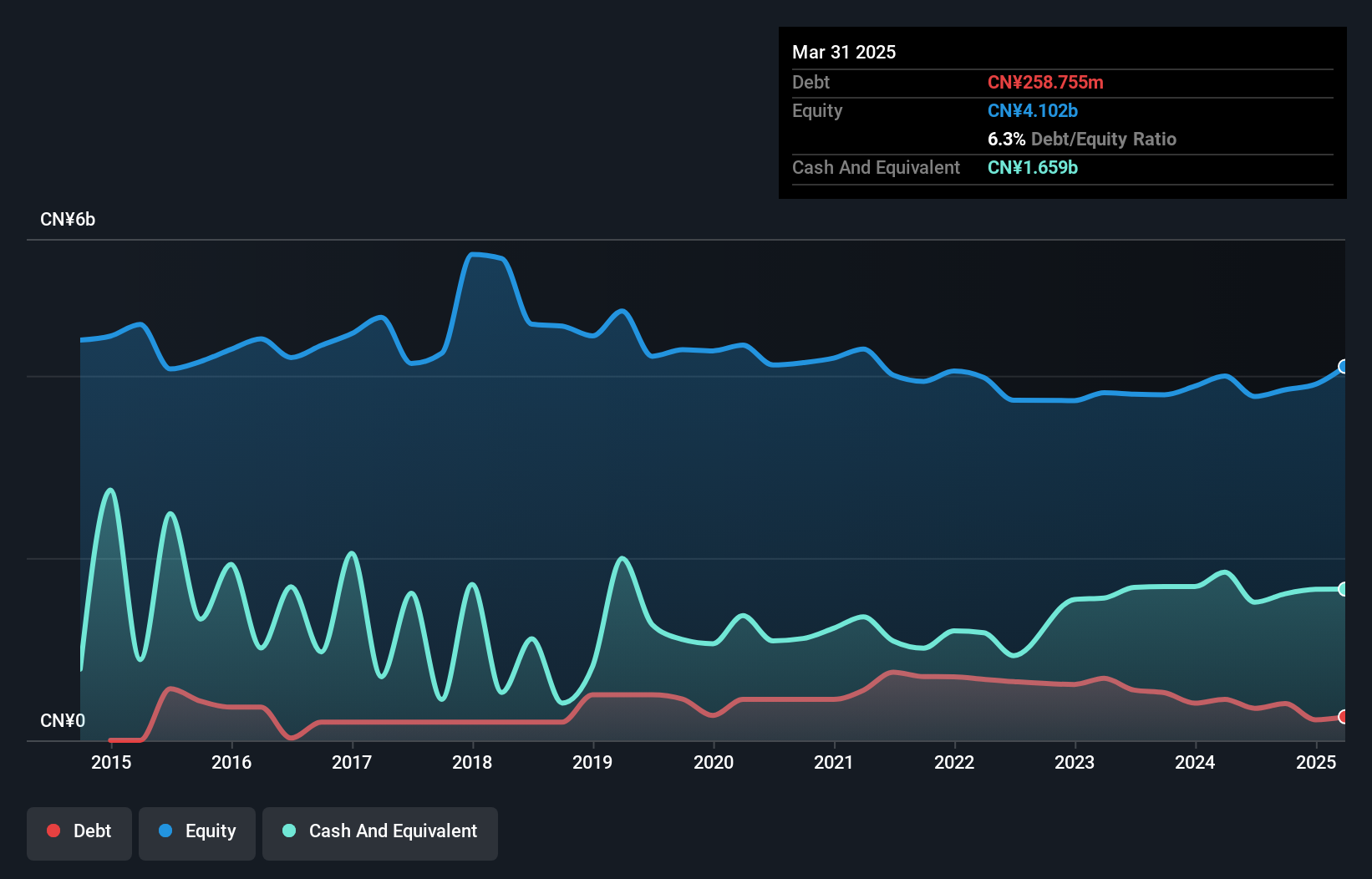

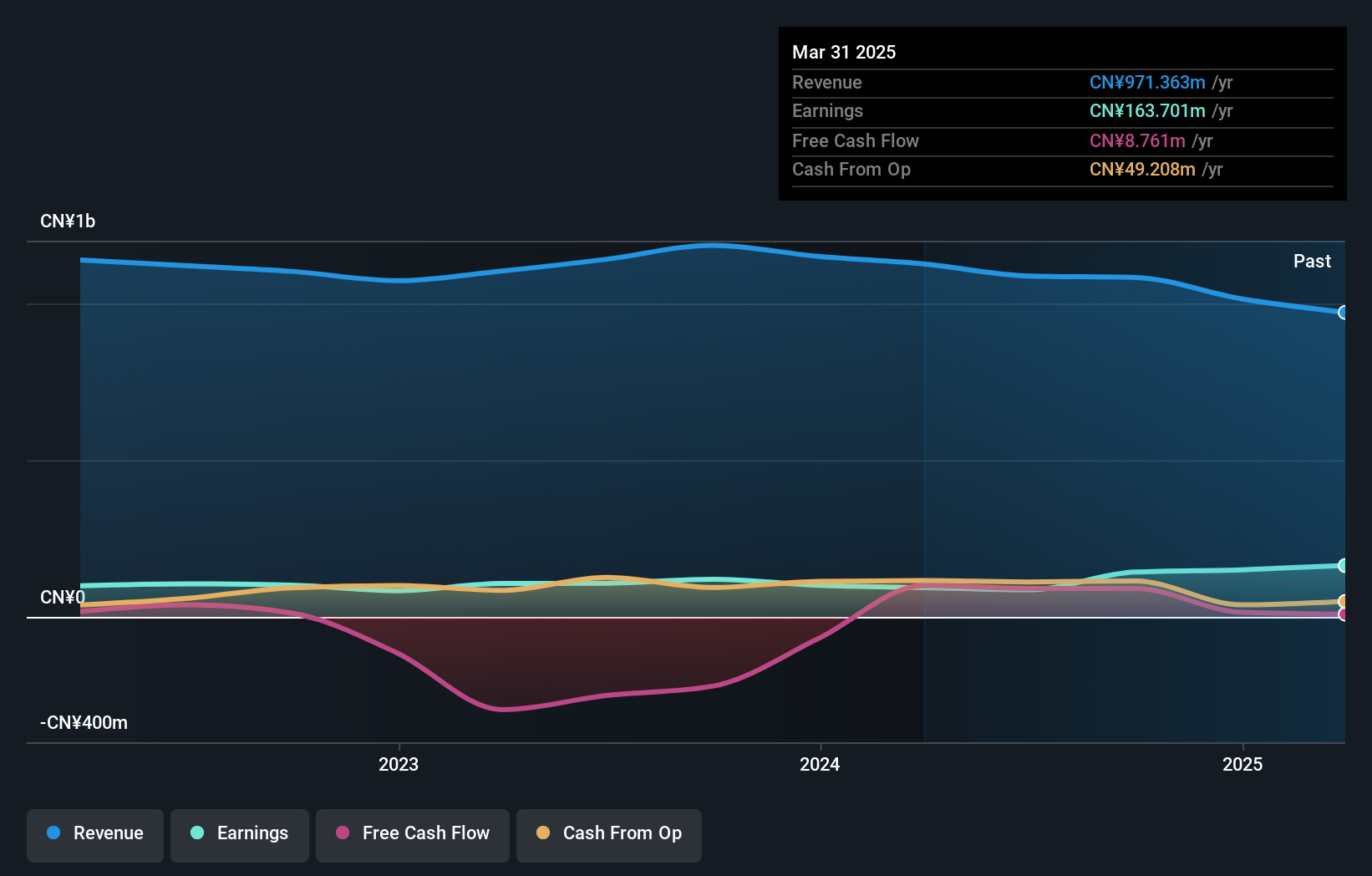

Shenzhen Riland Industry Group, a player in the machinery sector, has shown notable progress with earnings growth of 19.1% over the past year, surpassing its industry peers who saw a -0.4% change. The company’s price-to-earnings ratio stands at 27.1x, which is favorable compared to the CN market's average of 36.3x, suggesting potential value for investors. Despite an increase in its debt to equity ratio from 0% to 18.2% over five years, Riland remains financially stable with cash exceeding total debt and positive free cash flow reported recently at CNY90 million as of September 2024.

Make It Happen

- Investigate our full lineup of 4643 Undiscovered Gems With Strong Fundamentals right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300154

Shenzhen Riland Industry Group

Researches and develops, manufactures, sells, and services inverter welding and cutting equipment, welding automation products, welding material accessories, protective equipment, and precision sheet metal profile machining structural parts products in China and internationally.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives